it's not your keys, it's not your coins.

The need to keep money safe comes from a mentality or teaching that we receive from a young age, we are told: "The bank is your friend and it's the best place for your money to earn interest and be safe." And in school was the only financial education I was given, "Leave your valuable and hard earned money to a bank so they can get richer while you suffer inflation and your money is worth less". And they have always taught that giving your money to a bank is the best option for a happy life and also for a peaceful retirement, since they promise you 2% per year and in 30 years you will have a lot of money :D

But no, the system doesn't work that way your money is not safe with the bank, because in recession many of the greedy and unfortunate bankers steal people's money, or in case of an emergency with their bureaucratic policies they prevent you from withdrawing all your money. And more and more negative things about banks.

But everything changed when the idea of bitcoin and cryptocurrencies was born, a free money where no one has control of your economy but yourself, you can send and receive money anonymously and without having to pay a third party, you can have billions without being taxed, all discreetly and securely.

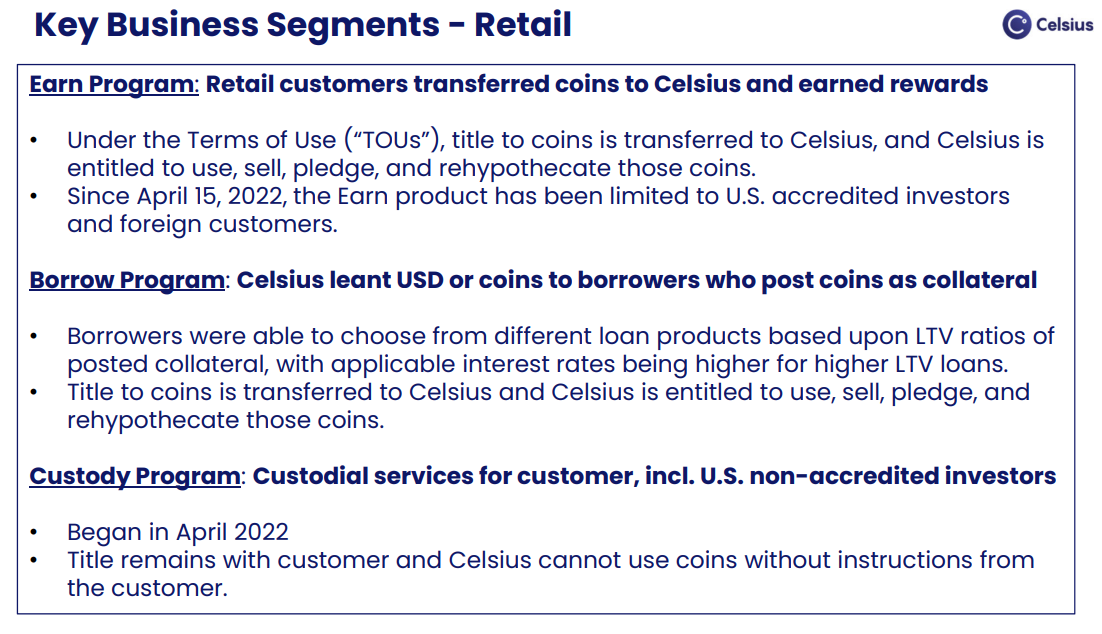

But as we are used to a banking system and making money without doing anything, financial companies like Celsius emerged, where they promised to keep your money safe while generating an annual interest rate, and of course it was much higher than that of a bank. So the idea of having crypto and not suffer loss and rather generate interest attracted many people who wanted this service of Celsius.

But many of these users did not read the fine print, and that is that keeping your money in Celsius generating interest does not make you the owner of that money, since the company in its contracts said: "They are not your keys, they are not your coins", since by depositing your coins in Celsius you automatically lost the right to a claim to the company.

This is such a strong phrase and with a lot of weight within the cryptocurrency economy, and it is so simple and to give an example, (This happens in Venezuela) imagine that you own a house and you rent it, but then people do not want to leave, but they do not want to pay the rent, what can you do? Go to the authorities, right? No, because if these people appeal to the law because they have children or no jobs or are disabled, then you will lose out because you have no home.

The same thing happened with Celsius, by depositing cryptocurrencies we give the absolute right of the coins to Celsius and there is no right to claim a refund as they appeal by law: "They are not your keys, they are not your coins". Right now they are fighting the legal battle to get Celsius to release the money from their shrouds, but it seems that this is not going to be possible any time soon.

Since as they argued the market is unstable and they will start giving money back "Only to the most valuable users" when there is a bull run. So these greedy bastards are taking money from people who feel their coins are not safe in their possession, and they are taking advantage of this and leaving over 1.8 million users affected.

In LeoFinance and Hive there is a lot of talk about keeping private keys, since each user is personally responsible for their money and keys, here no one will keep them for you, in fact, when you open your account there is a very explicit message that says: "If you lose your keys there is no recovery " and that is true decentralization and power.

That is why, even if bull and bear markets come and go, Hive blockchain will remain, because it applies in the purest sense the real and basic ideology of cryptocurrencies.

Posted Using LeoFinance Beta

100% agreed with your publication, @fabian98! That "trust" element is why I haven't had a bank account for years, and one of the key values of autonomous cryptocurrencies.

Well, the only divergence is when you deem BTC and cryptos as being anonymous: some of them are, unfortunately it's not the case with BTC (except if you put into practice a lot of security measures that 99.9% of Bitcoiners do not take the hassle of implementing, lol).

Posted Using LeoFinance Beta