Getting in and out of debt helped me understand the importance of credit scores

Debt. Loans. Credit cards. If you are looking for someone who has had a fair share of experience on this topic, ask me. I spend two years wrapped around the fingers of debt and every day it did not seem as though I would get out. If you check my wallet, you'll see my stakes do not match my reputation. At some point, I had to choose between sleeping less at night and unstacking and paying off everything I owed. It worked out fine. But today, I know a lot about Loan Apps that work in my country better.

Source

If I ever wanted to hit the "take loan" button again, this time, I'll be wiser with what I'll use the money for, and have a solid plan on how to offset everything before it becomes a burden.

In my country, we do not have credit cards, and to take loans you needed to have collaterals before the banks will look at you. I am not sure we have student loans either, we obviously don't because if we did we would probably have fewer people dropping out of school because of lack of funding and more students who have to work their asses off, later on, to pay off the loans they took for their education.

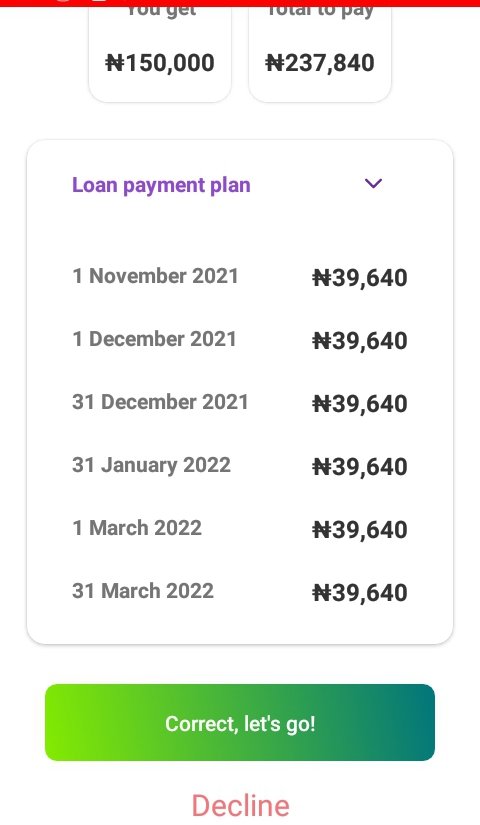

I think this is where loan apps came forth and thrived. Initially, they were a pain because if you defaulted on your payment, you would have your pictures circulated amongst your contact and sentences like the ones on the screenshot below.

An example of a threatening message from Palmcredit

They will also call these folks repeatedly throughout the period you are yet to pay. You won't be left out because they will buzz your phone multiple times a day, using different numbers, threats, and whatever they seemed fit.

These days, the hunting down has reduced because of the regulations by CBN, and the threats to shut them down if they persist. Some of them had been shut down, and the ones that are currently operating are a bit lenient, but the interest rates are still on the high side.

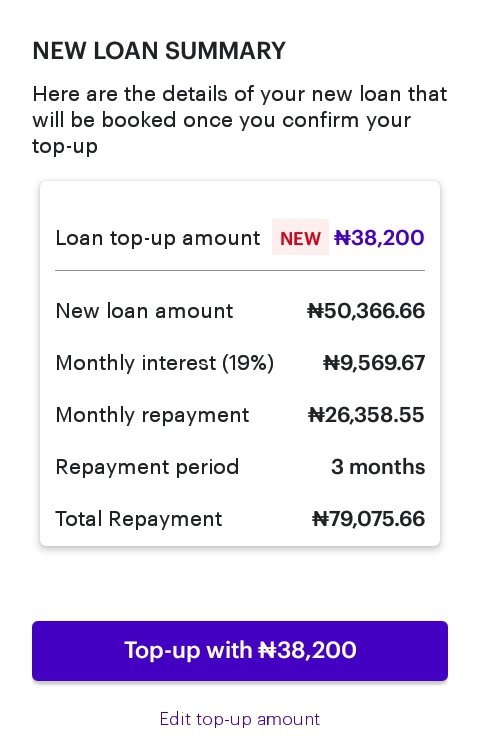

Fairmoney

For instance, Fairmoney could give you a loan of #150,000 to refund #237,840 in six months and this will be split into monthly payments. And a #300 additional daily interest any month you fail to pay. So if you can't meet the minimum payment for say, Nov. 2021 as shown in the screenshot, then, be prepared to add #300 for every day you can't come up with the money.

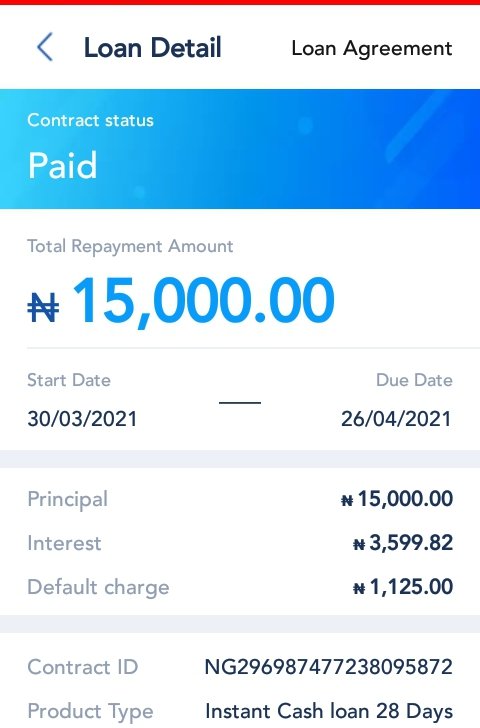

Carbon

Carbon could give you a #50,000 loan for six months, and just like Fairmoney, the money will be paid monthly. The difference is that carbon does not add interest for missing payments. What you agreed to pay is what you'll pay by the end of the six months duration. I do not know what measures they take since they are not gaining from late payments. I think they will make you less eligible for loans a few months before you can waltz your way back to them.

Palmcredit

The one loan app I wouldn't ask anyone to go close to unless they are really sure they will have the money when due is Palmcredit. They deal with you on due dates, they call close relations and threaten them as much as they call you and threaten you.

And their interest rates are on the high side, as well as the default daily payment. If you default for let's say 30 days, you'll be paying an equivalent of a full monthly loan if you had other people to settle. They could charge, #2000, for every day you miss a payment, added to the original principal and interest you agreed to when you borrowed. They don't give up to six months duration. It's often one month, with a huge interest rate.

Jumia

Jumia is as beautiful as carbon. They send emails alright but you can pay up at your own pace, just pay something to show that you are committed to paying. They charge #1000 at the end of 30 days if you don't get to pay on time. The longest duration for Jumia is 3 months.

There are subtle apps like Branch. Like carbon, they add nothing more than what you were required to pay. Instead, they will hold your eligibility period for a while before you can start borrowing again, starting with smaller amounts, and building your credit score, until you can unlock higher amounts like you did in the past.

Palmpay

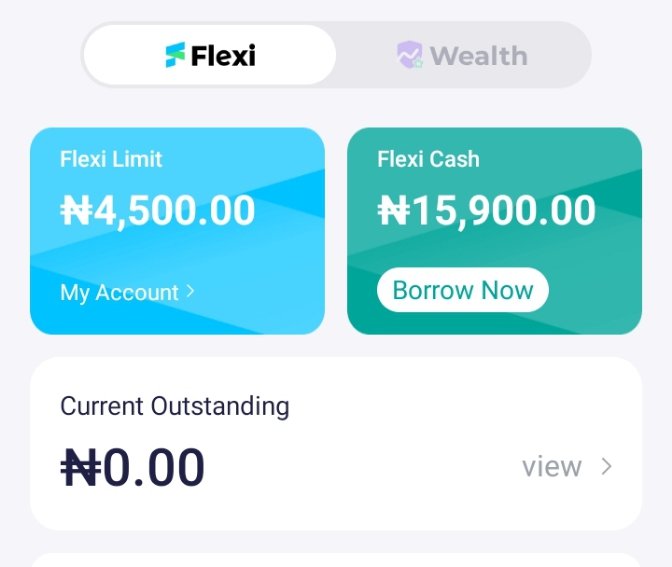

Recently, we have Palmpay, as a result of online banking getting embraced gradually in my country as a result of the Naira REdesign. These seem lenient, I haven't used them much because being debt-free was the goal. The only thing I do is try to raise my credit score, by taking a loan and paying up sooner than later, just to keep building my credit score, in case of emergencies in the future, or an investment opportunity that I need to access funds to step on the brakes.

We have Blackcopper, who I think add interest after you missed for a few days or weeks. I wasn't really paying attention to their models.

There's a sister to Palmpay and that's Opay. I only have an account with the bank but never used them. I have a feeling they give loans too but since I haven't used or tried in the past, I can't say for sure.

All these apps, you can access higher loan amounts. I did. These are just screenshots I remembered to take in the early days of my borrowing journey. I could access up #130,000 - #200,000 on a certain app, and if I added my eligibility rates for the rest, it was a lot. I had a good credit score.

Being in debt had lots of lessons for me, I started to understand why it's advisable to not take on debts if you were going to buy liabilities. I also understood the restrictions that debt brings. This is because an opportunity may show up and you can't take them up because your debt is staring you in the face.

My Hive account is a clear example of things one can miss out on. I had stakes in my favorite communities like POB, LEO, and the little Hive power I got but everything went down the drain to paying off debt.

Right now, it's me trying to build everything up while juggling bills and others

Another thing I learned was the habit of borrowing from Peter to pay Paul. This is what brought me to my knees, I did not have any source of income, so borrowing money when I had no means of paying was a crazy step in the wrong direction. So, the different loan apps I had to deal with were mostly me taking from one to offset the other, and doing it again. Until I got stuck. I couldn't go any further, the interest was too high, and my eligibility for one app wasn't the same as the other, so I could be caught borrowing up to three at once just to offset one single app. It was a crazy yet terrible decision.

But then, I got introduced to the world of debt, credit cards, etc, and I have no regrets over this part. I understood credit scores and how if properly utilized can serve one better on their journey to financial independence.

Ps: All images are screenshots I took in the past except the header image which as been sourced

Borrowing is an immediate relief for what you need, but a major headache for what comes next. I've had credit cards since I was young, but it took me a while to learn how to use them properly. And you are absolutely right about how counterproductive it is to borrow from one to pay the other. It's unnecessarily extending evil. Hopefully many people will take advantage of your substantive content. Greatings @edystringz

Greetings, @aaalviarez. Thank you for sharing your experience too.

It does takes a while to understand how to best use debt. Once you do, you'll probably knock yourself on the head for not doing better initially... Lol.

Definitely. It's counterproductive to borrow from Peter to Pay Paul.

I hope people learn too. Thank you again.

You are right. One thinks: "Instead of going into debt for this, I would have bought that". But well, no one is born learned. Regards @edystringz

Absolutely! No one is born learned. We learn as we go.

Loan sharks can send someone to exile. It's a terrible experience, they don't have soft loans here in Nigeria. So they took advantage of everyone that requested for loans.

Even the loans are not good for business, I hope there we shall be financially free and escape all this loan stuff.

I hope we will all be free indeed. Thank you for visiting, engineer.

You welcome dear