10 Days of Owning A Splinterlands Validator License

Splinterlands is one of the best Play2Earn / GameFi-modeled games in crypto history. The game has gone through several bull and bear market cycles in its entire lifetime. What has always been the same was the non-stop development of Splinterlands!

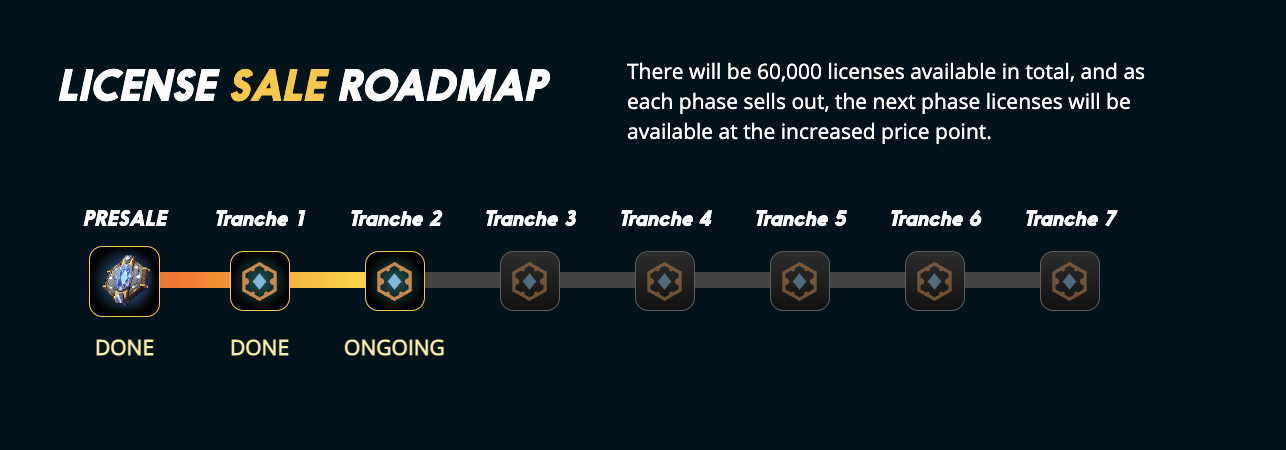

Recently, the sales of Validator Node Licenses started. With the hype, people rushed to buy in the pre-sale and Tranche 1. Some gamers/investors were able to purchase these licenses for $1000 in pre-sale and up to $1850 in Tranche 1. You can still buy in Tranche 2.

I made my purchase in Tranche 1 which cost $1850-$1900 with the sum of SPS, Vouchers, and transfers from the external market. Eventually, I own a Validator License for 10 days. Time to share my experience with those who want to buy one 🎮

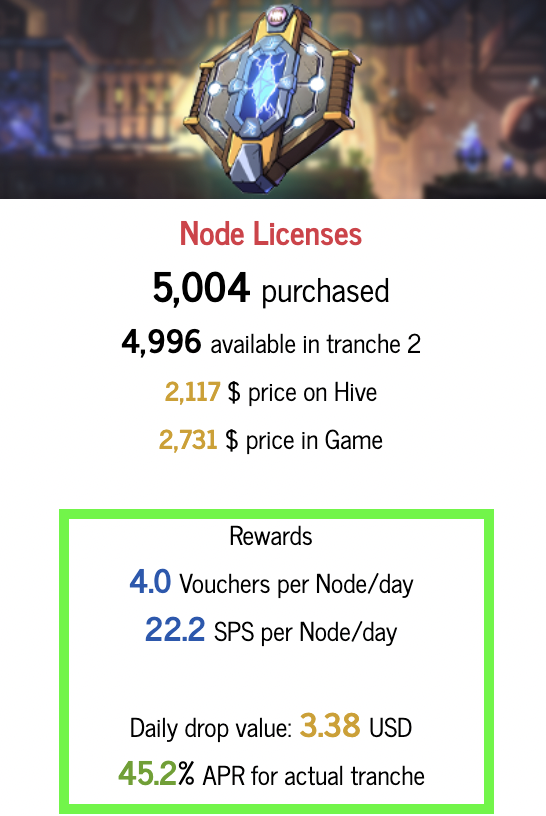

In this phase of sales, you can buy your license for $2,100 on Hive markets or you can use your SPS + Vouchers and buy it for $2,700+ in the game.

Where can you check it? On Splintercards 👇

Splintercards reveals that it is still possible to get 45% APR for your purchases as of writing.

We should not forget the fact that Voucher is traded for $0,48 and SPS is traded for $0,07 when the APR is calculated.

When we go back in time, SPS tested ATH for $0,88 when GameFi was trending thanks to the hype on Axie Infinity, AlienWorlds and Splinterlands. However, we should also consider the number of SPS (due to the pace of distribution) on the markets while comparing the price with today.

There were fewer SPS token in the circulation and there was an amazing APR for SPS staking on Splinterlands. In addition to the GameFi trend, Staking APR was the other narrative to stake SPS that pushed the price higher.

Splinterlands Evolved in Time

Actually, the hype on these days had less sustainable reasons IMHO. During a trend, any token can gain value if there is also nice APR rate to compound your gains. Yet, in technical charts, we see the price actions in addition to the story 😉

Today's Splinterlands is similar to the step to Splinterlands Metaverse / Splinterverse with the Guilds, Lands, New Game Modes, Licenses and more! Also, you can clearly see the ongoing hype that make it less than 1 minute to finish all sales in the pre-sale phases 🔥

Considering all these facts, 10 days of my investment showed me that I need more Validator Licenses because the game has not skyrocketed. $0,88 or $1,07 ATH is just nothing at all.

1 License to buy More Licenses

In 10 days, I received more than 40 Vouchers and about 250 SPS. What I'm going to do is keeping 500 Vouchers aside for the next License and swap Vouchers for SPS to get closer to own the second License.

Actually, buying a license can also be quite advantageous if the price of it stays close to $2000 - $2100 in Hive-Engine. In this case, I will keep 500 Vouchers aside and take profit from my staked SPS when I can swap them for another License.

Even in both scenarios, it is obvious that I'll enjoy Staking SPS that will bring more Voucher and SPS (around 34% APR) and compound the distribution coming from the Validator License.

Only 60,000 Licenses and potentially millions of players... My goal is to buy at least 2 more Validator Licenses in Tranche 2 🐉

Posted Using LeoFinance Beta

https://twitter.com/idiosyncratic1_/status/1574038423333208065

https://twitter.com/mypathtofire1/status/1574052158630002688

https://twitter.com/RuelChavez5/status/1574585790989930496

The rewards earned on this comment will go directly to the people( @idiosyncratic1, @mypathtofire, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Hate I missed out on cheap validator licenses.

Posted Using LeoFinance Beta

It is still $2100 on Hive Engine. I believe it is a fair value for now 😌

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Thamk you @bhattg and dear India-leo team <3

what fees do you take on it or is it the 50% of author rewards?

Posted using Splintertalk

What about the author portion do you curate yourself if so why would we not get some of that fee.? Im going to curate and it will offersome incentives for specific tokens like delegate spt and get a stake in the one up curator which will vote on a post of the delegators choosing once during a controact of at least a 1 month and then the delegator will get 75% cash flow from the author and curation rewards receiveds and 50/50 interest in a separate fund that is withheld to pool on non hive protocals and invest in varoius things and some funds which are interesting. Could vote a group of ppls articles and give people rewards if they produce good content and thenthey are the ppl who own the shares so they get there percentage of author rewards or we write and distribute autor rewards as well as curation bc are other accounts will up vote it. Tag it and re post on steem to and tag over there for different tokens of which we will keep 75% and the 25% gets added to your balance as it grows and is put in stable coin lps or sps staking to generate rewards increaing daily. or may charge like 5% see how much i can get for doing 5% fees and 95% of all author and curation so we get 5% to curate it and give out most of the rewards to the community not just 50% we will take 5-25% depending on the token and you get steem curation fees as well bc we will use your article there and post it as well ass many other crypto bloggin sites and you get 25% of those and we get 75% of the extra sites. so ppl will likely make more than bot author and curation rewards bc we will do it on many sites for them

Posted using Splintertalk

The Validator Nodes prove quite profitable with a great APR% together with their values increasing. Seeing now the rewards given I regret not pushing the trigger and buying one during the presale, but simply I feel overwhelmed with what it's happening in Splinterlands and cannot get on every launch they are marketing.

Posted Using LeoFinance Beta

I would love to buy a validator license too but I just don't have the resources. And even if I have, I would probably build up first my deck.

Congrats on owning a validator license and hope you will get another one. 😊

!1UP

You have received a 1UP from @thecuriousfool!

@monster-curator, @oneup-curator, @leo-curator, @ctp-curator, @vyb-curator, @pob-curator, @neoxag-curator, @pal-curator, @cent-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.

PIZZA Holders sent $PIZZA tips in this post's comments:

@curation-cartel(2/20) tipped @idiosyncratic1 (x1)

Join us in Discord!

Thanks for sharing! - @alokkumar121

It would be great to become a Splinterlands validator node

Posted Using LeoFinance Beta

Weere going to do node shards and just take a 5% straight split on it an will also have some wild ones with the value of each sps and voucher distirbution say this one is a 15% split bc of more active mgmt of putting each distribution in lps to collect fees an the best lp rewards for 4-5 pools. Also will have things in other funds on some like embers ember funds are a interesting one that can ebr accumulated with all or half the value of he distributions it would be interesting to have that and sps and vouchers be distributed or bought after swap then done eachweek with the ember funds to gain a larger dca stake in.

Posted using Splintertalk

or have one that is rented purely for a calculated amount of spt fixed each week and updated then we get to us ethe vote and staked spt for proposals and voting as well as voting income for are curation service to either sell votes at 2x curation for the cost of 1X to gain more power the lower margin isnt a big deal if you get like 100 million staked on your for it. Might be wworth a shot to use the combined voteing power to of pppl for a day to buy a node or a week do do a whole node fund if we get enough stakes for a week to buy a bunch of nodes and then all the staked tokens who helped us get propotional to the value a share of 90% with a 10% carried interest equity and distirbution fee for managing all of it and organizing the group for votes on what to do in certian situations basically the admin for the club each node shards club will have one to 5 nodes depending on the numebr of ppl and amount purchased per person. once nodes go live then the cost of running them will be deducted as well. But were interested in doing staking for node shares wheree we must get the vote value by being delegated say a few million spt some hiive and a bunch of other tokens we will vote for a week until we have enought for a node and purhase the node call it Node Cannon IC DAO 1 and keep doing them lol

Posted using Splintertalk

im going to start selling parts of them as a serivce where you can just buy the cash flow from one or both at a set amount per period usuallly like a week wont differ but months would have a premium on the cash flow. Also could have apppreciation token sold at like say a 15000 value cap at x premium price depending how much wiggle room they want in increases but as they goto 20K strikes or somthing just charge like 500 bucks and be done with it lol will be interesting if i cna also attract anyone to put up a loan to the node shared node club based on its debt service dscr and equity in the node as collaterol pro rata so the people and the gp can get part of the appreciation in the node by having a sale to other third parties who are looking to but interests in various node shares and the node shard fund which will hold many different interestes in each one in case ppl want a bunch of onces with different terms to average in and get special terms on some. The fund wiil give people allocations of cash flow for staking x spt on a scale or a comninmation of spt 50% hive 50% and there will be a scale based on what that stake will earn us to compute the time a day of staking x will get you in node shards which shifts as the stake changes invalue daily it is adjusted at least once which means you can be allocated more or less node shareds or any share based on if the value of the vote is up or down on your stake will be interesing to see how much of each coin i can get staked to vote with.

Posted using Splintertalk

i have 6 now going to go for 15

Posted using Splintertalk