Centralized exchanges are crushing DEXes

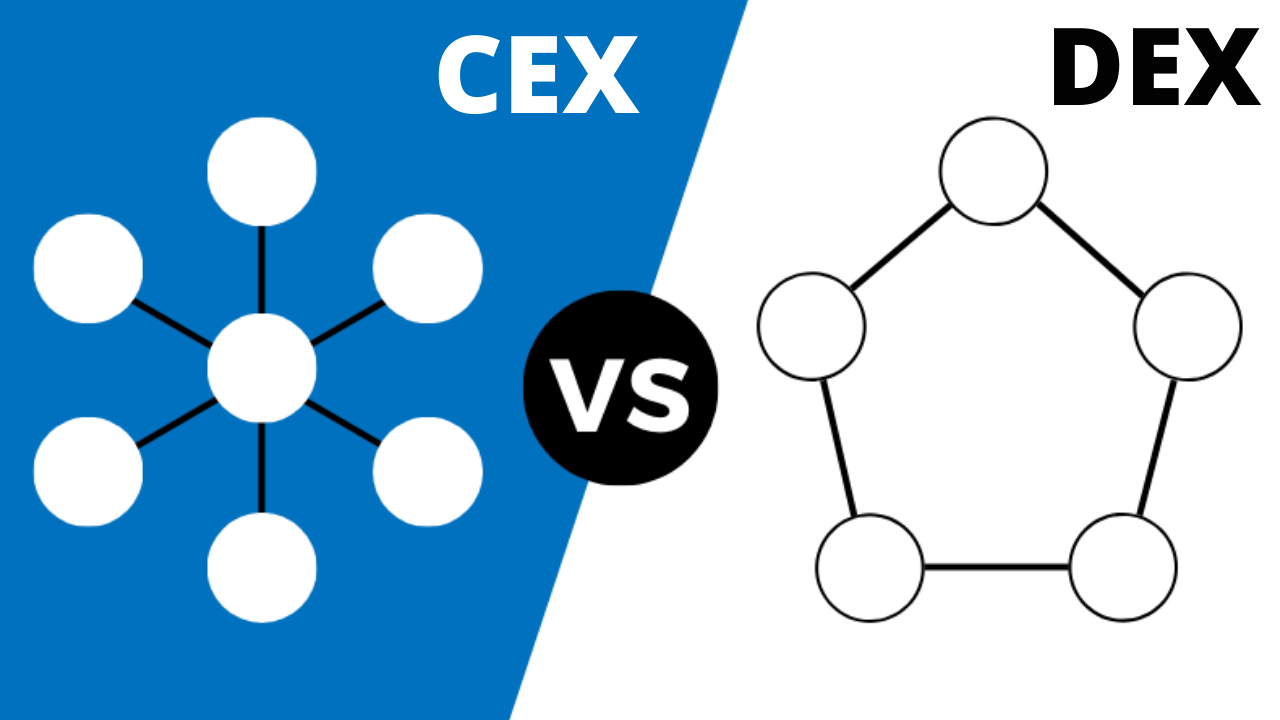

Swapping your assets right from your personal wallet is a cool experience. You’d want to repeat the process; especially when the transaction fees are not ridiculous and the blockchain isn’t jammed up. Decentralized exchanges are fun to use. Top DEXes command billions of dollars in trading volume, nothing compared to that seen in top centralized exchanges but decentralized exchanges are still a work in progress.

Not to paint words, decentralized exchanges face an uphill battle in their struggle to become the ultimate way to perform simple cryptocurrency exchange. Centralized exchanges are the earliest generalized cryptocurrency exchange option, behind normal Peer-to-peer exchange of course. Unlike decentralized exchanges, centralized exchanges are designed to be in custody of your assets while you transact them freely with other assets on the platform. Users are properly or partially identified.

Enjoying blockchain-level security and anonymity while exchanging assets are the biggest strengths of decentralized exchanges. A major reason why they have enjoyed the limelight since their introduction. Unfortunately, contemporary decentralized exchanges are still overshadowed by centralized exchanges for certain rather obvious reasons. I’ll name a few…

Centralized exchanges’ first to market privilege

Most cryptocurrency enthusiasts’ first idea of an exchange is a centralized exchange; probably Binance or a similar platform. Not only are these platforms more popular, they are more adapted to the needs of someone trying to get accustomed to cryptocurrency. Centralized exchanges already occupied the mind of cryptocurrency investors way before decentralized exchanges became an actual hypothesis. Unfortunately, this is still the case. Cryptocurrency investors’ reluctance to explore decentralized exchanges over centralized exchanges is one of the numerous reasons why decentralized exchanges are staying under the hood.

Decentralized exchanges are special, no doubt. Regardless, they still have a long way to go if they are ever going to offset this natural privilege enjoyed by centralized exchanges. Further developments in this space might do the trick, but just as said; this won’t come easily.

Inconsistencies and accidents on decentralized exchanges

There are no perfect systems; in comparison to centralized exchanges, modern decentralized exchanges are still in their early days. That being said, many vital aspects of its technology and management are still far from being completely developed. This result in certain inconsistencies which easily wear out users. The exploitation and complaints by users about the inefficiencies of decentralized exchanges are enough to scare away the next user and the current user of course.

Critics liken liquidity and staking pools to centralized exchanges’ hot wallets. Users run into same issues as seen when centralized exchanges get hacked. Only difference is, many reputable centralized exchanges have plans to compensate users in case of such accident. Decentralized exchanges are yet to develop similar plans; another important win for centralized exchanges.

Transaction fees

At its peak, you’ll have to pay over $100 in fees to confirm a token swap on Uniswap. For many micro investors, this is even bigger than the value of the assets to be swapped. Bigger investors might find this mild, but it is still way above what you’ll pay to exchange your assets on a centralized exchange. This fee is paid in addition to the liquidity provider charges, consider the transaction fees an additional payment to swap your tokens on decentralized exchanges. Investors who perform multiple swaps battle with these fees. A simple fix; centralized exchanges. Most users resort to decentralized exchanges for one-time swaps or to perform simple swaps.

Most cross chains boast of lower fees than the ethereum, but these chains are less popular than ethereum and host lesser projects and less exchangeable tokens. Even these cheaper chains get costlier with more exposure and frequency of use. On their way to attaining the same level as ethereum, they run into the same issues too.

Low Liquidity pool rewards

Considering the terms and risks involved in providing liquidity, liquidity providers might consider the liquidity pool rewards ‘low’. Most times, these rewards are not enough to offset impermanent losses. Locking tokens in a pool to enable decentralized exchange of assets is a huge sacrifice for the ecosystem, cryptocurrency investors are known to like ‘excess’ rewards. When this is not the case, they can easily forfeit the little rewards.

DeFi projects develop plans to add extra rewards to liquidity providers. Liquidity mining is a popular tactics. This have worked well but still has a couple of long-term side effects and might be completely unsustainable depending on the project and the reward ratio.

Albeit these issues, decentralized exchanges have shown to be a brilliant idea. Their current state is co-existing with a superior centralized form of asset exchange but with widespread developments, decentralized exchanges might claim the top spot sometimes in the future. Cryptocurrency’s direction is set in favour of centralized exchanges, this could twist anyways. Regardless, centralized exchanges are currently reigning undisputed and decentralized are pushed to being alternatives. They still retain the hype anyways.

What other features do you think centralized exchanges have over decentralized exchanges. Let’s hear you out in the comments and a second part could be on the way!

WOX exchange is the first decentralized reserve currency protocol available on the TRON Network based on the WOX token. Learn more about WOXDEFI

Have our next publication delivered to your mailbox

This special course contains every information you need to safeguard your assets. Get 60% discount when you purchase via This link

Would you love to read similar articles?

Have our next publication delivered to your mailbox

Follow us on Twitter

Follow us on Medium

Follow us on Publish0x

Follow us on Facebook

Posted Using LeoFinance Beta