Centralized exchanges are crushing Decentralized exchanges [Part 2]

I’ll say it once again and surely not for the last time; ‘decentralized exchanges are very brilliant”. In a previous article I urged using decentralized exchanges as a safer and faster alternative to the more popular centralized exchanges. With government regulations becoming more rampant, decentralized exchanges’ anonymity feature could come in handy too. That apart, decentralized exchanges still have a long way.

In the first part of this article, I mentioned just a few of them. But from the feedback received, those were just few of the numerous advantages centralized exchanges have over decentralized exchanges. Let’s discuss a few more.

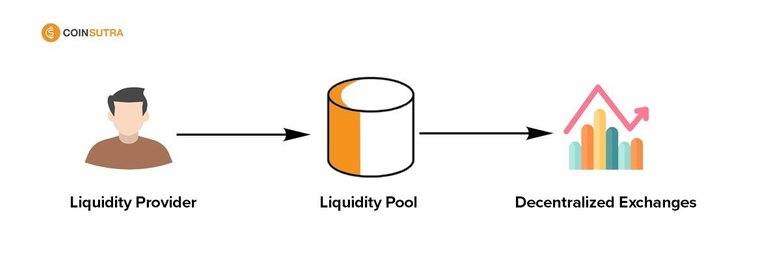

Impermanent losses

Cryptocurrency prices are ridiculously volatile. This crude and unpredictable changes in value of tokens results in a change in the number of tokens supplied by a liquidity provider to the liquidity pool; a phenomenon known as Impermanent loss. well; the loss is impermanent, but waiting for this to offset is sometimes impossible. Liquidity providers would have to come to terms with this loss, especially when they supplied a tangible amount of assets to the pool. Sometimes, they shy away from this risk, especially when the assets are positively volatile. This might lead to a rather centralized liquidity pool.

Insufficient liquidity is an issue faced by even the biggest centralized exchanges. Decentralized exchanges present frank liquidity; at least at that particular time. But when participants are reluctant to supply and maintain liquidity, it becomes a huge problem. Impermanent loss is a big scare and one of the leading causes of this reluctance.

Centralized liquidity pools

For a liquidity pool to be properly decentralized, the tokens in the pool must be provided by numerous independent entities. Just like a Proof-of-work network; the more participants, the more decentralized and stronger a network becomes. A decentralized liquidity pool ensures that the liquidity doesn’t get wiped easily by one entity pulling out their tokens from the pool. Unfortunately, this is hard to achieve in decentralized exchanges. Only very popular and established projects can boast of a relatively decentralized liquidity pool. Investors are easily scared away from projects with a centralized liquidity pool. This is not favourable for the growth of the project and the exchange.

Decentralized exchanges are ‘Chain specific’

If you wish swap ethereum and its tokens, then Uniswap is your best option. 1inch has a crosschain feature but you’re simply switching to a new chain to exchange tokens traditional to that chain. SpiritSwap and SpookySwap are most prominent decentralized exchanges on Fantom opera chain; other smart contract platforms have specific DEXes for holders who wish to swap assets. In contrast, centralized exchanges have a swift support for several chain and tokens from these chains can be traded against each other without the need to bridge your tokens or switch chains. This is simple, user friendly and secure. Bridging tokens is a complicated smart contract operation and can be risky and time-tasking too. Holders are badly limited on decentralized exchanges. It simply isn’t suitable for people trading various assets from different chains.

Decentralized exchanges simply lack ‘range’

Decentralized exchanges are cool…until you need options and varieties. That’s not available on contemporary dexes; you might have to look elsewhere; centralized exchanges are your best bet; unfortunately. Thanks to being ‘chain specific’, emerging and not widely adopted; decentralized exchanges are likely not to offer you what you want if you’re in search of varieties and wide range of options. You have very limited options for everything; available tokens, supported chains, financial activities…even the most popular and advanced decentralized exchanges are not close to average centralized exchanges in terms of available options. It’s frustrating and could kill interests.

I get it, decentralized exchanges are very young prospects and even centralized exchanges had countless shortcomings in their early days. However, these problems will be hard to overlook. This article simply spells out issues which decentralized exchanges must tackle if they must become the prominent way of exchanging cryptocurrencies. Tackling some of these issues might require DEXes being more centralized, a dilemma. The future is bright for decentralized exchanges, regardless. Brilliant fixes for these issues will emerge with time. Some of them are already in evolution.

WOX exchange is the first decentralized reserve currency protocol available on the TRON Network based on the WOX token. Learn more about WOXDEFI

Have our next publication delivered to your mailbox

Posted Using LeoFinance Beta

Congratulations @joelagbo! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next payout target is 7000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!