Stock Market and Dividends

Stock Market and Dividends. If you’ve ever been interested in buying stocks, you’ve probably heard of Warren Buffett. The legendary investor, who is now 86, continues to excite the global financial world. The consolidated revenue of Buffett’s super-profitable car – Berkshire Hathaway – at the end of 2016 amounted to 223.6 billion dollars. If you type Warren Buffett on Google, you will find many more impressive figures that make you think: if investing in securities is so profitable, is it possible to receive dividends on shares here, where I live.

- What are dividends, stocks, capitalization – we study the terminology, and at the same time understand how dividends are paid.

- Bank management funds are what really works if you want to buy securities, and you have a minimum of 10 thousand dollars.

- Stocks and dividends, which the whole world is talking about.

Understanding the terminology

Dividends

To begin with, let’s define what dividends on shares are. This is the profit that the company’s shareholders receive based on the financial results of the reporting period. If you buy shares, you are entitled to dividends on them. When a company develops and earns a profit, it shares it with shareholders. Income is distributed in proportion to the share owned by each of the investors. Some companies pay dividends annually, others quarterly.

How the dividend yield is calculated

Suppose the company decided to pay 10 rubles per share. You bought it for 150 rubles. The dividend yield is (10 rubles / 150 rubles) * 100% = 6.7%.

Each company has its own dividend policy. Some immediately declare that in the first few years they do not plan to pay them. Others don’t promise anything concrete. Still, others rely on numbers, for example, are willing to pay shareholders 75% of net profit or 50% of free cash flow, or, for example, at least a certain amount per share.

Growth shares vs cash cows

In the West, joint-stock companies are divided into two categories – companies with growth shares and “cash cows”. The board of directors of the former invests most of the profits in business development, they either do not pay dividends at all or reduce them to a minimum. The goal is to increase the market value of shares, investors, and in this case, speculators, buy securities in order to sell shares at the peak and earn on the difference. The founders of the “cash cows” do the opposite – they promise large dividends and attract as many investors as possible.

Share is open-ended issue security, it is proof of your contribution to the authorized capital of the joint-stock company. Investing in shares gives the right to participate in the management of the company and receive part of the profit in the form of dividends. Shares of the company are issued when they create a joint-stock company or increase the authorized capital.

The price of a share at which it is purchased by the first holder is called the issue price. At the market or exchange rate price, a share is sold and bought on the secondary market. The market value is formed on the stock exchange, it shows the real price of shares. It is influenced by the financial performance of the company, sometimes news or remarks of influential people can dramatically change the value of shares.

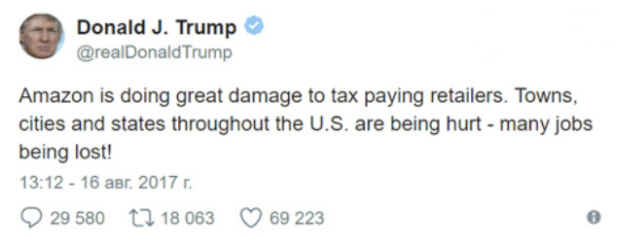

There is a curious application for traders that informs users about Donald Trump’s tweets: because of his statements, the shares of more than one company fell in price. On August 16, Amazon’s capitalization fell by about $ 5.7 billion in just two hours. The reason was the tweet of the President of the United States, he wrote: “Amazon causes great damage to retailers who pay taxes. U.S. cities and states are suffering from this, a lot of jobs are being lost!”

Capitalization

At the beginning of the year, Toyota shares fell in a few minutes. Trump threatened the company with duties for the intention to build a plant in Mexico. That tweet cost the automaker $1.2 billion. In December, Trump brought down the capitalization of the largest American defense company Lockheed Martin. 3.5 billion dollars was worth the statement of the future president that the program for the development of the F-35 fighter is too expensive. That’s how the capitalization of companies changes in a matter of hours and even minutes.

Capitalization is an increase in the value of shares due to the growth in the value of the company itself. To make money on capitalization, you need to sell shares more expensive than you bought them. The growth of the exchange rate is one of the main reasons for investing in stocks.

How capitalization is calculated?

Capitalization = the value of one share * their number. If you bought a stock for $10 and its price rose to $15, and for that amount you sold it, you made a 50% profit.

How to buy shares and receive dividends?

One of the most painless and quick options is to conclude an agreement with an intermediary company that invests in securities. It turns out that you do not directly buy shares. An intermediary can be a bank that offers a trust management service – a bank management fund (FBU).

How do bank management funds work?

In fact, this is a collective investment: legal entities and individuals transfer money to the bank, which manages the entire amount as one investment portfolio. Money is invested in various assets – in shares of corporate issuers, shares of mutual investment funds (mutual funds), Eurobonds, government securities and corporate bonds, derivative securities (futures contracts, options). The effect of “economies of scale” works here: if each investor managed such a portfolio independently, then the costs of managing investments would be much higher, as well as the risks. It turns out that your task is to invest money in the fund, and professionals will invest them. In addition, bank management funds provide real access to the world securities market, where you can buy shares of Google, Facebook, Amazon, IBM, or Coca-Cola.

Trust management is a long-term investment, the minimum period is one year, but a noticeable profit can be seen after a long time, at least in three years. Therefore, investments in the FBU are suitable for those who do invest not the last money, especially since the entrance threshold is not small – from 10 thousand dollars.

The interest of the bank is 1-2% per annum of the investment amount, the percentage is fixed. If the investment turns out to be profitable, the bank will ask for an additional bonus – a percentage of the profit received. It is better to clarify the details in the specific bank with which you conclude the contract.

_How much you can earn on shares

_

Assume, you invest $ 30 thousand in equivalent, if you choose a conservative strategy, where there are fewer risks and lower returns, you get up to 14% per annum, that is, $ 4,200. With a moderate strategy, it will be able to earn up to 16% per annum – $ 4,800. An aggressive strategy can bring up to 18% – $ 5,400. If you decide to form a portfolio, then professionals advise 80% of the money to invest in low-risk stocks and 20% in high-risk ones.

Summary

It is not worth spending strategic savings on the purchase of securities. No one will tell you what dividends you will receive from shares, at what price they will be able to sell, and what percentage will bring investments in the funds of the bank management. And if taking risks is not about you, and the nerves are not ironclad, then put money on deposit or choose another method of investment, which we talked about. One thing is fair about shares – you need to build long-term relationships with them, and preferably with an impressive financial basis.

|  |  |

|  |

Yay! 🤗

Your content has been boosted with Ecency Points, by @jobonlineclub.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more