Trusting Centralized Crypto projects in 2023? A ticking timebomb!

Centralized crypto projects (exchanges, payment processors, wallets, etc) declaring bankruptcies or suddenly coming up with fund restriction announcements should not be a regular thing in the crypto space. But 2022 has taught us that a lot has changed. We now wake each day to news of one winding up or another. We read these sudden withholding of someone else's hard-earned investment and it seems like a normal thing. I just wish users will listen and learn - or at least ask questions before risking their money.

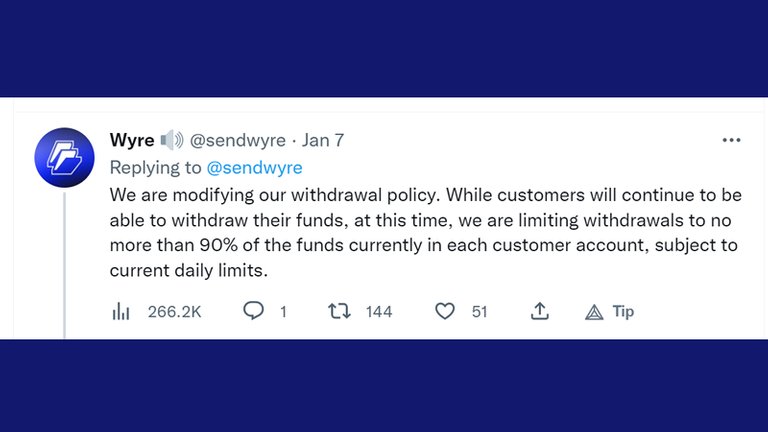

I came across this discouraging Twitter announcement by yet another centralized crypto payment processor - Wyre. The tweet made on 7th of January 2023, informed users of this service that they can no longer withdraw all their money in the wallet. Going forward, they can only withdraw at most 90% of what they have. If you want to see the annoucement Tweet, click here.

Wyre facilitates crypto payments. One of their service is helping clients receive crypto payments and have the fiat equivalent. Now imagine a big business or even some smaller users waking up to see that for now, they no longer own 10% of funds in their wallet. 10% might look like a small number, but when you have thousands or even millions of users, their cumulative 10% is certainly no small number. So the point is this:

Should you trust any centralized crypto projects with your hard-earned funds?

The FTX saga, plus an endless list of collapsed or collapsing centralized crypto projects should be sufficient evidence to re-think your strategies. While centralized projects are not going off soonest, you better check what you are dealing with. The advice to invest what you can afford to loose cannot come at a more relevant time than now.

Centralized crypto projects are like a one-man business. Your boss can wake up on the wrong side of the bed and decide to fire you. These crypto CEO's are waking up each day and putting out a one line Tweet to seal your fate. Just as Wyre customers are waking up to see this Tweet, they can do nothing about it. Just a few clicks and the admin will lock up the 10% whether customers like it or not. After all, there is likely somewhere in the Terms document (we usually dont read it) where they will say or imply that your money is no longer yours once you deposit it with them.

I keep on saying that sometimes, these acts are carefully orchestrated right from day one. These guys even anticipate litigations which is why they are usually prepared from the onset. Users are only prepared to loose money or other valuable assets. I said that centralized crypto projects are still powerful today no matter what happens - and we the users give them this power (for instance, Binance is still the top crypto exchange). But then, we have already seen enough to still fall victim to what has already happened to others.

You need not be another statistic in 2023..

and that will mean you never learnt your lessons. The pattern we have seen at least more prominently since 2022 is:

- they will either lock up some of your crypto assets against your will OR

- they will file for bankruptcy

either ways, you will be at loss. If you are looking to our legal systems to help you recover funds in case of a FTX-style collapse, well you might be in for further heartbreak. Yes the judicial procedures and final outcome is usually such that the thief face little time behind bars (if at all) and that is it. They will not recover your funds. They rarely do. So in order not to be another victim shedding tears in 2023, be careful when putting your hard-earned money into any centralized crypto project. Or..

..Why dont you look at great web3 alternatives like Leo Finance

The way we talk about LEO might make it look like it is a perfect project. Its not. But Leo Finance is a decentralized alternative to the centrally controlled crypto projects that have made people cry. When you invest in Leo (this is not advice), you stay in control of your investment. Its your money because no one has the keys except you.

Whether you are staking in the new Cub kingdoms, or you wish to invest in the native LEO token, you are in control. Currently, Leo is powering a rewarding micro-blogging crypto project called Threads. This is where you are rewarded to do what you do on Twitter. We call it crypto twitter and it is the next big thing in the Leoverse. Of course there is more to explore and be part of in LEO Finance. Here is where you put money, sleep, wake up and nothing happens. Decentralized or web3 crypto projects is the future and the future is right here with us. Make up your mind and join the moving train that puts you in the driver's seat.

Finally...

Its not worth it to keep on risking and loosing more! We have heard enough cries. The bear market alone is enough bad news. No need to have more. The FTX saga and many other collapsed crypto projects are warning examples of the risk inherent in any business controlled by one person.

Invest where you will have peace of mind - and that is in decentralized crypto projects. Of course you know this is not professional advice. Its best you advice yourself after having done research properly. But then, web3 is the future and Leo finance remains the pioneer project in this space.

Posted Using LeoFinance Beta

Let's talk about Binance:

Read about it here

Ionomy, HitBTC, and Bittrex have always credited my account when there was a mistake in the memo after communicating with support.

A lot of these centralized exchanges are using their customers funds and have successfully provided customer's money immediately after using it. But FTX has exposed these schemes, making it difficult for them to continue. Originally I think FTX was running scams while these other exchanges were not. But because no one wants to keep their money in centralized exchanges anymore, it's difficult for these exchanges, to return the money of all their customers in one fell swoop, so this is probably one of the reasons why we're is making some changes as this. It's saddening how FTX has exposed so many exchanges.

Honestly. I think this also applies to banks too. Imagine what will happen if every customer requested for 100% withdrawal of their funds. A lot of bank CEOs will be exposed - a lot of money wont even be accounted for. Maybe that was why Wyre choose to lock 10%, so that there will never be a situation where everyone is withdrawing all, because they wont be able to fulfill the withdrawals.

Posted Using LeoFinance Beta

Exactly, this is why wyre chose to do what it did. 10% locked, so that everyone would not choose to take their money at the same time. I think every financial institution does this. FTX just turned his own to a bigger scam, instead of being satisfied with what he's already earning.

Poor poor FTX! We are learning from other people's mistakes. What an eye opener!!!! Not too long ago, i kept close a hefty amount in Binance for 4 months. Its a big 6 digits. How naive and how so fortunate I am now. A single click from the admin would have sent me back to the dust!

Let's talk about Binance:

Read about it here

Ionomy, HitBTC, and Bittrex have always credited my account when there was a mistake in the memo after communicating with support.

I would never try such a thing. Even me who had and kept 70$ on binance, I still felt unsafe, not to talk of a bigger sum. I'm glad if wasn't even FTX. If it's not hive, nowhere else.

Let's talk about Binance:

Read about it here

Ionomy, HitBTC, and Bittrex have always credited my account when there was a mistake in the memo after communicating with support.

Did I even understand the implication of what I did? Now I know much better!

Would have just signed and stamped my empty will, hahaha.

You make an interesting point, and also raise another. While we think of exchanges having 100% of our money on hand because we depositied our funds there, they use the funds to make money. This is also true of banks where fractional banking rules only require them to retain 10% of depositors funds. But the big difference is banks have a central bank which will print money if there is a run on the bank, while in crypto their is no such entity. Ironically crypto enthusiast fled one system we didn't like to another system we are now not fond of...

Posted Using LeoFinance Beta

You too Wyre?

It's starting to look like you can't trust anyone in this business.

I think it's time for cryptocurrency operations to live up to their name of trustless and permissionless operations with our funds protected by our cryptographic keys.

The notion that possession is 9/10ths of the law is never truer then in cryptocurrency with courts recently ruling that crypto investors funds deposited in a centralized exchange wallet belong to the centralized exchange has made this very clear.

Not your keys, not your crypto

Posted Using LeoFinance Beta

Honestly, not your key,not your crypto. Each day brings another story of loss or near loss of funds or of control. We cannot trust anyone of these web2 projects anymore. If Its not web3 project, am not interested in keeping my money in a sinking ship.

Posted Using LeoFinance Beta

This is why v4v.app service which converts payments in Lightning into Hive is so special. I don't hold funds for more than a couple of seconds!

The longest I hold funds is when a person is streaming sats (sometimes 1 sat per minute) to a @threespeak video. I then batch up all the payments to send as HBD but I wait 5 mins after the listening session ends. Then the funds go out and I'm no longer in the loop.

For all the larger conversions of Hive to Sats or vice versa 1000 sats and above I pay out in seconds or return all funds if something goes wrong.

This is the way.

Never heard if v4v.app but it does sound as a great service. Would really like to learn more about it. Honestly, the more we see loss of control over crypto assets, the more we embrace web3 projects. Where can i read more about v4v.app

Posted Using LeoFinance Beta

What a bad omen! Honestly, accumulation of 10% equals to millions. And worse yet, no one can predict the future of web2.

Hmmm, now is the time to stay alert. Maybe, tomorrow, it will increase to 15%. God forbid!

I've seen reasons with you that #leofinance is at least a better option, we can't bear the losses anymore

We're going through a lot already