Ethereum Burning Up and Is it good for Ethereum and Crypto?

On August 4th, Ethereum’s new improvent proposal EIP-1559 went live.

One of big change from EIP-1559 was transaction fee mechanism. It made new concept “base fee” that is minimum price per unit gas.

This price fluctuate regarding network load.

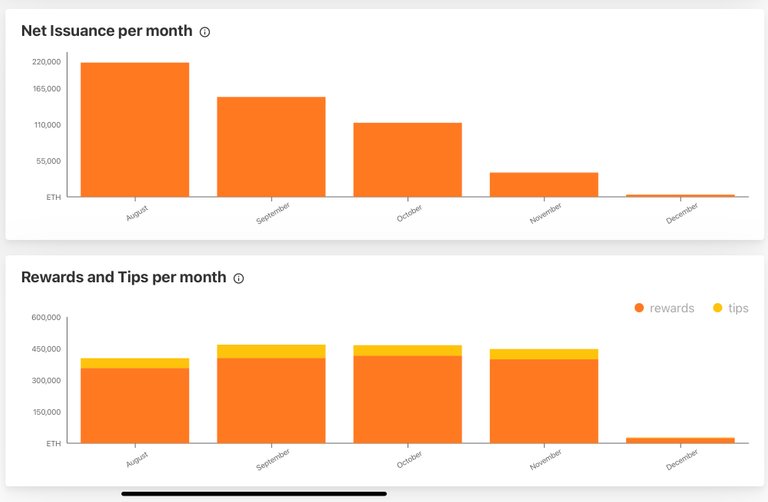

Ethereum base fee concept have burnt much Ethereum that hit all-time high in November, as over 360K ETH burned. And with 19% of monthly growth rate, the burning rate have grown continuously for recnet months.

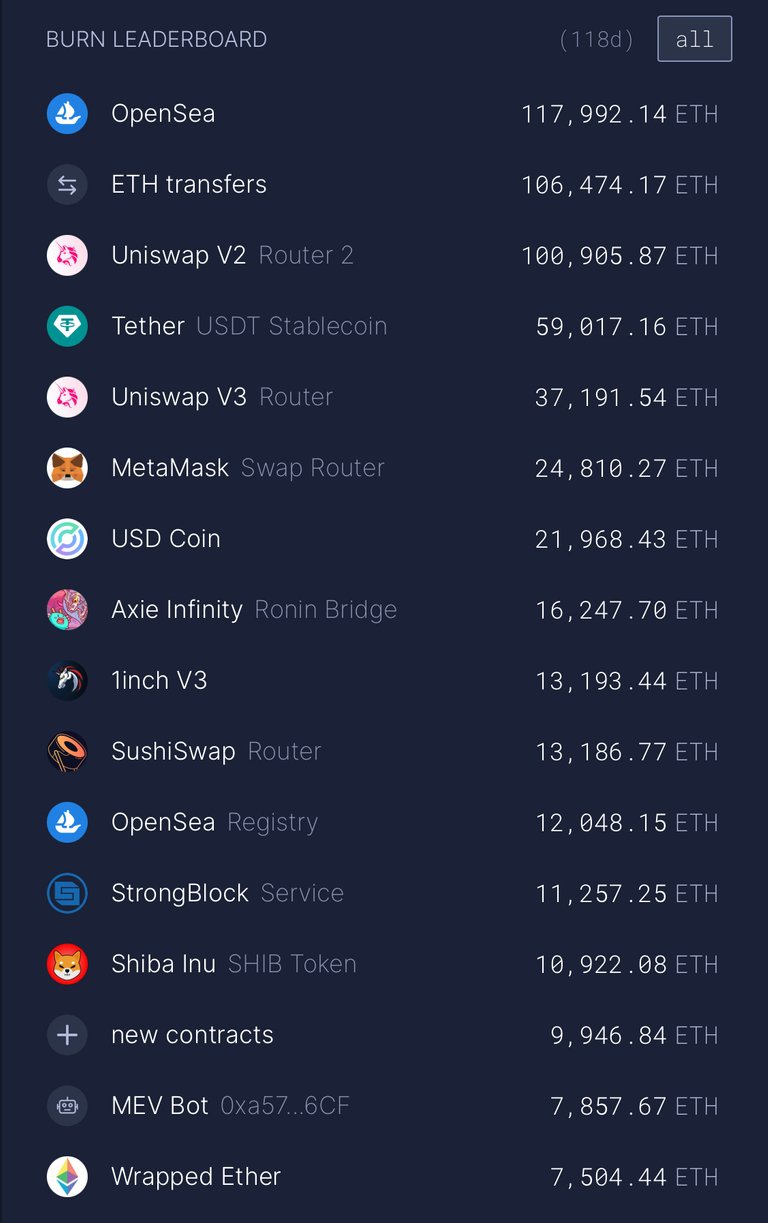

Up to date, Opensea accounts for the top ranker of burning Ethereum as of 118K burned.

And ETH transfers and Uniswap take 2nd and 3rd postions that have burned 106K and 101K respectively.

But Net Issueance continuously has decreased. On Novemeber, the issuance is 37K.

Regardning this raw data of ETH supply and burning, we can estimate that Ethereum would be deflationary, its price may rise based on this data if market demands keep going on.

There are clear opinons that even though the gas price limit market expansion and block consumenr adaption. And this options are attacked by what most of major ETH consumer would be whales or large institutions. They wouldn’t care the gas cost, and thay amy welcome this high gas cost. Because it may make competitors hard to enter this new opportunity market.

But most important point in human market and price decisoin is consumer and market itself.

If gas fee continuiusly reduce the Ethereum’s popularity, other more efficient and revolutionary chains and protocols may hit Ethetreum.

In this crypto world, intitutions could not control everything, crypto’s start was decentralization. It’s a kind of mother of crypto concept even thogh it is not wasy to make it realied.

Reference: Messari, Ultrasound.money, watchtheburn.com

Posted Using LeoFinance Beta