Why Stack Silver Dimes?

Silver Value is Artificially Low

As we watch many prices go up, it's a sure sign of INFLATION. Certain items will "float" on top of inflation, meaning it's value increases keeping up as the dollar looses it's buying power.

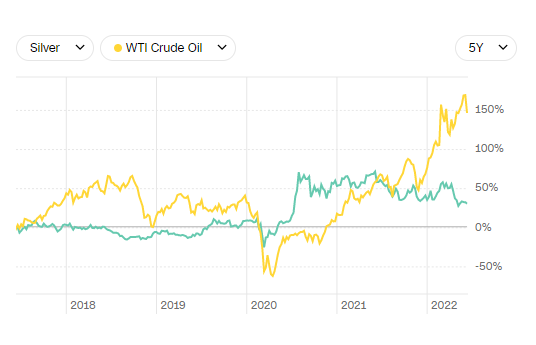

Silver (and gold) are known as a hedge against inflation - but there's one catch: a manipulated silver market. What that means is that silver can be purchased at ridiculously low prices. Historically, silver has run similarly with crude oil in terms of value.

August 2nd, 2020 is when the silver market manipulation really becomes apparent. As silver prices were fairly stable while oil prices were rising, suddenly oil prices dipped, silver following right along. But silver did a funny thing, it bottomed out and began climbing very quickly... until it mysteriously stopped.

The green line (silver) should have followed the yellow line (oil) on the climb up, but it didn't. It was artificially suppressed.

The Rig Will Eventually Fail

When commodity prices go up, it's very difficult to keep a material like silver down. The easiest way to keep people away from investing in silver is to ensure that every time the price goes up, it goes right back down again. This is because paper silver trades are instantly dumped on the market and sold for big dollars.

For more information on how the silver market is rigged, check the "Road to Roota" website.

"The Road to Roota Theory postulates that there is a group of people in the United States as well as around the world that are working to remove and destroy the financial banking powers that have secretly controlled all aspects of our lives for hundreds of years." - Bix Weir

When the Rigging Fails

Once the fakery is no longer able to be faked, we are going to see the correction of all corrections. We are about to see (physical) silver prices skyrocket. This is because the comex will still be reporting reasonably low silver values, but the TRADABLE value will be outrageously astronomical.

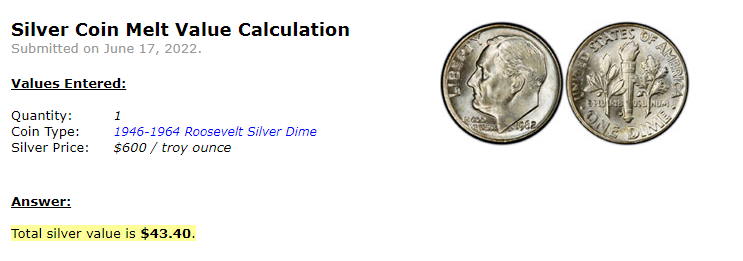

If silver goes to $600 (a low estimate), then we need a small silver denomination to make our trades. Otherwise, we'll be sawing our 1 oz coins and weighing them... what a pain!

Stacks of Silver Dimes

By stacking up those dimes, trading will be easy. With $600/oz, dimes will be worth about $40 each.

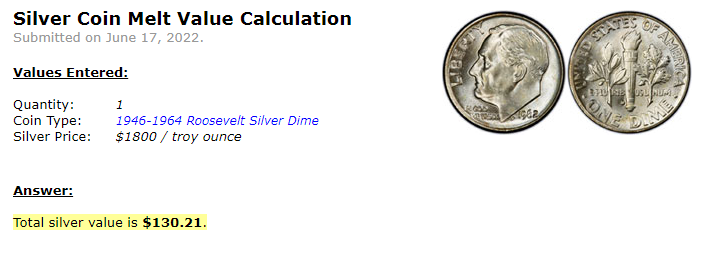

With silver $1800/oz, one dime will be enough to (perhaps) fill a few bags worth of groceries! Sadly once the market corrects, food items will also explode in price and paying $100 per BAG of groceries may be a reality.

In today's world, $1800/oz is unimaginable, but this is not as outragous as you may think. A market that's been artificially manipulated for decades (perhaps even centuries) will OVERCORRECT at first. Meaning for a time, silver prices will be almost imaginary prices before it stabilizes at the fair market price.

But to answer the question: Why Stack Silver Dimes? Because they are small, portable, verifiable and valuable. And if silver prices become something out of a dystopian fiction novel, the smaller the denominational weight, the better.

What do you think? Am I off my rocker with these numbers?

Bless the Most High!

Do You Like Discovering New Content?

ListNerds is a content discovery platform. Members promote content, various products and interesting links. Every click rewards you with MAIL credits to promote whatever content you want to share! If you'd like to learn more, visit Listnerds.com

Posted Using LeoFinance Beta

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

I wonder how much of the total gold/silver market is pure paper. Do you know how much one of those silver dimes could buy back in the day? If I reckon 1oz of gold during the free banking era could buy the same amount as today at 1800$/oz

It's estimated over half is paper. It's a known fact that more silver is trading than physically exists - sort of like elections, more people voting than registered. Everything is a sham!

What a clown world we live in. It's almost like in the book 1984... fake statistics, fake data. That book should've been dystopia, not reality!

Junk silver is no junk 😉

So true!

Nice stack, those coins are definitely worth more than their melt value though :P.

Yes, I put that shiny barber on top, the rest are roosevelts.

If things play out as you say, then maybe. However, I still think the liquidity for converting things will be tough as you need to sell them to other collectors.

Posted Using LeoFinance Beta

Thankfully where I live we have buyers on every street corner: pawn shops, coin dealers, jewelry stores all pay cash for gold/silver. It's possible that if too many people are selling at once (with high prices) they might not be so willing to buy from everyone!

Hopefully, I will find some this year with my metal detector.

I hope you do!

I've stacked a lot of silver dimes knowing full well that I will be helping out some family and friends that are not as committed in preparing for the Economic disaster coming. It is the ideal fractional currency for emergency commerce.

Emergency commerce, good way to describe it.

I am definitely seeing a time that will come where the price of silver will be worth $50

Yup, sometime before it reaches $5000.