Zero To Hero Challenge Ep 21: Four Hundred Forty Four and Forty Four Cents

Some days I have to remind myself to stay positive. There has been so much trauma in the market lately, both in crypto and in stock markets. Bitcoin suffered cascading liquidations which set off all DeFi markets into a downward spiral. I got liquidated, my project got liquidated, and so did everyone else I know.

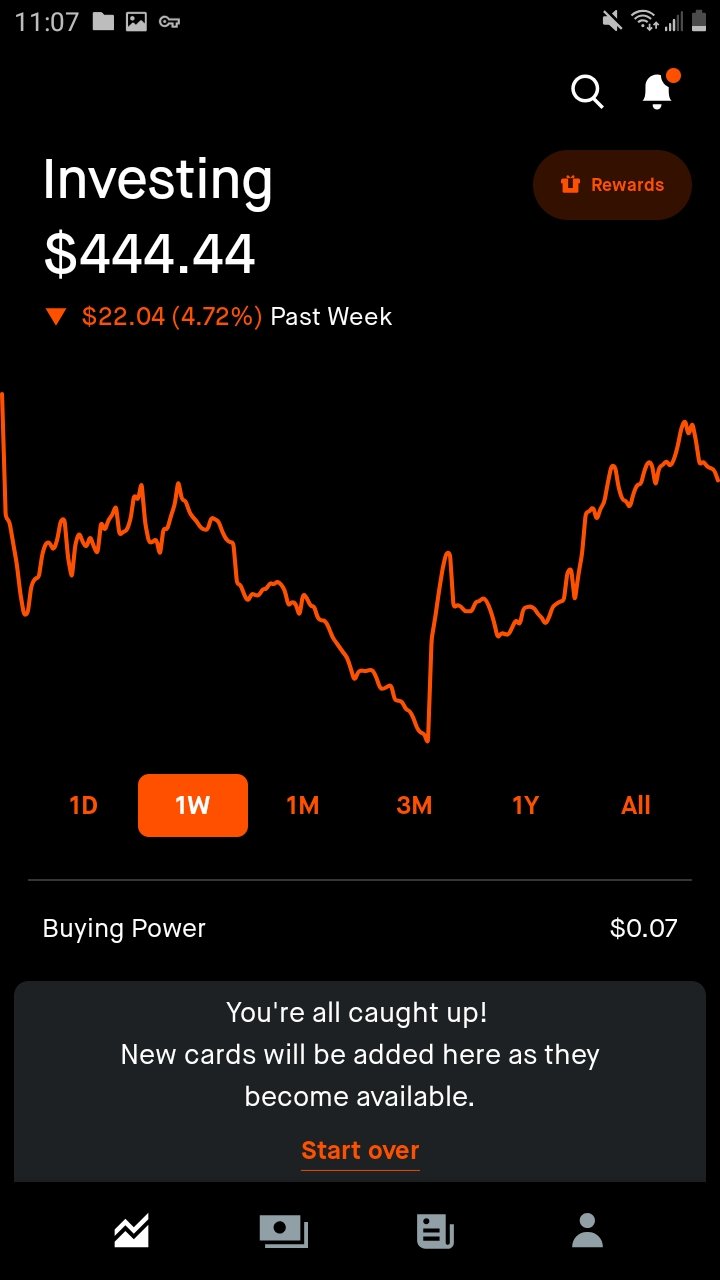

The end result has not been pretty as most retail traders are just giving up at this point. Full on capitulation has been seen across many different asset classes and it just wont stop. Personally I have been shredded beyond belief this week and sometimes it can be hard to bare.

The journey must continue and people want to know how the progress, or lack thereof, has been. Must keep posting regardless of how I feel inside because this is for science (and fun)!

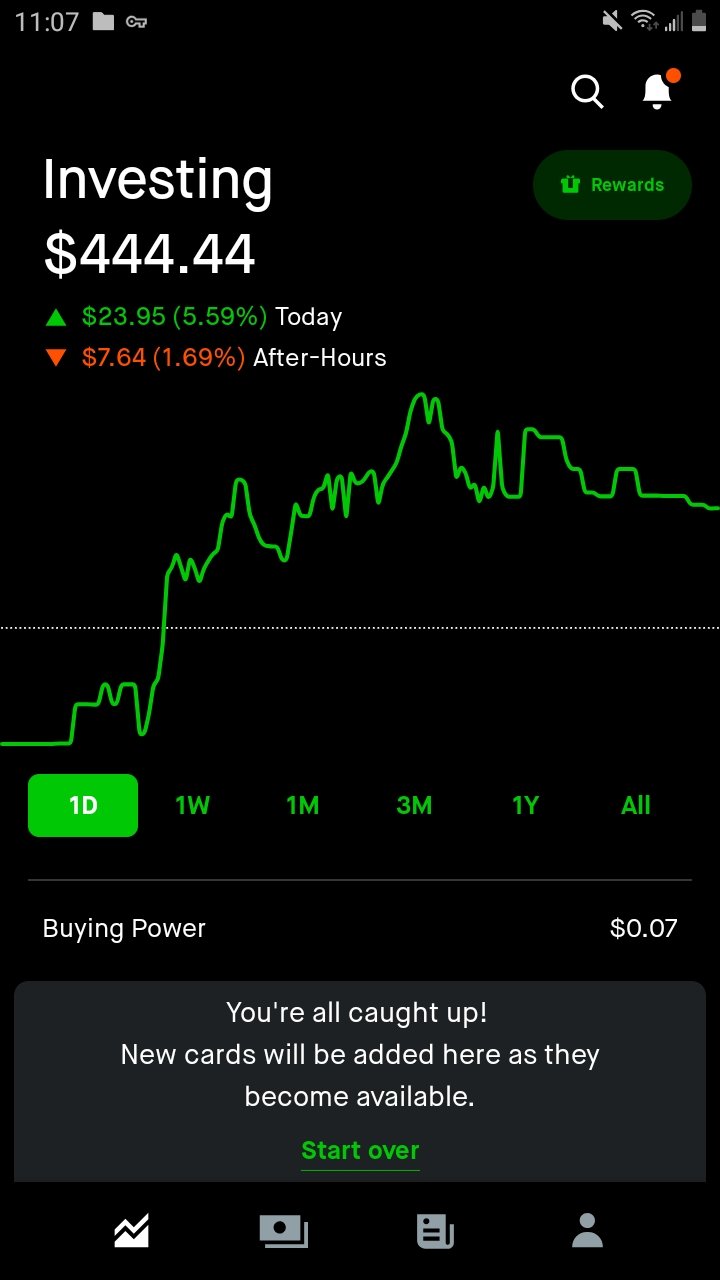

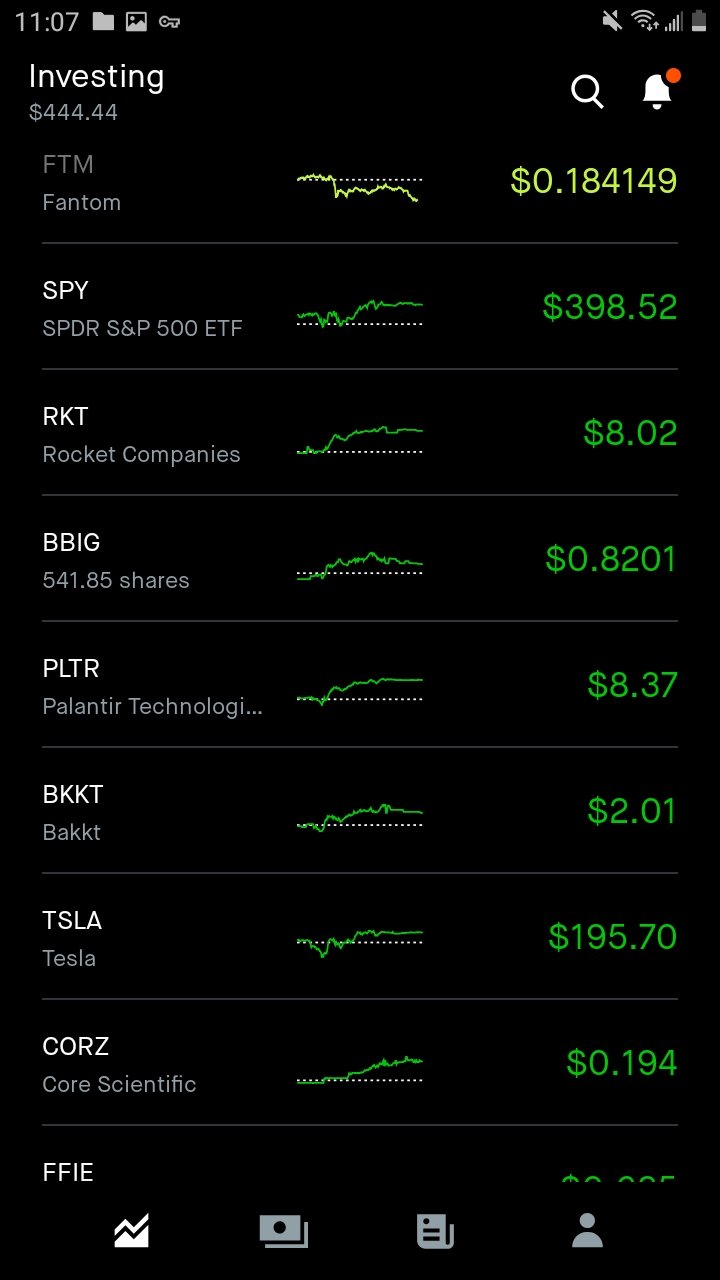

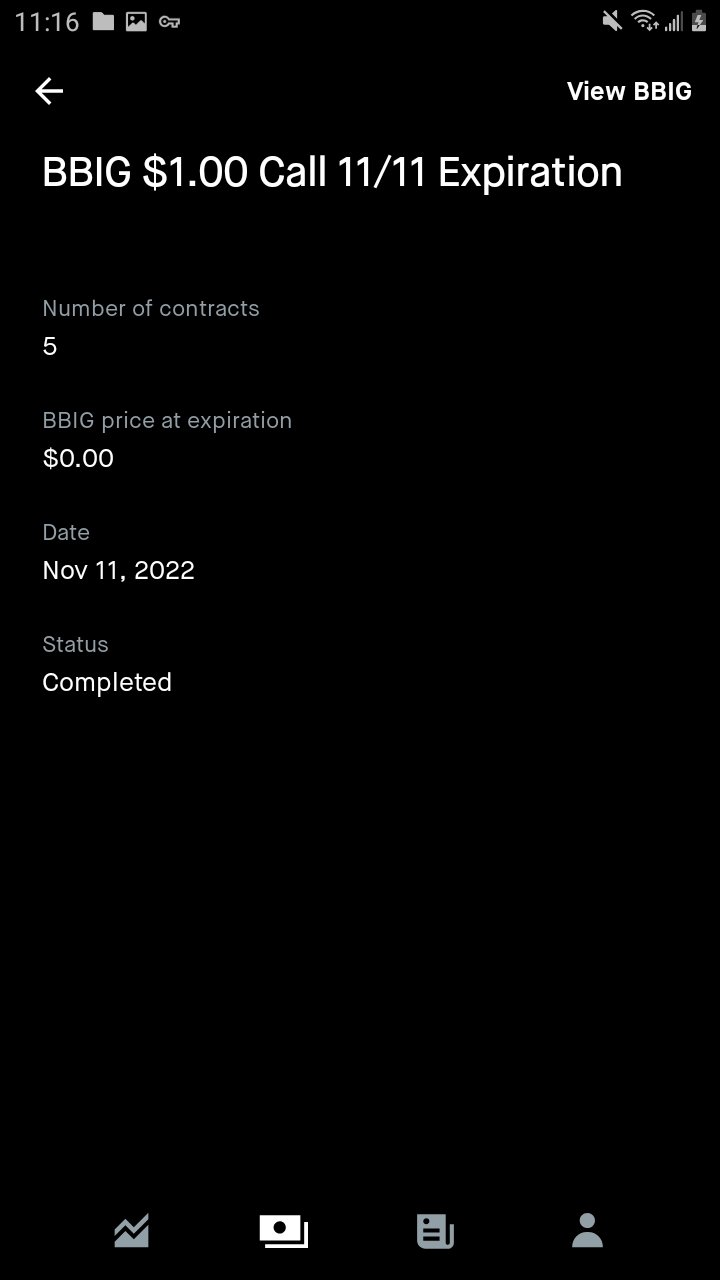

My covered calls expired today out of the money meaning I extracted maximum value from them. This helped to buffer my losses on BBIG when it dipped, but still gathering myself at these levels. My 500 shares have been unlocked from collateral and will be used to sell more contracts next week... not sure if I want to write at these prices however as premiums are terrible unless you go out at least a month.

I wish BBIG would go back towards a dollar since this will allow me to write my calla at decent premiums. Ideally I can collect $30-50 off my next move and add this to the stock equity, by buying more shares.

This week the CPI report showed 7.7 YoY inflation which rallied the major indexes. Traders see this is the Fed pivot signal since it shows their measures are helping to curb inflation. The real issue was printing more fiat and letting it circulate in the economy, which is the literal only cause of inflation. The only solution is to normalize inflation pricing and adjust wages accordingly to compensate for housing cost increases. They have tried to strengthen the dollar (DXY) which only hurt the equities and crypto markets further.

Where do we go from here? Who knows but it doesn't feel good to be along for the ride into the dark abyss.

Still reasoning

For those curious the strategy that I am employing to earn money based on the time value is called "The Wheel" for stock options

Here are the steps:

Find a stock that is both optionable (offers stock options) and is also something you are comfortable with holding for longer term. You must then buy at least 100 shares of this stock to use for the strategy which will generate CASH (premiums) for your trading account.

Open the options order book and click "SELL" then click "CALL" to ensure that you are writing a covered call- it will show the option to use 100 shares as collateral of the given stock. The amount of cash you receive depends on several factors but mainly the time til expiration.

For each contract you write it will require 100 shares and will lock them up as collateral for the duration of the trade

A few key notes to remember:

You are SELLING to OPEN the position so you will need to BUY to CLOSE if you want to exit before the expiration.

Waiting til expiration risks the contract going "into the money" which would result in getting "called away", meaning you would have to sell your 100 shares at the given strike price on the contract.

As time goes on the contract will decay in value based on the Theta.

Best case scenario you get paid only once and worst case scenario you get paid twice.