History rhymes again!

Almost like predictive programming, we may be heading to the final capitulation of the crypto market. You probably have been watching the FTX meltdown on top of all the "conspiracies" that came with it. While I am unaffected, I know people, who I converse with regularly, that have suffered because of this event.

They aren't newbs to the crypto space. Some of them have been veterans from previous market cycles. They recognized that they fell into this situation due to their complacency. They thought FTX was too big to fail, and it was getting cozy with the regulators.

Platforms like FTX offer people "passive" returns via lending or so-called staking on assets. Often, these returns are on assets that don't have native staking. Sounds familiar? Same soup, different name.

My grandmother used to say, "你要他們的利, 他們要你的本." The rough translation is you want the interest while the other party wants your capital.

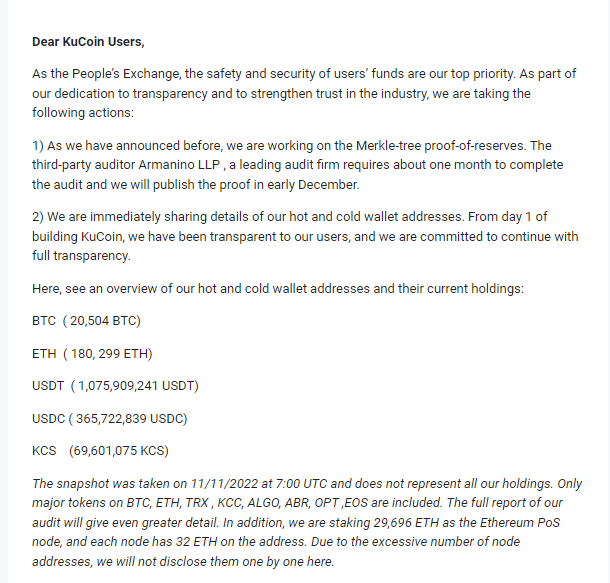

As the meltdown unfolds, I have received several emails from the exchanges I use:

They are all scrambling to declare that they are solvent entities to prevent further bank runs.

Does it matter to me? No.

I use exchanges as an on-and off-ramp. I'm not interested in leaving assets lingering on exchanges. I only have a small number of stablecoins to ensure asset withdrawal when I purchase them. Otherwise, it would usually take several days before I can move my coins off the exchange. I'd much rather risk several hundred dollars than be faced with the prospect of not being able to withdraw.

If a coin has native staking, do it with your wallet. If it doesn't, don't get greedy and relinquish control of your assets. Greed has destroyed many people and will continue at a large scale if nothing changes.

I understand the appeal of getting several percentages back on valuable assets like BTC. The return potential can be very high when we see how the market behaves during a bull market. In my opinion, if you want to participate in that scheme, don't go all in.

Remember, not your keys, not your coins.

Posted Using LeoFinance Beta

This whole story is just too wild! I can't believe this happened!

It's a strange world right now.

People never learn to control their greed. Greed is good, but you have to control it or....

FTX pissed me off because I used the Blockfolio/FTX app to track prices on my phone. It's dead now. Have any recommendations for a price tracking app?

I generally don’t care much for price tracking apps.

I personally just use the default Stocks app on my iPhone as they include crypto anyways.

Actually, I think it makes sense that they might not have all the funds liquid for people to withdraw. Are they supposed to sit on the crypto and do nothing with it? They should but I think they are also after profits. So they will either need to sell things at a discount or get a loan from somewhere else to cover the shortfall.

Posted Using LeoFinance Beta

Their business model is financial service.

Operating under fractional reserve seems to defeat the purpose of crypto.

I didn't know you had asian roots :) your grandmother was quite financially savy btw

I am Asian, but I live in the US.

yeah, the US part I knew :)

I moved most of my stuff off of the centralized exchanges just the other day. I didn't have much out there, but I am not taking any chances. I want it someplace where I know I have custody of it. I still have some regular buys happening, but I will move those funds as time and limits allow.

Good move!

Yeah, it's funny because I even found some tokens tucked away I had totally forgotten about!

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

They’re all showing us “snapshots” of their reserves but I’m thinking the total of all customer’s deposits is way more. Funny they leave that little tidbit out lol.

They only have so much insurance.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

Ahh yeah that makes sense. In hindsight i guess Coinbase higher fees aren’t looking so bad now (if they’re telling the truth and they make it through this unscathed). I'm with you though, only as on/off ramp

We are most likely in the crypto equivalent of dotcom bubble burst.

Thanks for the informative post @enforcer48