The Real Yield Narrative and Sustainable Crypto Startups

There was an interesting discussion in the LeoFinance Discord server earlier today about projects and funding through the DHF. Some projects are getting huge payouts from the DHF on a daily basis while other projects on Hive are self-funded and/or have sustainable revenue models.

A huge debate in the crypto space more broadly takes us to discussions around real yield (DeFi protocols) and overall sustainability in this industry. In 2020 & 2021, we saw a major influx of VC money flood this space.

That caused the likes of FTX and other crypto startups to jump to massive valuations. We saw ridiculous money flowing in. Dumb money chasing dumb money.

The problem with money like this is that it tends to prop up what would otherwise be losers.

Shakeouts are needed. This is why markets have cycles. The cyclical nature of markets allows losers to lose and winners to win.

In every cycle - crypto or otherwise - we see who the losers are. They disappear into the void of nothingness while the winners stay humble, grind away and try to attain more of their TAM (Total Addressable Market).

The Real Yield Narrative and Sustainable Crypto Startups

Our discussion around DHF funding for Hive projects reminds me of the Real Yield Narrative. This started at the outset of this most recent bear market where DeFi protocols seemed to get hit the hardest first.

We saw 99% of DeFi projects completely fail. The founders either rugged or the community headed straight for the exits.

What remains are the leaner DeFi protocols with hardcore communities. The protocols that have been able to generate revenue on their own as opposed to unsustainable tokenomics have also outperformed.

What I'm interested in seeing is which DeFi protocols are able to slowly churn out more and more Total Value Locked (TVL). These protocols could become massive winners in the next bull run.

MakerDAO is super interesting on this front for me. CUB is obviously chasing a similar path to utilizing real yield to drive TVL growth and hit the next bull cycle with feet on the ground.

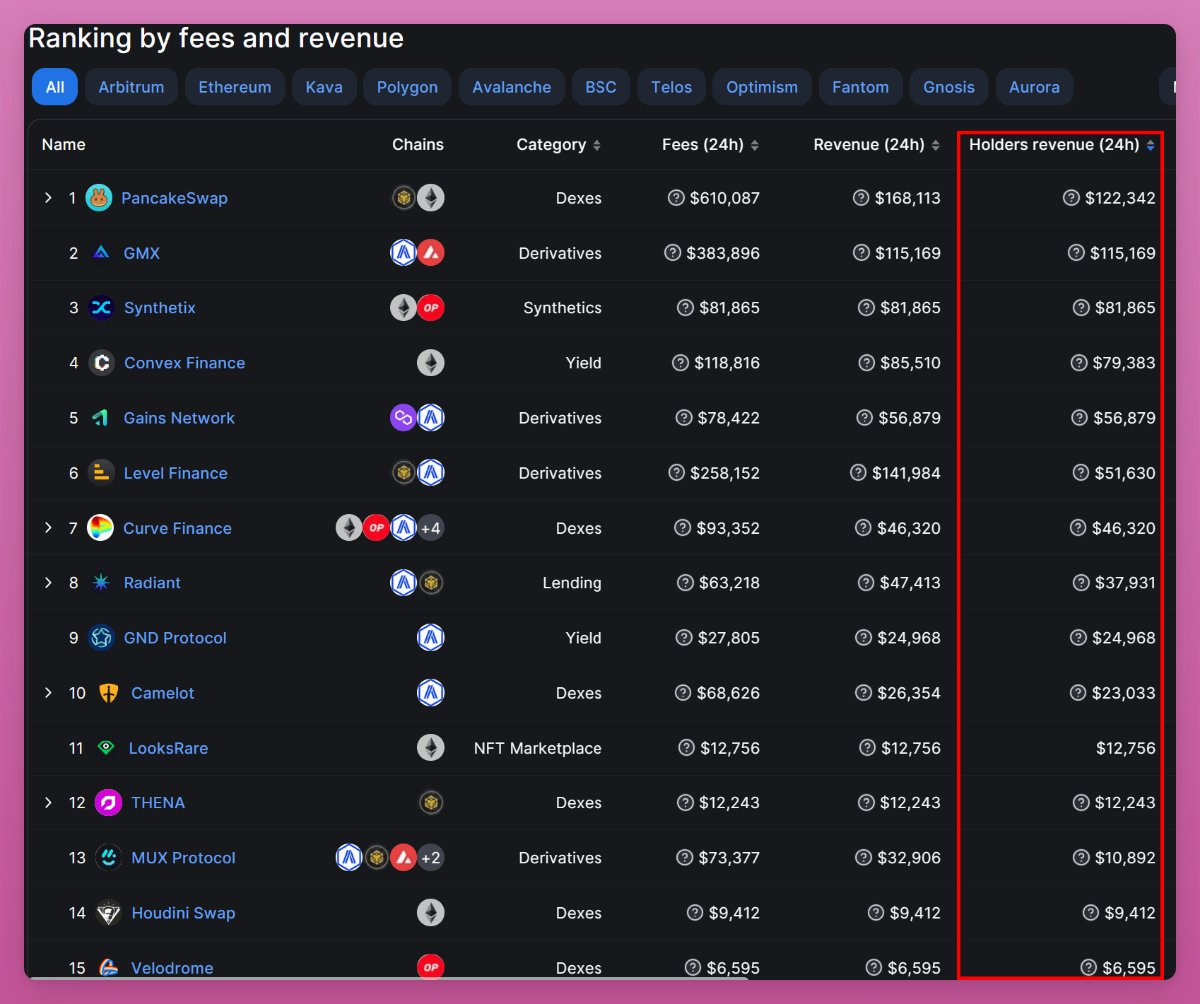

Here we see the top 15 DeFi protocol s who are earning real revenues. Majority of them are DEXes. Pancakeswap is obviously a huge winner here. Charging fees on every single swap on PCS on BNB Smart Chain... which is quite a lot.

$122k+ per day in 24hr fee revenue generated. Wild!

Despite that, their token has been going down in price. There can be a lot of other reasons for this, but that is outside the scope of this article.

What we're focused on here is survival, revenue and sustainability.

How to Survive

In order to survive as a startup of any kind - but especially as a crypto startup - you need to be lean and also discover revenue models.

Yes, you can get funded by the DHF or other DAOs... but what happens if that funding suddenly dries up?

Do you have any actual business? Or do you get caught with your pants at your ankles.

Bear markets tend to show everyones' true faces. In my opinion, there are a lot of crypto projects being propped up by external funding.

If that funding were to go away, I have a feeling the founders would also go away quite quickly.

Being a founder is hard. Being a crypto founder is torture. You live on a daily basis wondering how you will survive the night.

The great thing about this industry is how fast it moves. It also makes it super hard and challenging to navigate. I love this industry and every day I show up here, I look for more ways to achieve sustainability, lengthy runways and lean operations.

The winners in the next bull cycle will be the projects that were able to lean up in the bear market, generate external revenue and build better technology than the previous cycle.

What projects do you see that are doing these things?

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Alpha

@khaleelkazi, I am still waiting to be unblocked on leofinance discord and ask for a refund. Unfortunately, I was one of the members that got caught by the scam on 2nd June. Please can you assist? I did try sending you a message on discord but haven't heard back.

Hi Khal,

Please give me an update on the geyser payment automation for the WLEO-ETH pool.

I would like to move a pool’s funds to that investment and would like to know about the payment schedule and the projected yield.

Thanks

It occurs every 15th of the month and you can check the @wleo.pool payouts to delegators and cross-reference them with deposit amounts to calculate real-time yield

Posted Using LeoFinance Alpha

Of course, Threads does. I've seen one of my threads rake up around 0.2 Leo within hours and that's just the start of what's yet to come.

I bet we'll see greater ad revenue sooner than later. All it takes is the community and users' effort to make it work, which they will because it's all a win/win for everyone.

Projects with sponsors or big funding usually get too big that they can't become lean and persevere when the hard times come.

It's a pretty heated subject for me and I know I'm rather aggressive on my stance on things which can rub people the wrong way and seems to get myself in trouble here on hive. The thing is I'm not calling anyone a-holes or trying to come off being an a-hole myself. Instead that's just my nature to be aggressive and push as quickly towards profitable gains possible.

When I see how much money is just wildly being toss out of hive with little to nothing replacing it I get upset and I think more people should be upset about it. It's why we have a low token price. It's why every time things ramp up it's quickly sold off and crushed again.

If it where up to me funds would be for a single project in which that project would have milestones for payout and a completed project of which at that time if that person, persons or developers would have to generate revenue to fuel it be it through fees, sponsorships, advertising etc. It just feels like there's minimal building going on around here for a quick way to tap into "free" money and it just exits and is extremely lazy. I seriously wish more people saw and understood things but I guess you have to have a business mind set for that.

Me parece muy interesante su información, de verdad me gustaría participar en su ecosistema y aprender sobre el mismo.

Running a startup is a challenge. You always need to plan your expenses well. In my opinion, it is especially worth investing in SEO. It is a great and necessary investment and this post proves it: https://vocal.media/journal/seo-for-startups-how-to-optimize-your-business?utm_source=Iterable&utm_medium=email&utm_campaign=

Well hey, it is hard to get leaner than the #Galactic-Milieu! :)

Well over a decade as lean as can be and still ticking along... :)

Funding is an important part of finance. Most, if not all projects need funding to grow. However, the issue is depending solely on the funding or using money to solve every problem. This is why most projects fail.

There are hardly any projects on hive that have scope outside the hive ecosystem. The problem with this is that the hive cannot sustain these projects for long especially when they do not add value in terms of attracting more users.

Being value-oriented is one key way to create a superior product or service and I think Leofinance are on that path.

Micro threading is one of the ways to achieving this , it may look insignificant but yet performing great wonders underneath , this has given me some few leos I least expected and I pray individuals in this space wake up to this rare opportunity given to us through the platform of Leo finance

I noticed no stats on Uniswap. I assume their earnings are very high. Are their stats hard to find?

Thanks

Lassecash

Undervalued. I'm buying $1B worth

Posted Using LeoFinance Alpha

Very interesting post!!