PolyCUB Bonding Protocol: Another Way of Achieving the Yield Optimizing Goal

I need to remind those that aren't aware that PolyCUB is a DeFi 2.0 platform with a Yield Optimizing mindsets and strategies.

The launching of PolyCUB in early March saw a shift from DeFi 1.0 to DeFi 2.0 with the aim of working and collaborative motives with other blockchains and smart respectively.

What does it mean to be a DeFi 2.0 platform?

The traditional DeFi 1.0 is mostly concerned with earning opportunities and protocol liquidity, while DeFi 2.0 came with the idea of creating stable value and still maintain all the qualities of it's predecessor (DeFi 1.0).

DeFi 2.0 also looks at a more yield optimizing opportunities to enable it last longer than DeFi 1.0.

More qualities about DeFi 2.0 is finalized by the arrival of PolyCUB and became more significant through the bonding protocols with other smart chains like Bitcoin (WBTC), Ethereum (WETH) as well as Sushi Liquidity Pool (SLP).

What does bonding protocols offers the success of PolyCUB

PolyCUB on its own has been programed in a way that it can create and achieve it's yield optimizing goal through the presence of xPolyCub but to go further than expected, there's need to have other smart chains partner with it, hence, the need for bonding protocols.

We all know the power of bitcoin and Ethereum in cryptoglobal. So bonding with this crypto big wigs is very important for PolyCub's growth.

Bonding protocol simply means swapping PolyCUB to the above mentioned crypto smart chain and receiving the rewards in PolyCUB. Let take SLP for instance, it's the LP Token you get to represent your position in any liquidity pool on Sushiswap.Source

Bonding on this platforms can be either positive or negative depending on the price as at the bonding harvest. This might not be the actual explanation for this paragraph, to get more information about the negative and positive state of bonding price click here

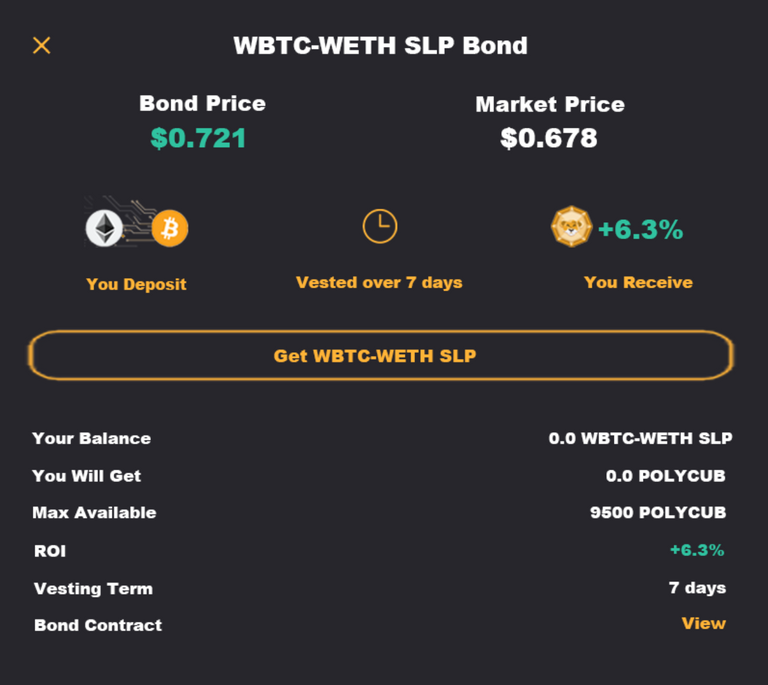

- User A deposits $300 worth of WETH-BTC SLP tokens into Bond #3

- $300 is added to PolyCUB's Protocol Owned Liquidity where it is utilized to autonomously stake, earn rewards and use those rewards to buyback POLYCUB and distribute back into the POLYCUB Rewards Pool

- User A locks in whatever ROI is currently available (+6.3%)

- User A is now owed $300 + 6.3% of their deposit, paid out in POLYCUB

- Over 7 days, User A is distributed POLYCUB tokens at whatever market prices they locked in ($318.9 worth of POLYCUB @ the market price of POLYCUB when they initiated their bond: $0.678 in the above case)

- User A can continuously claim their bond over the 7 days or wait the full 7 days and claim 100% in one click

https://docs.polycub.com/mechanics/bonding-protocol

Posted Using LeoFinance Beta