Best algorithmic stablecoin in 2023

Direct from the desk of Dane Williams.

With so many collapsing around it, we look at why Hive Backed Dollars (HBD) is the best algorithmic stablecoin in 2023.

When you talk about the best algorithmic stablecoin in 2023, the sad thing is that we no longer actually have all that many to choose between.

When you take all of the centralisation, algo blow ups and hacks across the algo stablecoin space into account, you aren’t left with a whole lot of competition for what I still see as the clear best.

The best algorithmic stablecoin in 2023 is Hive Backed Dollars (HBD) - The decentralised algorithmic stablecoin that is pegged to $1 USD worth of HIVE.

At this point, it’s not even a contest.

Let’s take an updated 2023 look at why HBD is the best and how you can take advantage of its truly decentralised properties.

2023 stablecoin update

In my 2021 look at the best algorithmics stablecoins, I highlighted HBD as an underrated gem.

HBD was a clear choice as the best option then and it’s still a clear choice as the best option a year later.

But the crazy part is that in that post, I listed HBD alongside two other options.

Who were those other algorithmic stablecoins I spoke about alongside HBD, you ask?

UST and FEI.

Yikes.

The code behind Terra Luna’s UST was fundamentally flawed, seeing its completely unsustainable tokenomics send the stablecoin into a death spiral to zero and investors rushed for the metaphorical door.

FEI on the other hand faced a hack and the completely centralised nature of the stablecoin meant the task of making investors whole again was a complete disaster.

While the coin technically still exists, why you would ever trust an algorithmic stablecoin that is anything but decentralised and permissionless after something like this, I will never know.

Hence we come back to the best and only truly decentralised algorithmic stablecoin on the market.

Hive Backed Dollars (HBD).

What are Hive Backed Dollars (HBD)?

First of all, let’s start with a quick refresher on what the algorithmic stablecoin called HBD actually is and what sets them apart as we search for the best.

Stablecoins like HBD are based on trustless algorithms.

Although pegged to the USD, they are actually priced in HIVE and backed by the entire value of the Hive network.

As such, you’re always able to use an on-chain conversion mechanism that allows holders to convert 1 HBD to an equivalent of $1 USD worth of HIVE tokens.

And of course back the other way from HIVE to HBD.

This is where the magic of HBD occurs because it’s via this on-chain conversion mechanism that HBD really sets itself apart in the algorithmic stablecoin space.

This way, the price of HBD is pegged to the price of the USD without ever actually holding any USD in collateral or transacting in the currency.

As long as the underlying network remains decentralised and untouchable by single state regulators, then HBD remains truly permissionless.

As long as the Hive network exists and HIVE has value, then HBD will continue to operate in this manner and hold its peg.

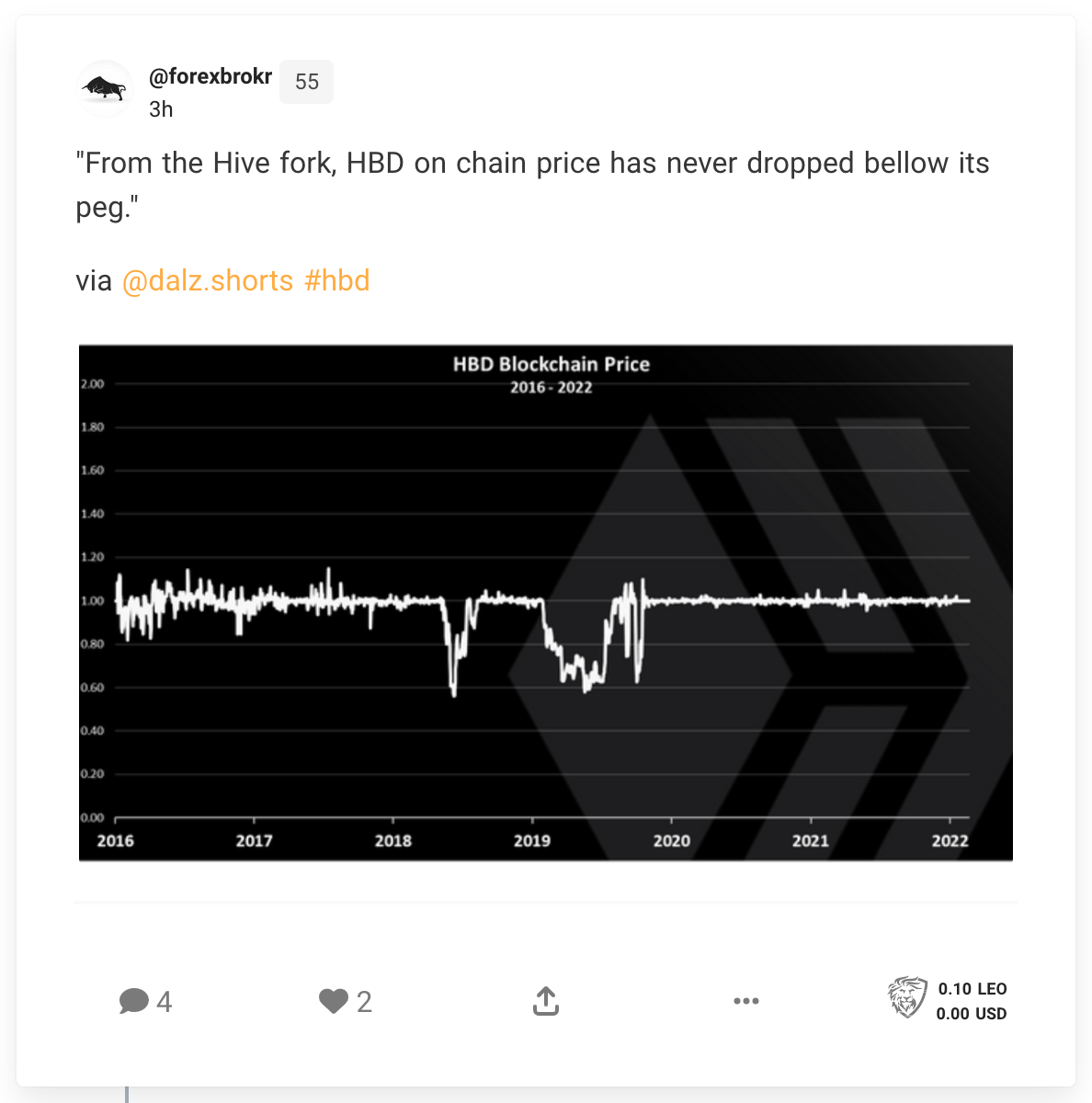

Since Hive forked from Steem, you can see that HBD’s on chain price has never dropped below its peg:

The most recent Hive hard fork has lifted the debt limit to 30% and elected Hive witnesses are still ensuring HBD stored in savings accounts on chain earn an industry leading 20% APR.

Where to now for HBD?

While HBD’s link to the Hive blockchain makes it the only permissionless algorithmic stablecoin on the market and therefore the clear best choice, it does have a long way still to go.

In the grand scheme of things, HBD is - and in the short term at least will - remain tiny compared to other stablecoins.

In my opinion, the biggest thing holding HBD back from achieving its full potential is liquidity.

Moving into HBD via the blockchain’s conversion mechanism puts you at the mercy of price for 3 days.

A necessary security measure to help protect HBD from falling into the same death spiral that ended UST, but a constraint nonetheless.

If whales instead try to use Hive’s internal market, they’re quickly limited by a severe lack of liquidity that just doesn’t make it viable for big players.

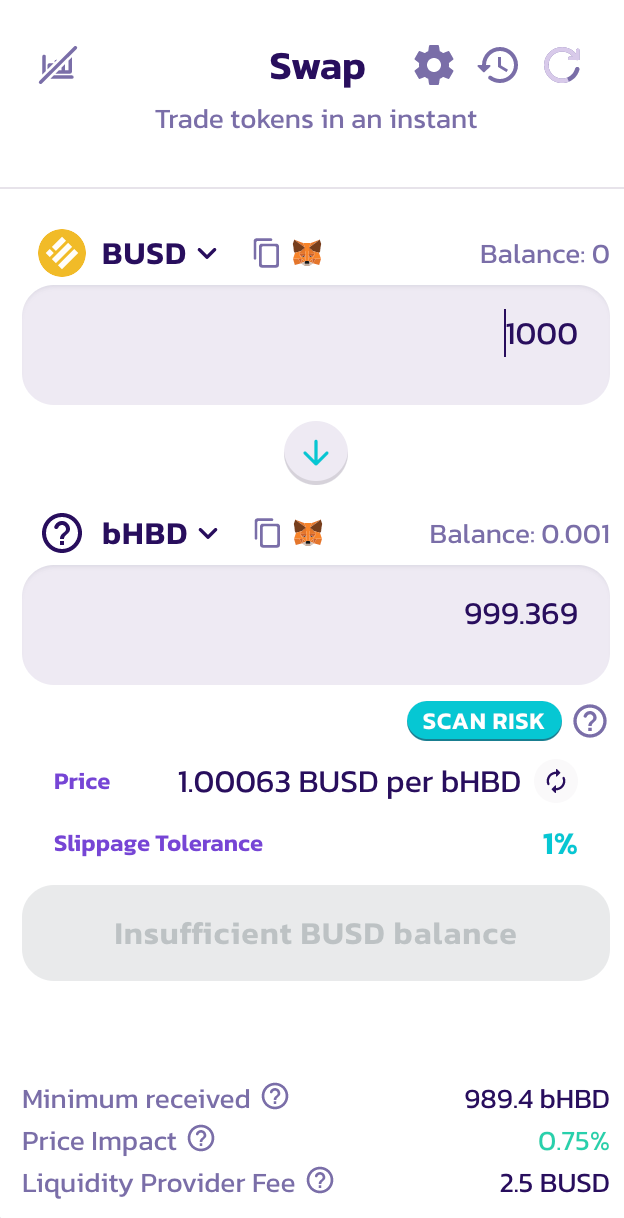

Enter LeoFinance, the ability to wrap native HBD into bHBD on BSC and use the Cub Finance DEX to permissionlessly swap between bHBD and BUSD.

Leo’s Cub Finance platform is currently incentivising the bHBD:BUSD LP with a 27% APY and currently houses $250,000 of liquidity.

Nowhere near enough for big players.

But at the moment, that’s the price you must pay to store your money in a truly decentralised and permissionless algorithmic stablecoin like HBD.

Any other stablecoin in 2023 opens yourself up to a whole other world of risk.

Best of probabilities to you.

Posted Using LeoFinance Beta

https://twitter.com/3979726700/status/1583346708054179841

https://twitter.com/1415155663131402240/status/1583495058812043273

The rewards earned on this comment will go directly to the people( @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I think HBD is a good stable coin and I know the community took in the feedback from UST to figure out how to prevent it. It's not like Justin Sun who decided to make a copy of UST and try to attract people. At the same time, stablizer and Defi pools are doing a decent job of keeping prices as close to $1 as they can.

Posted Using LeoFinance Beta

This made me lol.

Justin Sun's USDD should not ever be muttered in the same breath as truly decentralised algorithmic stablecoins like HBD.

I've written about the fact it is nothing more than his exit scam for TRON and honestly can't believe that the media still give that criminal air time.

Oh well, controversy gets clicks I guess...

Bringing it back to our own HBD, yep I agree that we're doing a good job building the liquidity required to go mainstream.

Thanks for mentioning the stabiliser which is a good start, but not sure how scalable it really is.

We need to incentivise serious liquidity and that's why I'm so proud of what the LeoFinance team are doing on Cub Finance.

Ensuring that the payouts on stable LPs including HBD over 30% is super hard to ignore!

Posted Using LeoFinance Beta

Hacks and centralization are truly the Achilles heel of most stablecoin that might have been prospectful. UST really messed things up and it create this putrid feel towards Crypto and not just stablecoins. I hope the liquidity of HBD will not be our bane at the end of the day

Posted Using LeoFinance Beta

Yep, the UST death spiral really was a PR disaster for the entire crypto industry.

Everyone, including normies ALL saw the negative headlines that this event triggered.

Even if they don't understand what happened, they remember it and get a bad taste in their mouth.

It's going to take the whole crypto industry a longggg time to recover.

Posted Using LeoFinance Beta

Wish you the best of SEO for this article! HIVE needs all the attention it can get.

!PIZZA

!CTP

Posted Using LeoFinance Beta

Someone's gotta do it 😉.

Posted Using LeoFinance Beta

You are already doing a good job!

I gifted $PIZZA slices here:

@vimukthi(2/5) tipped @forexbrokr (x1)

Please vote for pizza.witness!

HBD is indeed an underrated gem in the algo stablecoin space. I think over time (hopefully soon) the lack of liquidity problem would be solved opening the door for more use cases with HBD.

The LeoFinance team are honestly doing god's work by incentivising the bHBD:BUSD LP on Cub Finance so highly.

They don't get the credit that they deserve from the Hive elite and then on-flowing from that, the greater Hive community.

If they can get millions of dollars in that pool, and I don't see why they can't at this point, it will be a game changer for HIVE itself!

Posted Using LeoFinance Beta

Yes, the bHBD:BUSD LP on Cub Finance is doing great work on bringing liquidity to HBD. I think it would've been great if all the Hive community pool into it, it would massively solve the liquidity problem with HBD. Leofinance is really doing great work!

Yep.

We all use HIVE, making it in EVERYONE'S best interest to support these pools.

Community tribalism and anti-LeoFinance sentiment in this regard is literally the dumbest thing.

Posted Using LeoFinance Beta

The only thing holding hbd back is the liquidity and apart from that I see success for hbd and nothing more.

Posted Using LeoFinance Beta

Liquidity will certainly open up a lot of opportunities for HBD and HIVE.

Of course once HBD does go mainstream, it will open Hive up to increased scrutiny from regulators and the like.

At the moment we are small and insignificant enough to just fly under the radar.

But it's going to get interesting fast when they try, but realise that HBD is literally untouchable as an algorithmic stablecoin.

Strap yourself in, it's going to be a wild (but fun) ride!

Posted Using LeoFinance Beta

HBD works. xD

Posted Using LeoFinance Beta

HBD - The best algorithmic stable-ish coin!

Posted Using LeoFinance Beta

Have you seen this?

https://hivehub.dev/market

It has a nice feel of an AMM, although still works like an order book behind the scene as far as I can tell.

Posted Using LeoFinance Beta

Wrong account...

Posted Using LeoFinance Beta

How good is it!

I shared a few thoughts on this interface via Threads the other day.

I absolutely LOVE the front-end design that the HiveHub.dev team have implemented here.

Unfortunately front-end design too often gets overlooked when it comes to Hive, so this was truly refreshing to see.

Yep, it just makes using Hive's current internal market easier.

For smaller trades, it has been getting me a better price, with less effort that if I was doing it manually myself.

All for free.

Would highly recommend!

Posted Using LeoFinance Beta

I see HBD as underrated Stablecoin meanwhile it's not. HBD is the best Stablecoin right from time I'm on this blockchain. I always wondering why this is not recognize by most of Cex.

Posted Using LeoFinance Beta

The best decentralised algorithmic stablecoin...

...not recognised by the best centralised exchanges?

Who would have thought! 😉

But while not being listed on major CEXs is inconvenient in the short term, the end game is permissionless money.

It will take a while and there will be plenty of short term pain for users.

But in the long run, HBD will stand alone in an untouchable parallel.

Posted Using LeoFinance Beta

The word recognize is not appropriate here, listed is best word to use.

Encouraging the use of a stablecoin that falls outside of their regulatory jurisdiction - like HBD - is bad business.

HBD is like Kryptonite to CEXs and we need to stop worrying about them.

The key is building HBD liquidity with other stablecoins on DEXs and then we have our on/off ramp back to CEXs.

Posted Using LeoFinance Beta

That'll be the best thing to do.

To keep building and stop worrying.

Thanks for the knowledge

Posted Using LeoFinance Beta

Whereas I very much like HBD as a stablecoin, and the 20% APY definitely is very attractive, I end up bumping my head against a couple of fundamental questions:

Number one, is it even capable of scaling adequately? I'm not talking about the general lack of liquidity, but what are the numbers behind making HBD a $5 billion market cap? We talk about the desire to have "significant investors" discover the merits of HBD, but these are the kinds of people who move around $50 million with the click of a button...

Number two, HBD is definitely "holding the peg," in a manner of speaking, but trading between $0.96 and $1.04 is probably "scary" to those who expect a stablecoin to stay between $0.995 and $1.005, and freak out when it doesn't.

Seems likely to me that the future of HBD might more likely look like a really excellent small cap stablecoin for smaller investors and Hive users, but not so much on a greater scale.

But hey, I'm no expert!

=^..^=

Posted Using LeoFinance Beta

From a technical pov there is nothing stopping HBD from scaling up to that point.

And it all starts with making it easier for bigger players to move in and out by increasing liquidity.

LeoFinance is doing god's work!

I don't think this matters because algorithmic stablecoins serve a completely different purpose to their more stable collateralised cousins.

Algorithmic stablecoins are censorship-resistant, permissionless money.

Something you will never be able to say about Tether, BUSD, USDC and the like.

Both versions will peacefully co-exist and people can choose whether they want to risk their money being frozen in a 'stable' collateralised option, or ride out the instability in HBD.

Posted Using LeoFinance Beta

bHBD and BUSD is a great a pair.

Stable Stablecoins are a great way to survive this crypto winter.

HBD is the cream of the crop, even 20% on savings is unheard of.

That alone is a fantastic reason to join Hive.

Posted Using LeoFinance Beta

20% on chain in savings...

Or 35% in the bHBD:BUSD LP on BSC that helps build the liquidity required for HBD to go to the next level!

Posted Using LeoFinance Beta

pure dead brilliant

Posted Using LeoFinance Beta

I am not much familiar with a lot of stable coins. Though, I've seen a few of them biting the dust during this bear season and I'm amazed on how HBD is holding up. Out of all the stable coins out there, I realized that I was lucky to find Hive (HBD) as early as I dip my toes into crypto. 😊

Agree. We need more liquidity for the bHBD:BUSD pool. After knowing what happened to LUNA I just realized how important a pool like bHBD:BUSD is.

!1UP

Posted Using LeoFinance Beta

RIP UST and LUNA...

Posted Using LeoFinance Beta

You have received a 1UP from @thecuriousfool!

@leo-curator, @ctp-curator, @bee-curator, @neoxag-curator, @pal-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.