Michael Short: Retail Banking 2.0 & DEFI Magic Tech (Magitek)

The cringiest smug-fuck maximalist is at it again!

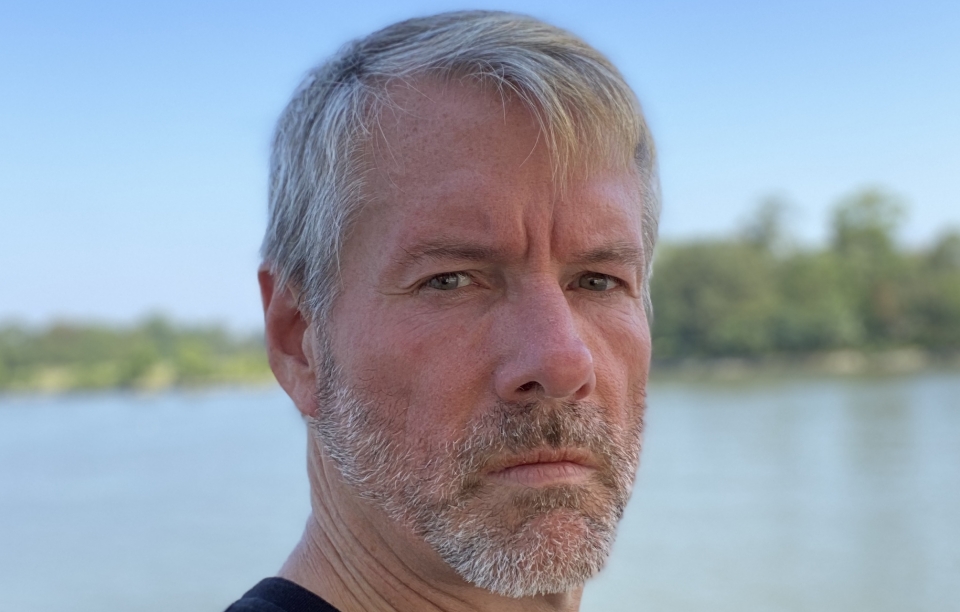

Did you think Michael Saylor was some champion of the people? Nah, think again. He's basically even worse than Peter Schiff in terms of cringe tribalism, and he proves that every day.

If I'm being honest, I approve of his confidence level and even his manic energy when defending his position here. I do the same thing. Unfortunately, that doesn't make it any less cringe. To assume that Bitcoin is the only game in town with such blind faith and certainty is simply ignorant and downright insulting. Such is the life of a maximalist.

So what's Saylor done this time?

MicroStrategy’s Saylor Lays Out Ways Firm Could Generate Yield From Its Massive Bitcoin Holdings

Hm, yep. Clearly ol' Saylor Moon is feeling the sting of his obviously overextended position. He's a businessman, and he's looking to generate passive income (yield) from his Bitcoin holdings. I mean, why would you not?

To generate income from its bitcoin, MicroStrategy could lend some portion of it to a “trustworthy counterparty,” CEO Michael Saylor said.

The company could also put its bitcoin into some form of partnership with a big tech company or bank. “You could think of that as putting a lien on it,” Saylor explained.

MicroStrategy might also look to put a mortgage against its bitcoin, generating long-term debt under “favorable circumstances.”

Finally, MicroStrategy could develop “some kind of interesting application” for its bitcoin, said the CEO.

Yeah, lol.

A hardcore Bitcoin maximalist talking about delegating their stake to a "trustworthy counterparty"? Can you believe this fucking guy? He can't be serious! Can anyone see where this is going? I had to do some more digging to see if people are as smart as I am!

Is MicroStrategy Considering Lending Their Bitcoin To Generate Yield? WHY?

Turns out, yes, there are people who can see the writing on the wall here.

What does “a trustworthy counterparty” mean? Is it just a company that can guarantee yield, custody, and return of their BTC? Or are they talking about a company that’ll use that Bitcoin in an ethical way and not short their own investment?

That’s one of the main reasons hardcore Bitcoiners are against lending. People who borrow BTC usually use it to short Bitcoin. They bet against the asset and drive the market down. Is that in the best interest of MicroStrategy? Will they partake in the activity for the yield alone? Maybe they won’t. Maybe they’ll find a use case in which the lender doesn’t use their Bitcoin for nefarious purposes.

Michael Short indeed!

So yeah, it's very obvious that Microstrategy lending out their Bitcoin is going to lead to that Bitcoin being dumped on the market and shorted. So so obviously.

The other reason Bitcoiners are against lending doesn’t affect MicroStrategy. Hardcore Bitcoiners don’t lend their BTC because they don’t want to lose custody. Self-custody is paramount in Bitcoin culture, and the yield isn’t worth the risk of surrendering your BTCs to another entity.

If the rumors are true, Coinbase is already the custodian of MicroStrategy ’s Bitcoin. Make of that what you will.

Exactly!

Microstrategy is a business. Michael Saylor is a CEO. Saylor's personal politics might be that of a Bitcoin Maximalist, but we can clearly see that there is a huge conflict of interest between his personal politics and business mechanics. Michael Saylor the man and Michael Saylor the CEO are two different people.

Microstrategy took out massive loans and junk bonds to get their phat stack of bitcoin. They owe interest on those loans. If they could then turn around and loan out their Bitcoin like a fractional reserve bank would, for exponentially higher yield, then wouldn't it be stupid to not capitalize on that opportunity? In other words, if you could borrow a billion dollars at 3% interest and then loan that billion dollars to others at 25% interest, you'd obviously do that. That's just "risk-free" money sitting on the table waiting to be claimed.

It all comes down to the "Trusted Counterparty" risk.

An even then, this might not be true. If Microstrategy simply loans people BTC to short the market, there is very little counterparty risk because that loan is collateralized with USD. If that collateral shrinks to the size of the amount that was borrowed, they can simply liquidate the collateral to buy their Bitcoin back.

In this case the main risk would be a Black Swan event that crashed the market and drained liquidity so fast that they couldn't get their money back. I'm gonna go out on a ledge here and say the chance of that happening is quite low. This is especially true considering how much exponential liquidity DEFI AMM farms are starting to generate, in addition to the magnitude of centralized exchanges that have massive liquidity pools.

But if Microstrategy let's people use their own Bitcoin to short the market that hurts Microstrategy's investment!

Said the greedy short-sighted retail investor with their head up their own ass! Michael Saylor is a long term thinker. He doesn't give a shit about short term price action. There's just a good a chance that people who short the market using MSTR BTC get squeezed and liquidated and Saylor is just sitting there laughing all the way to the bank. This is truly a win/win for MSTR and there is very little downside, especially in the long run. Longing and shorting the market at the same time with favorable interest rates in both directions is the ultimate hedge. Just ask literally any retail bank.

Microstrategy is evolving

What are they evolving into? Isn't it obvious? They are transitioning into a retail bank and a tech company at the same time. This is retail banking 2.0. They are borrowing money from large pools at low interest rates and turning around and loaning that money out at a higher interest rates. It's brilliant and also just the same shit we've been doing for over a hundred years. It just has a new spin on it.

Collateral

This entire economic system of debt absolutely depends on collateral. Bitcoin is the best collateral there is, and Michael Saylor knows it. Bitcoin isn't a store of value. It's a store of security and a beacon of trust. It's also a store of collateral. Unlike most collateral (NFT) Bitcoin and other cryptocurrencies are totally fungible with very good liquidity and a market that says open 24/7. These factors make Bitcoin the best collateral in the world.

So not only can Microstrategy take out favorable loans to buy Bitcoin, and then turn around and loan that Bitcoin out at an exponentially higher interest rate (just like a retail bank), they can also give themselves a loan, which is insane. Imagine a retail bank being able to give themselves a loan with their own collateral. In terms of legacy banking this is called quantitative easing, and it normally comes with a negative connotation. On top of this fact, legacy QE requires permission from the FED.

In traditional QE, the FED will buy the bank's bonds and give them cash for it. That is basically the same thing as leveraging assets back into loans. However, with crypto as collateral, a whole new world opens up for banking. All of a sudden a tech company can permissionlessly stack value into a smart contract, draw a loan from it, and turn around and use that loan to generate even more yield. This stuff gets really mindblowing when we actually start looking at specific examples and seeing the tools that are becoming available to institutions.

Example.

Let's say some kind of trustworthy DEFI token pops up that gains a lot of trust in the legacy economy. Michael Saylor is no longer a maximalist. He's thinking, "Wow, this new token is amazing. I would have never imagined such a thing could be created." So what does he do? He leverages some Bitcoin to take out a loan, and uses that loan to buy this new magical DEFI token.

What can this DEFI token do?

This DEFI token has NEGATIVE interest rates. That's right! Negative. This platform will pay people to stake it and take out loans. MakerDAO has it all wrong. MakerDAO is a hyperdeflationary asset that charges interest rates on loans forged with collateral that is already owned by the lender. This is incorrect.

Imagine it:

Imagine trying to charge someone an interest rate on collateral that they already own. It's ridiculous. However, the legacy economy does this all the time (because they have to in order to make the business model viable). This would be akin to taking out a second mortgage on your home. The bank has money that you want for a personal/business loan. You get the loan from the bank and put your house up as collateral. That actually makes sense.

What doesn't make sense is doing it in crypto. Because in crypto, WE ARE THE CENTRAL BANK. So why would we allow OURSELVES to be charged interest rates? That's dumb. What we really want is negative interest rates, because this is the attention economy. We want people to use our system and take out loans and create debt, because when citizens use our protocol instead of another the token price will go up.

To reiterate.

Michael Saylor leverages Bitcoin to take out a loan and then buys this new magical DEFI token with negative interest rates. He then proceeds to stake the new token in a CDP (collateralized debt position). He then uses this position to mint stable coins out of thin air. Every coin that he mints generates negative interest rates... so he's actually making money by taking out this loan. Mindblowing.

But wait, there's more.

Because unlike MakerDAO, this new magical DEFI token (let's call it Magitek) is hyperINFLATIONARY rather than hyperdeflationary. This sounds bad, but it is actually great for generating sustainable growth because all the inflation is being allocated to healthy sustainable locations.

So where is the inflation allocated?

To the liquidity pools of course! At least that's one of the main allocations. Exponentially large liquidity pools are super important.

- So Saylor has leveraged Bitcoin to buy a DEFI token (loan #1).

- He then takes out a loan with the loan and makes money on negative interest rates (loan #2).

- Then he uses the stable-coin and the defi token to add liquidity to the AMM yield farms to generate even more money (thinking like 50%-100% yield). This creates an even deeper liquidity pool and allow new users to enter the protocol fairly without causing supply shock.

But negative interest rates are unsustainable?

LOL, are they really? Says who? Unsustainable for who? The Federal Reserve? How is the Federal Reserve going to make money if they give people negative interest rates? Isn't that the FED's problem? Who gives a shit how the central bank is going to make money?

Take it one step further:

We are the central bank. We are the Federal Reserve. We can provide negative interest rates because the way that we are generating income and value has nothing to do with being paid back more within a debt-slave based system. It really is that simple. This isn't a debt-based system, therefore negative interest rates often make sense in this context. The reason why creating debt needs to be incentivized so aggressively is that no one is going to want to incur any debt in a system where they are already filthy rich and don't want to accept impermanent losses, liquidation risk, and things like that.

KISS

Keep it simple stupid!

What I've come to actually realize during my crypto travels is that directly manipulating interest rates is totally pointless and overcomplicated. Interest rates for giving oneself a loan should ALWAYS be 0% IMO. I was just using negative rates as an example here to show how yields can be stacked on top of yields in crazy ways using crypto.

The first stack is leveraging Bitcoin to buy the defi token. The second stack is leveraging the defi token to get stable tokens (which pays yield). The third stack is dumping that liquidity back into an LP pool for exponential yields. Income can be generated four times within this system (holding Bitcoin, holding defi token, negative interest rates on stable coins, AMM yield farm). It's insane when we actually lay it out like this.

In any case...

The best way to incentivize people to stake tokens in the CDP and draw out stable coins from them is to manipulate yields rather than manipulating interest rates directly. Increasing the yield of the DEFI/stable-coin LP pair would usually be good enough, but there would also be single-token farms (which Magitek calls the "Cache") who's yield can be manipulated. Increasing the yield of the stable-coin (Ice) Cache is effectively identical to increasing negative interest rates and incentivizing more debt to exist. Although while in the Cache this value is locked, while in the LP pool this value is for sale and increases the stability/liquidity of the governance/defi token.

Back to the real topic at hand.

As cringe as Saylor is at times, he's a very smart guy with a ton of great insight into what's going on here. Are these liquidity pools connected? Yep, they sure are, especially in the short term. The problem is that while the data he provides is clearly uncontestable, the interpretations of the data are obviously wrong.

For example go to 2 minutes and 30 second in.

He describes how most non-Bitcoin assets are securities (rather than property). Funny thing is as he lists off all the reasons why they are securities, Hive does not apply to his list, which is pretty awesome. It's safe to assume Saylor knows nothing about Hive, but he will. He'll be forced to within the next 5-10 years.

The main implication here comes from a perspective of the legacy economy. Saylor assumes that because these things are going to get labeled as a "security" by regulators that they are doomed to get shut down. Isn't that funny?

Most of the altcoins should disappear.

Why? LOL? How? Saylor thinks that altcoins are going to disappear because the SEC said so. How fucking ridiculous is that coming from someone who actually understands decentralization? If the SEC tries to shut down or regulate the Ethereum Foundation, the Ethereum community is going to fork their stake to the void. If the SEC tries to shut down Block.One... oh wait not only did Block.One already get their slap on the wrist AND pay the fine, but the EOS community is saying FUCK IT and forking them out anyway. This is what Michael Saylor does not understand, and he's going to pay for his ignorance at one point or another. I'm sure he won't mind because he'll still be a multi-billionaire.

What Saylor is correct about is that A LOT of the venture capitalists are going to get wrecked by the regulators and forced out of the market. That's when things like SOL get temporarily crushed, but the SOL community isn't going anywhere. Hive can attest to the fact that no matter how badly we get beaten and bruised, the community will simply emerge grizzled and unkillable over the long term. We survived a 99% reduction in value and lived to tell the tale. These comparisons to the Dot Com bubble are rooted in outright ignorance and delusion.

4 minutes in:

If Bitcoin doubled every year for the next decade it still would be but a small fraction of the money in the world.

WOW!

I have NEVER seen someone talk about the obvious doubling-curve of Bitcoin (except myself of course). It's nice to see that Saylor has eyes. It's a shame he's pretty bad at math for a rocket scientist. A doubling affect over 10 years is basically x1000 (2^10 = 1024). So take Bitcoin's one trillion dollar market cap and go x1000 to one Quadrillion. LOL, is he fucking high when he says this? What the fuck!? Bitcoin/Ethereum are going to become the go-to collateral for the entire banking sector. It's quite obvious at this point, and that's a good thing. It means the system won't collapse and we can just continue building without having to suffer a decade long Great Depression 2.0.

He also makes an interesting statement about "the gold people"

He thinks it's ridiculous to team up with gold and we should just absorb their market cap. Again, I'm not sure if this can happen, but if it does it will be short lived. If crypto goes from 1 trillion to 10 trillion and gold goes from 10 trillion to one trillion, guess what? I'm buying me some gold. Physical gold, not that paper bullshit they are peddling at the financial institutions.

This will in turn expose the paper market for the fraud that it is. When gold on paper is worth less than 50% of real physical gold (high premium) that entire sector is going to collapse, and it will collapse because crypto holders forced it to collapse, by buying real gold as a redundant hedge, rather than trusting that paper gold is just as good. It is crypto's job to hedge, create redundancy, and expose the hypocrisy of the legacy system. It's only a matter of 'wen', not 'if'.

Nobody can change the fact that the world runs on dollars.

Very wise sentiment.

Most maximalist live in a magical fairytale land where this is possible.

It's nice to see that Saylor does not.

We're starting a war for no reason.

If we went up to every corporation at gunpoint and told them they needed to use Bitcoin [over fiat] we'd have to shoot all of them.

Exactly, we can't force legacy systems that are intrinsically rooted within that legacy economy to uproot themselves and embrace crypto. Everything has to be slow and transitional.

The current tax code implies that you should buy [Bitcoin] and hold it forever. And the current tax code of currency implies that you should get rid of it as soon as you can: because there's no cost to get rid of it.

Hm, nice.

Again Saylor hits the nail on the head by pointing out that you only get punished by the legacy system if you sell the Bitcoin and get forced to pay taxes on it. Don't sell it: be your own central bank. Leverage your property into loans like smart-guy Saylor over here. Sorted.

Afterthoughts

We can clearly see that Saylor is coming at this from personal experience and knowledge, just like everyone in this world does. Saylor is brainwashed to lean into the status quo and legitimize the legacy economy. I'm brainwashed in exactly the opposite way (anarcho-capitalism), this is why Saylor and I constantly come up with exactly the opposite opinion given the same information.

Conclusion

It was foolish to think a shark wasn't going to be a shark.

Again, lower your expectations.

Think Saylor is going to completely overextend his Bitcoin position and then not leverage that position to make free money and derisk his bags? Think again. Of course MSTR is eventually going to find "trusted counterparties" to hold their Bitcoin. Of course they will allow those counterparties to short Bitcoin. Saylor doesn't care about short term price action. He's playing the long game, just like me. Kudos to him for bringing a very unique perspective into the space that we can all learn from. It doesn't matter if some of the stuff he says is wrong. In fact, sometimes perception becomes reality. Self-fulfilling prophecy is a real thing.

But just in case you hate Michael forever for allowing BTC to be shorted:

Michael Burry

Shorted the housing market in 2008

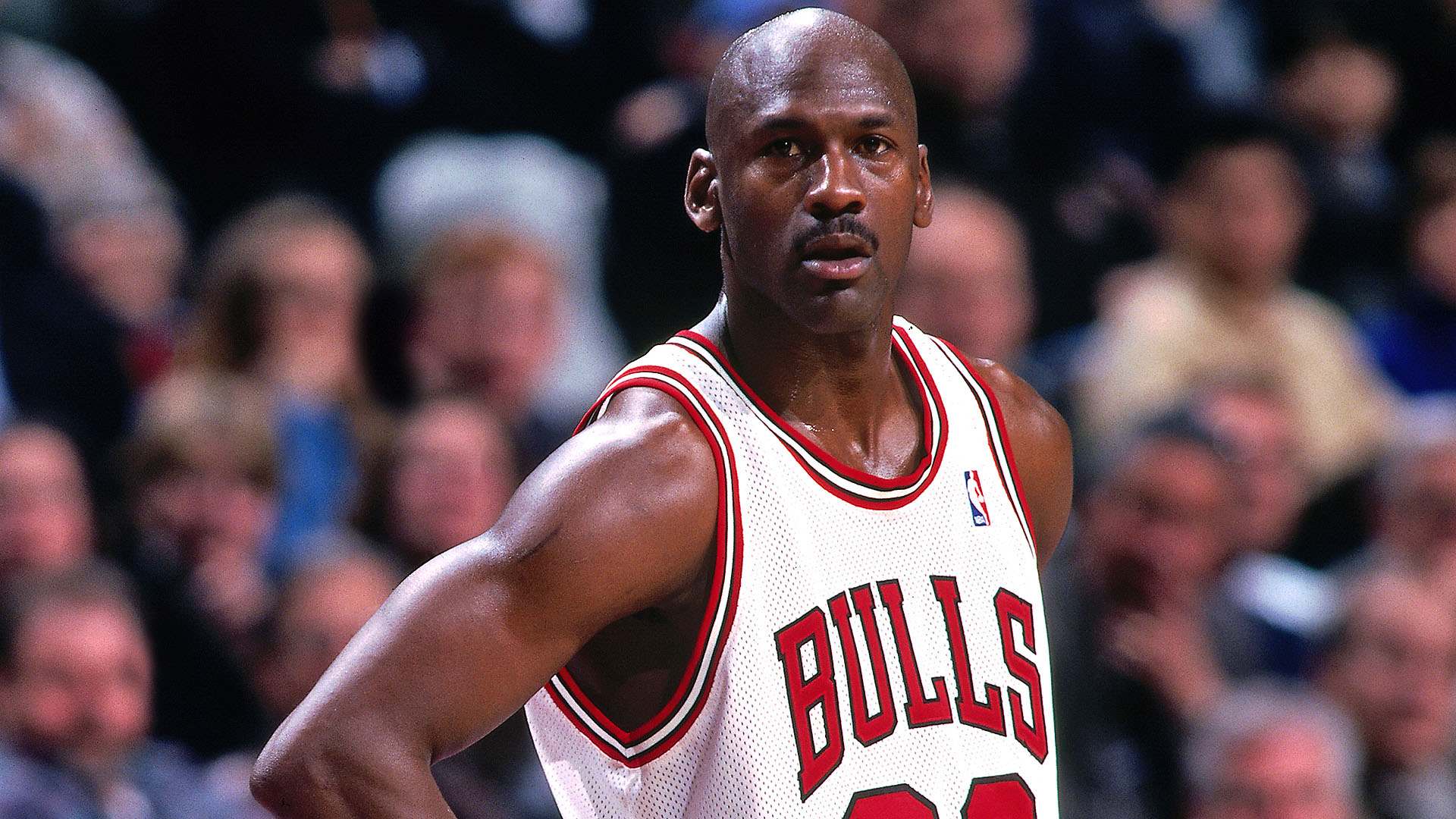

Michael Jackson

Shorted the color of his skin and his sanity.

Too far?

Michael Scott

Short on intelligence, long on heart.

Michael Myers

Short on life itself.

Obviously the real question we need to be asking is what the hell happens to your kid after you name them "Michael".

Michael Cera

Ew stop I can't take anymore!

Short on manliness.

Thank Christ, a non trash-monster.

Oh God damn it!

Never mind.

Short on manners and respect,

long on gambling and being a dick.

Never go fully long on dick.

Giggity.

Posted Using LeoFinance Beta

Oh my god my sides are killing me from this post. I haven’t laughed like this in a while.

You get post of the day in my opinion.🍺

I have a feeling that Saylor might not care if BTC goes down or not that much so long as it doesn't completely tank. Like you said, the interest will give them a bunch of money. So if market goes sideways or down, the BTC will cover them. If markets go up, their asset price goes up. It's like a win-win and Micro strategy also gets management fees too.

Posted Using LeoFinance Beta

I also misspoke about the Black Swan event.

If Bitcoin tanks the shorts become profitable.

Only when Bitcoin spikes UP too quickly is it possible that the collateralized USD positions wouldn't be liquidated fast enough to get the BTC back. I feel like that makes the situation all the more interesting, because obviously if BTC spikes up too fast people like Saylor win big regardless.

Actually they give them a bank instrument that is a reserve. They do not swap for cash. The bank got the security because it had to get rid of the cash into something that generates a return.

Posted Using LeoFinance Beta

Yeah it sounded wrong when I wrote it but I wasn't quite sure.

But I feel like that opens up another can of worms like if the banks need to spend their money on something that generates yield... aren't they going to eventually stop buying bonds and start entering defi protocols?

Daniels over Micheals for the win

Posted Using LeoFinance Beta

Although I like the arguments he explains on BTC I have to admit I like much better Raoul Pal's position over the years. He also was a maximalist but he now analyzes other projects and has mentioned several times his portfolio has a bigger amount of ETH than BTC plus some other Alts.

Being in crypto and not seeing the value of different projects besides BTC is as blind as keep saying GOLD is the only hedge against inflation. Yes BTC is the first one, and some of its code is unique but that does not make it to be the only one to bet on.

This is just retail banking of nowadays.

Yeah, he's in it just for the profit. That was my impression after one interview I listened with him. Small shark sees opportunity to become whale overnight.