Some More Thoughts On How To Take Crypto Profits

In Step Four of yesterday’s blog post I discussed @achim03’s advice about taking crypto profits from lower priority crypto holdings to invest in higher ones.

In today’s blog post I’m going to talk through how my thoughts have developed on the idea of taking crypto profits. I did a bit of research on price histories of various tokens on the Hive blockchain and it’s clear to me that I need to think carefully about how and when to take crypto profits.

Moving Crypto Profits From Low To High Priority Tokens

If you are taking crypto profits off the exchanges and cashing out, one obvious consideration is tax. However, that is not the focus of this blog post. Instead, I am looking at how to move crypto profits from lower priority to your highest priority crypto currencies.

In my case, one of my highest priority crypto currencies is Bitcoin. I am also accumulating FUN tokens. FUN is an important part of my crypto portfolio (not least because you can earn up to 25% per annum on locked FUN tokens).

However, I rank it as second in priority to Bitcoin. That means I will sometimes take profits from FUN and invest them into Bitcoin.

One Way To Take Crypto Profits: FUN to BTC

I found it relatively easy to think of a way to take some FUN profits and plough them into Bitcoin.

Back in August 2021 I sold some Bitcoin and bought 50,924 FUN tokens. Then I locked them away for one year so that they will earn that juicy 25% interest, or 12,556 FUN tokens. If you have a FreeBitcoin account it is quick and easy to do.

When the one year term expires I will cash out 50% of the accrued interest (6,278 FUN) and buy Bitcoin with those FUN tokens. The rest I will lock away for another year at the highest interest rate that FreeBitcoin offers.

A couple of questions arise, however…

One question is, how much will FUN tokens be worth against Bitcoin in August 2022?

Another question is, how much will one Bitcoin be worth against the US dollar?

What if FUN declines against Bitcoin and Bitcoin declines against the dollar? What if FUN declines against Bitcoin but Bitcoin gains against the dollar?

For me, I want to keep on accumulating and hodling Bitcoin, so as long as those 6,278 FUN tokens get me a reasonable amount of satoshi, I won’t complain too much.

But I guess I should set a limit on the downside which, if breached, would mean that I would simply reinvest the FUN tokens so they keep earning interest rather than swap them for BTC. If FUN declines against BTC by more than 25% then it would perhaps be better simply to lock away 100% of my FUN tokens for another year.

Thinking About Moving Profits From Second Tier Tokens To Hive…

Turning to my other top priority crypto currency, HIVE, my goal is to take profits from various second tier tokens that I am also accumulating on the Hive.io blockchain and put them into the primary HIVE token.

However, a difficulty arises from the happy news that HIVE jumped 10x and more in value during 2021 whereas many of the second tier tokens failed to replicate those gains and have declined against HIVE even while their dollar value has increased in many cases.

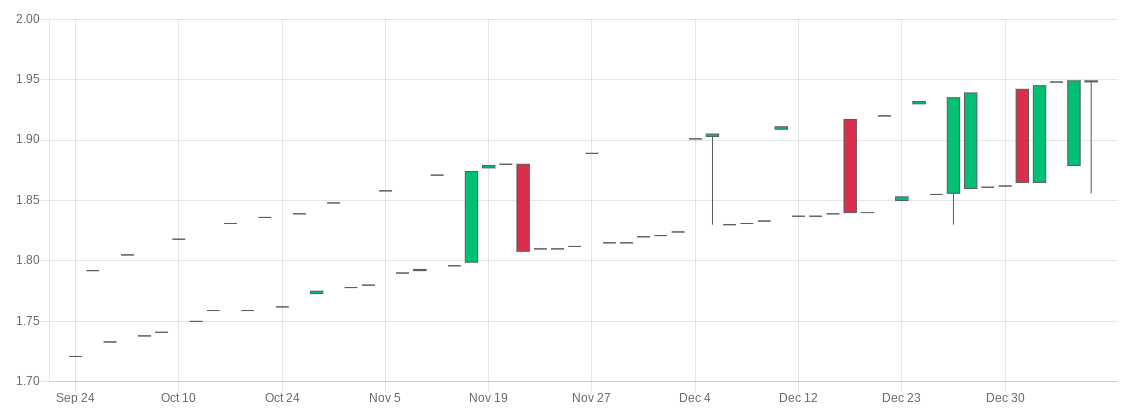

One second-tier crypto currency stands out though, because it has bucked the trend and gained in value against HIVE, is CTPSB. (Read this document to find out how CTPSB can gain in value against HIVE: https://ref-hunters.ch/ctpsb/index.php )

Here is a chart of the progress of CTPSB over the last few months. While the trading volumes are thin, the steady gain in value has enabled CTPSB to achieve a 70% gain in 2021.

If CTPSB can maintain these results then perhaps it would make more sense for me to take profits from other second tier crypto tokens and put them into CTPSB once a quarter, and take profits from CTPSB to put into HIVE about once a year.

Hit Your Targets Before Taking Crypto Profits!

However, looking at my second tier holdings, and my accumulation goals for 2022, I realize I am nowhere near being in a position to “take crypto profits” at this stage. First, I need to hit my targets for the year, and THEN think about taking profits depending on the relative value of second tier tokens to CTPSB and HIVE, and of HIVE to the US dollar.

How do you go about taking crypto profits? Let me know in the comments below; I'd welcome any insights into this tricky topic!

David Hurley

#InspiredFocus (??)

Posted Using LeoFinance Beta

Hello David,

I like the way you are thinking. What I realized for myself is that it all starts with which tokens you want to collect. For myself I have decided to focus on only two tokens for my goals. I'm trying to build all the other stakes as well but I just use like 10% to buy the tokens I focus on.

I think that people don't really realize how great CTPSB is. Well of course I'm a bit biased lol but every token is backed with Hive Power. It will increase at least at the speed of an account that curates posts. However at the same time, thanks to delegations and post rewards, the increase is leveraged. It's possible that the APR will slightly drop but it will be always higher than just staking hive. At the moment I'm trying to reduce the spread of the market maker and also adde more liquidity to the market. Like that people can simply park hive into ctpsb for a certain time and then when they need the liquidity, sell it back with a nice profit.

Congratulations @hirohurl! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

I have not earned anywhere near what you have earned on FreeBitcoin. When you reach a certain amount of Satoshis do you move them from FreeBitcoin to a wallet?

Hi @mba2020 - That's what I plan to do when I hit a certain number, but not there yet. Thinking about getting a hardware wallet later this year.