Microstrategy is Outperforming the Entire Market, Thanks to Bitcoin

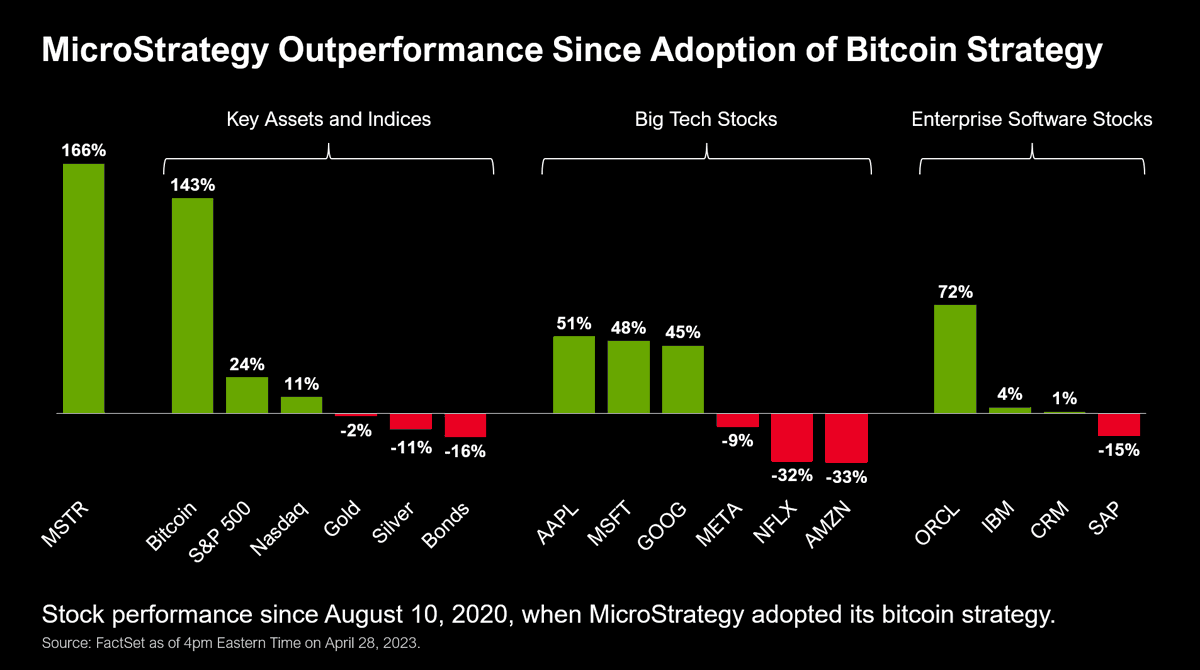

Microstrategy (MSTR) reported their quarterly earnings yesterday. In it, they discussed growing revenues as well as how their stock is up 166% since the adoption of their Bitcoin accumulation strategy.

Microstrategy is vastly outperforming the majority of public companies out there. They're also slightly outperforming BTC itself.

A lot of this comes down to the amount of Bitcoin that they've accumulated. It's pretty amazing to see how well this strategy is working for them.

I've long been fascinated with Microstrategy. They dipped their toes in the water, decided they liked the temperature and then just dove head first into the deep end.

Now, they're one of the largest holders of Bitcoin in the entire world and the adoption of their strategy is undoubtedly being discussed at shareholder / board meetings of other public companies who may wonder if they can get a slice of the performance that MSTR has achieved.

Levering Up and Buying Bitcoin

One thing that MSTR has done is lever up to buy more Bitcoin. Just when people thought that MSTR was at the brim of how much Bitcoin they could buy, they went out and bought more.

All of this public awareness also drove more business to their enterprise software.

They simultaneously:

- Acquired a massive stake in Bitcoin

- Grew their cash generating business

The firm now holds 140,000 BTC, which were collectively purchased at an average cost of about $29,803. CT

The thing that I love about this is that it's something that you can tangibly feel as an individual.

Can you imagine that you focus on acquiring a stake in Bitcoin by consistently dollar-cost averaging while simultaneously focus on generating more cashflow?

As an individual, this might look like setting up a daily automatic buy of Bitcoin. Then you may focus on your job or the business you own or start a side hustle in addition to either of those two.

No matter where you are in life, you have the ability to adopt "the microstrategy" strategy.

Accumulate Bitcoin.

Grow your cash flow.

Accumulate More Bitcoin.

Microstrategy Weighing in Deeper as Revenue Grows

The Bitcoin-savvy firm is also in the process of developing a Bitcoin layer-2 Lightning Network-based Software as a Service tool for corporations. CT

It's clear that MSTR has become somewhat of a "proxy ETF" for BTC. This is relevant because there are plenty of hedge funds, institutional investors and corporations who may want to get a little BTC exposure but who don't want to jump through all the regulatory and board approvals to buy actual Bitcoin.

Instead, they can just buy MSTR which is a publicly traded company. It's well within existing mandates for a lot of companies and institutional money.

MSTR isn't just resting on this thesis of being a proxy ETF - which I think is important. One day I fully expect a "real BTC ETF" that is globaly accepted and highly liquid.

So MSTR's position as a proxy ETF in the long-run isn't solid ground. What they can do, is develop technology that feeds more revenue into their business while continuing to stack sats.

That appears to be exactly what they're doing. They're beginning to RnD a lot of Bitcoin technology for enterprises. This is a huge bet. If they come out with a few good products and services to sell B2B, they could create another massive cash cow... where will that revenue go? I'd bet more BTC.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Alpha

Sssh, don't let Gary Gensler hear that :)

Haha love the angle they have taken. Their software strategy has always been meh (I used to sell competing business intelligence software and never lost to them in a head to head deal) but they really are Gamestopping the market aren’t they?

Such an interesting strategy, or I guess it is a micro strategy?

Go crypto go!

I think they are taking to much risk, I don't think it's a good strategy to put all eggs in one basket

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Interesting 🤔