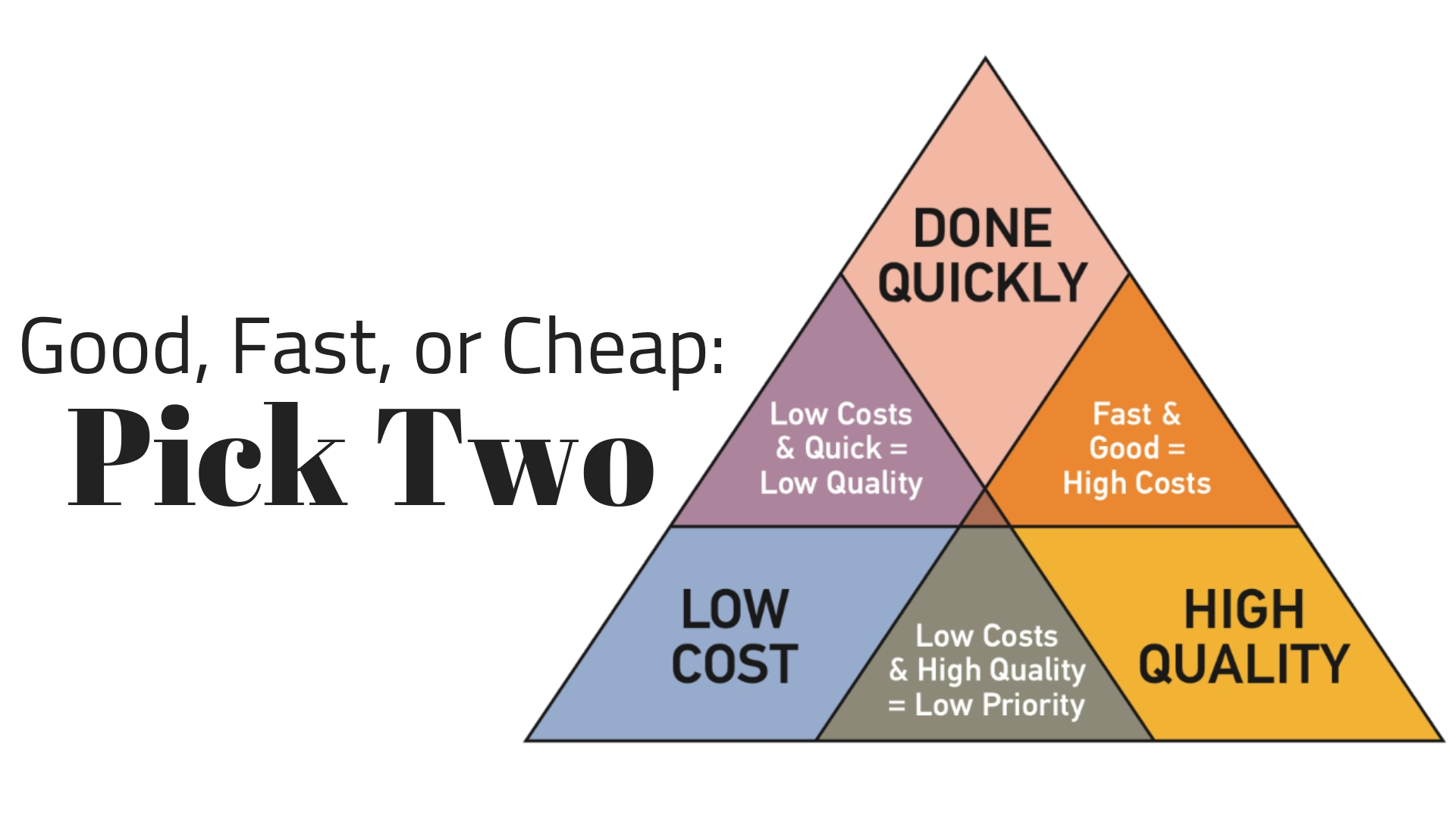

The Choose-Two Trilemma

"You can't have it all."

This choose two problem extends back quite far back into history. Not really sure when it began, but it is a classic scarcity/priority issue that extends into almost all parts of our lives. Priorities must be set. Sacrifices must be made. Resources are scarce. We can't have everything at once.

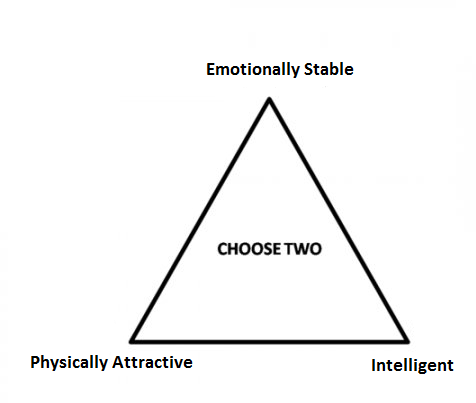

However, clearly the triangle doesn't take everything into account. It inherently assumes that we can not find balance. It inherently assumes that no one will be the jack-of-all-trades and do a little bit of everything. Clearly that is false, but the concept is still sound. We can't have the best of everything. Or can we?

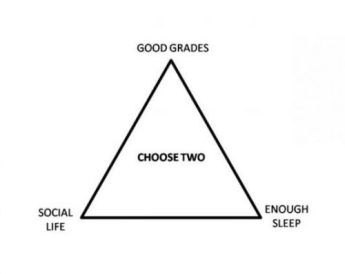

Like... is it really that difficult to have good grades, a social life, and get 8 hours of sleep? Seriously, people take the triangle too far. Obviously we can have all these things and more.

This one is particularly toxic gamer shit. Like, yeah... if you play video games 8 hours a day that might cut in to other stuff. Obviously. I simultaneously identify with this one, and am also disgusted by it.

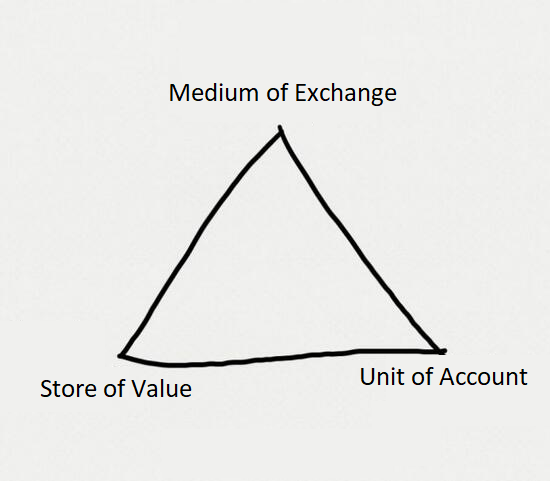

Can Crypto have it all?

I've actually already brought up the trilemma multiple times in other posts, but I've never actually investigated the trilemma itself. Wow... looking at that post it was right before the hostile takeover split into Hive. Crazy stuff. Blast from the past.

Here's a more recent post where I explain how we can have it all with crypto. Technology is creating a situation where everything is getting an upgrade. We no longer have to choose two. We can have it all. This is especially true when we look at the entire cryptoverse as a whole. Even if Bitcoin is always going to be a poor unit of account, it has very strong liquidity pools to other tokens that easily could be.

In fact, unit-of-account is going to go down in history as the most epic upgrade to crypto ever. It is the one thing holding us back and the most difficult to achieve. So difficult, in fact, that most people just piggyback off of USD because no one is looking to reinvent the wheel just yet. The more USD starts failing us the more incentive we have to create a unit-of-account coin ourselves. The secret lies somewhere in DEFI and elastic supply, that much is certain.

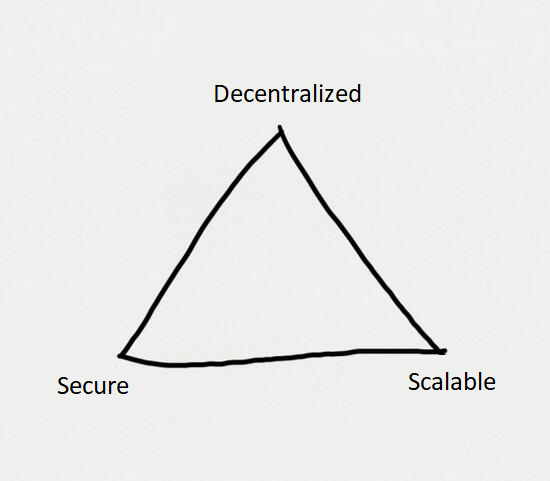

This is the triangle I wanted to talk about all along.

This is the reason I created the post in the first place. Super smart nerds like Vitalik even reference this triangle, but is it really valid? I think not!

Decentralization and security are the same thing.

In crypto, there is no trilemma.

There is only scaling vs security.

Decentralization and security boil down to the same thing.

Decentralization is security.

Security is decentralization.

They are so intertwined they don't count as two separate things.

For example, how would one go about sacrificing security for decentralization? Vice versa, how would one sacrifice decentralization for security?

Another way to look at it:

How would one sacrifice security for scalability without also sacrificing decentralization? How would one sacrifice decentralization for scalability without also losing security? How would one sacrifice scalability for security or decentralization without affecting the other variable? It's like the people who painted this particular triangle didn't even think about what they were saying but they keep repeating it all the same. Kinda mind blowing considering how smart these people are and how much theory crafting they've done.

Trying to come up with an example.

Let's say it was really easy to mine a Bitcoin block. Instead of it taking 10 minutes to mine a block on average, lets say they reduce that to something like 1 second. The Bitcoin blockchain would still be decentralized and would become more scalable, but it would indeed lose security (sort of).

Of course... it wouldn't really lose security on something like a centralized exchange, because a centralized is still going to wait 30 minutes so that enough confirmations have gone through that it's nearly impossible to roll back the chain. So again... is this really a valid example?

What about Hive?

If we turned the top 20 consensus witnesses into the top 100 consensus witnesses, we gain decentralization, but perhaps we lose security because the top 100 are not as trustworthy. Perhaps this is a valid example. But still, these examples seem very niche and borderline nonsensical. For the most part, decentralization and security are linked at the hip.

What about Blurt?

For those of you who weren't around for the hostile takeover, Blurt was a fork of Steem that came about to stop the "theft of funds from particular users". Sounds like a good idea right? It was a terrible idea.

In any case, due to technical difficulties, Blurt removed resource credits entirely. Theoretically this lowered security and increased scaling. Shoot, I guess that's not the example I was looking for. Never mind :D

They also centralized the power to a single arbiter which kills decentralization entirely. On a very real level it's just a matter of opinion. We could argue this is less secure because centralized, and we could argue it's more secure because centralized leadership during a crisis can sometimes be the difference between life and death. Just something to think about. Much of this is just opinions of the theory-crafters and doesn't really apply in the real world until we actually test it out.

Conclusion

We are entering an age of abundance where the trilemma of scarcity no longer applies. We really can have it all. We just have to keep grinding and upgrading these things so that they are superior in every way to the legacy systems in place. It's not only possible, it's guaranteed to happen given a long enough timeline.

Sure, once crypto takes over, then we can boot up the argument all over again and start comparing crypto vs crypto and whatnot. That's not a relevant argument at the moment. It's crypto vs fiat. We can turn on each other after we win the real war. Or perhaps that sentiment is rooted in the old ways of the past that are about to become antiquated forever. One could hope.

Posted Using LeoFinance Beta

https://twitter.com/ascha3a/status/1551261332665765888

https://twitter.com/YanPatrick_/status/1551642335997530114

The rewards earned on this comment will go directly to the people( @aschatria, @shiftrox ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The trilemma is actually only a model of a decision tree in current time.

It does not apply if you include any kind of technological advancements.

Today, we build things far faster, far better, and far cheaper than things in the past.

A T-shirt today takes minutes of time (per shirt) from cotton bale to finished shirt.

It used to take one woman a month of her time to make a shirt.

(spinning, weaving, cutting, sewing)

The future of cryptos... (the far future... probably 50 years)

Imagine every group of people (a small community. They will call themselves a family)

And each of these groups has at least one techie person who will run a full node.

So EVERY group that is part of the currency-exchange system has a full node, and thus mining is 100% of the user base. And everyone confirms every transaction.

In this kind of environment the entire structure of the problem is completely different.

And thus, the terms of the current trilemma do not even apply. Are no longer a concern.

However! there is always the dilemma of where do you put your time. Each of us only has 24 hours in each day. And spreading it out to three goals... gives you a trilemma that can never be solved...

It seems to me that the above two statements are contradictory. If the odds of any one witness being untrustworthy is X in 100, the odds against a majority of witnesses being untrustworthy are far higher in a pool of 100 witnesses than a pool of 20. While an individual witness may be untrustworthy, the impact of one or more untrustworthy witness(es) is much reduced in a larger group, which supports your latter statement that decentralization increases security.

Perhaps looking at the inverse, the odds of a witness being trustworthy are X in 100, changes this calculus? But then decentralization decreases security as the following statement indicates.

So much of human society cannot be reduced to such simplicity as the above equations attempt. Quantity and quality aren't comparable. From observation I note that centralization always proceeds from decentralization, and eventually produces inequities that cause destruction. Fortunately I believe my anecdotal experience is inadequate to assert confidence, and my observations are wrong.

I have faith.

Thanks!

It doesn't, he's talking straight out of his ass since leadership and security aren't interchangeable or the same thing at all. One leader is absolutely, completely, totally idiotic and as compromising as it gets when it comes to network security. Network security is a measure of exactly the opposite of such centralized idiocy. Look at ethereum, ETC went bunk because they chose to persist as a compromised fraudulent bunch while the consensus formed without any centralized authority and secured the network in the most efficient manner, while a centralized position could have only compromised the security and in the end it would have not changed or effected anything more robust than the forking.

Or your observations are correct and he's spinning bullshit which he hasn't critically examined or observed himself.

I think the strong side of crypto is the abundance of technological improvements. As people start to decrease human-related problems (such as trust and abuse), the ecosystem is growing in a healthy way.

If we were to apply choose two dilemma for crypto, it would not have survived and evolved IMO ^^

Posted Using LeoFinance Beta

Congratulations @edicted! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 430000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPin theory, we could have 10 witnesses only. If the chain is super easy to copy and past ( i mean really super easy), it would always be a fork if they go crazy.

There must only be enough to not heist the chain.

But that lead to the problem of security will never be enough in term of looting pools.

IMo the theory would be: Biggest stakeholder x10 ( or more) of potential loot. If lower is not worth the risk. Special if Witnesses are the largest

20 is IMO a really good number. Maybe at some point, the rotation can become bigger to top 40 ( if enough witnesses are here to spread higher earnings to more).

Would it be needed? Maybe. But I think to have more witnesses would never hurt and DPOS is pretty solid. Special with a working token distribution.

It takes just 4 witnesses in top 20 to stop consensus. In 40 it would take 8. Each time we increase it, the harder and harder it will be to form consensus, which is exactly why only 20 exist and why increasing it will certainly weaken our robustness of forming consensus and agreeing on what code to run.

it's about the rotation and distribution, not to let them act like the 20 elected.

If there would be an attack, in theory, the next replacement candidates need to have a reason to be up to date.

That works with money and rotates from the top to 33% more to top 40 would bring more security.

And yes it would be a tradeoff between efficiency and security. On a larger scale, security matters more than efficiency ( even 40 are pretty efficient, but the risk of 8 doesn't work is also high to loss consensus).

But as far i remember there is some solution from it if witnesses would loss connection to each other from blocktrades.

An example was the US losing its connection to EU.

In that example, it would work.

The number of witnesses is about what? The number of witnesses has nothing to do with the stakeholders holding witnesses in check.

What attack? What kind of attack do you think top twenty are susceptible to, and tell me that without telling me your an idiot.

What works? What "that"?

You're not gaining any security and compromising consensus which is not behind only 4 would be hostile witnesses, but 8. Its far easier to get rid of 4 hostiles, than 8. What's the benefit to increasing the consensus from 17 out of 20 to 33 out of 40? Why not 330 out of 400?

Cool story bro. Make absolutely zero sense.

whatever. looks like you are an idiot

O no, what will I do now that I didn't gain your acceptance, random internet genius?

Lol butt hurt by simple questions. Figured you for a moron, yet confirmation is priceless.

This post reminds me of a story called The Gilded Six Bits. It seems interesting how before the environment becomes secure, everyone is on board with things developing. It isn't until the difficulties are beating that people start turning on each other because of greener grass. Bug your point seems interesting. Those triangles tend to be off from the real situation ls they try to depict.

I'd love to see the the result of the confrontation between crypto and fiat. Systems tend to collapse with new things arrive and prove to be better. Maybe we are onto times similar to the Bronze Age Collapse. I just hope it doesn't turn into a new dark age for humanity. 😅

If the number of witnesses to reach consensus increases it'll be that much more difficult to achieve consensus. As for centralized vs decentralized, its always less secure whenever something is centralized, it obviously creates security risks immediately and will persist until its decentralized.

Yeah sure, normally I would agree with that sentiment.

But what if you have a choice between running an empire or letting there be 100 separate city-states? There are many cases where strong centralized leadership is the difference between life and death. Steem died in this exact way. Instead of coming to consensus, politics got in the way and users would not vote the top 20 witness. We had it in the bag but people just wouldn't do it.

Classic example of how decentralization can fail.

How is one empire more secure than 100 separate entities? More powerful, but not more secure. 100 cities coming together will never know the corruption of such an empire, an empire divided into 100 parts will eclipses all other parts in how corrupted it is. You're conflating leadership, power, and security, which are all exclusive of one another and completely independent. Leadership can be decentralized, power can be decentralized, security can be decentralized. You want to say an autocratic dictator can act more swiftly than a parliamentary government, great, it has zero value in crypto and network security. Your argument is that centralized power would have helped steem?

I truly detest your idiocy. You are arguing that a centralized position was what Steem was lacking, because without a centralized position consensus wasn't possible? No, it was that consensus was literally impeded by one position of central Power, that is what stopped consensus, not that "politics got in the way" with your stupid and blatant revisionists history of Steem.

I love this , many people and organizations fail to understand this concept, they don't understand you can't have it both ways.

HBD at $2 what do we do, how did it happen?

and I again called the Hive pump :)

https://peakd.com/hive-167922/@tobetada/crypto-analysis-or-hive-about-to-pump-again

How do I take advantage of it? I don't understand how to arbitrage HBD.

Posted Using LeoFinance Beta

You could convert HBD to Hive. It is always profitable when it is above $1.05 (HBD). But in a pump like this there are many unknowns. E.g., will Hive continue to go up? If it goes significantly higher then holding Hive and selling it is perhaps even a better idea... If you have a bit of HBD I would convert it just that you try different routes. You can reconvert the HBD you instantly get from the conversion

I see, I wondered what the mechanics were. Thanks

Posted Using LeoFinance Beta

This deserves my double BOOM. (Done on a comment)

Posted Using LeoFinance Beta

This choose two problem extends back quite far back into history. Not really sure when it began, but it is a classic scarcity/priority issue that extends into almost all parts of our lives. Priorities must be set. Sacrifices must be made. Resources are scarce. We can't have everything at once.— clearly reminds me scale of preference and opportunity cost .

Centralization is a single point of failure for a digital currency. It is not about security only in terms of miners securing the network from attacks, but the control of the network, the trustlessness, and its permissionless nature. These features are the fundamental difference between centralized tokens and decentralized cryptocurrencies.

Permissionless systems deliver censorship-resistant characteristics. Centralized systems are vulnerable to interference by third parties and governments. We want to remove interference that gives power to (let's say) a dev to censor some transactions in the network, generate black lists of not wanted users, or rejection codes similar to the banking institutions and payment processors.

Posted Using LeoFinance Beta