Market Watch: I Have Returned!

After a brutal 2700 mile move across the country,

I've come back to continue the grind.

Looks like it took me pretty much a full week to move, as my last post was 8 days ago. Crazy stuff.

A lot has happened since then.

While I was on the road CUB transitioned from Version 1 to Version 2; a huge upgrade. However, this was a difficult transition, as the process of farming CUB is competitive. As soon as V2 pools were generating yield the V1 pools needed to be deactivated. This put me in a very awkward situation because I was on the road while this happened, and my LP tokens just sat there in V1 generating zero yield.

Regardless of all that, I was still able to farm 2600 CUB when I reached my destination and transition to V2. I was also taught an important lesson.

Don't put all the eggs in one basket.

I realized too late that I had put some of my crypto security 100% in the trailer I was towing across the country, including CUB. Instead of taking my Trezor with me on the trip, I packed it, and I realized that if the trailer had been stolen I'd of basically have lost the fifty thousands dollars I have invested in CUB at the moment. This made me a bit nervous at times, but lesson learned... the hard easy way. I only lost a couple hundred dollars in yield by making this mistake.

However, this brings up another important question: is this a sustainable practice as we scale up? Is it really reasonable to expect millions of dollars of liquidity to transfer from one version to another with less than 24 hours notice? I would say this isn't really a solution that would work if CUB had billions of dollars in market cap rather than millions, but I guess we won't have to worry about for a while, or if we do that would be a great problem to have.

Those who noticed that V1 was no longer generating yield got a huge bonus for transferring early. I personally know someone who got an extra 1000 CUB just for moving over early, and any bots that sniped the swap got way more than that during the initial opening yields that were massive because no one had joined them yet. Value was siphoned from investors that didn't move instantly to those that did. It's not really fair, but this is the Wild West after all.

Silver Lining

One really great thing about moving during this time was the dip on September 21st. Need I remind everyone of the prediction I made for September 21st 8 days ago during the last post I wrote before moving:

Bitcoin to Break $50k on September 21st.

Once again I prove that it's very easy to predict when there will be volatility in the market, but not so easy to predict which direction that volatility will flow. I predicted a big spike and we got a big dump. It's crazy how often that happens to me. Take note, as even though it looks like I got it exactly wrong, I would actually be more wrong if the market had traded flat and we got a huge nothing burger.

Of course, many attribute this dip to the China Ban on crypto, but I think that would be a foolish assumption. This exact same thing happened in September 2017, and look what happened then. September is always a poor performing month, as I have mentioned a dozen times by now.

Even worse than China banning crypto transactions, it seems that Binance is bending the knee to regulators more and more as of late.

Fellow Binancians,

Binance reviews its products and services on an ongoing basis to determine changes and improvements in light of evolving global compliance standards. To enhance user protections and provide a safe crypto environment for everyone, Binance is making the following changes:

I love how they say complying with regulations protects the users when it is blatantly obvious that they are only doing it to cover their own asses legally. Nice try, CZ.

Effective immediately, all new users are required to complete Intermediate Verification to access Binance products and service offerings, including cryptocurrency deposits, trades and withdrawals.

Shit.

Existing users who have not yet completed Intermediate Verification will have their account permissions temporarily changed to “Withdraw Only”, with services limited to withdrawal, order cancellation, position close, and redemption. This will be carried out in phases to minimise user-experience disruption, from now through 2021-10-19 00:00 AM (UTC). Existing users will be informed directly with more details. Once users complete the Intermediate Verification, they will be able to resume full access to Binance products and services.

This part is a little weird because I've been using my account and I'm getting no actual warnings that my account will be disabled even though this claims I will be cut off on October 19th at the absolute latest. This puts me in the denial phase and I wonder if they are actually going to limit my account. Why aren't they letting me know when I log in that I need to KYC? Very strange.

Binance strongly advises users to complete their Intermediate Verification promptly to avoid delays in the verification process and restrictions on their access.

Uh huh, yeah I'll bet you do, CZ.

Binance is announcing these measures to help support its efforts in Know Your Customer (KYC) and Anti-Money Laundering (AML). This will further enhance user protection and combat financial crime. To learn more about KYC, please click here.

Again, lies. This is just as much about "user protection" as Bitcoin is only used by criminals and drug dealers. The powers that shouldn't be are threatened by Bitcoin, and they make the rules; plain and simple.

Thanks for your support!

Binance Team

2021-08-20

Eat my ass. KK thanks.

Looks like I may be in the market for another exchange!

What the regulators don't get is that they can't stop new exchanges from popping up and providing pseudo-anonymous services. Where supply meets demand, markets are made. There will ALWAYS be a demand for privacy in the cryptosphere, and if the centralized legacy companies can't provide the supply to that demand, DEXes and peer to peer trading will take over even faster. It's only a matter of time.

Honestly I'm seeing this situation as a golden opportunity. Q4 is still perfectly on track for a mega-bubble. Price action in September is irrelevant. We still have plenty of time to hit all time Highs in October and $100k in November. These are the targets we need to smash to have any hope of hitting a $250k+ mega-bubble in December/January.

In fact, this dip is so good that I've learned how to margin trade on Binance for the first time ever. My VPN was set to Sweden but I was being told I was IP blocked by Binance. This was confusing until I found out that the server in "Sweden" was actually based in Germany, which is absolutely banned from margin trading on Binance.

Once I switched my VPN to Mexico it worked fine, but I did make one more mistake along the way. I borrowed Bitcoin thinking this was the correct play. That's actually the exactly opposite of what I needed to do.

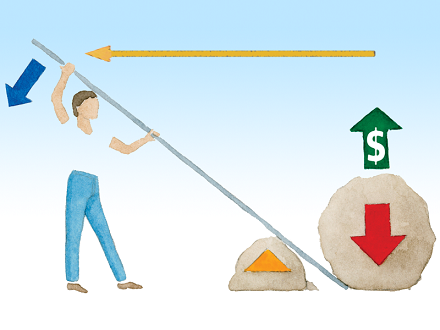

If you borrow Bitcoin, you have to pay Bitcoin back. Meaning the asset you borrow is the asset you are shorting. Therefore I needed to short USDT by borrowing it and dumping it for Bitcoin. After a few moments of stumbling I got the hang of the multi-account margin trading and borrowed $2400 with only $1200 worth of collateral.

Unfortunately the interest rates for margin trading on Binance are absurd. I'm being charged 25% APR. That's worse than a credit card. It would be way smarter to just get a credit card and buy Bitcoin with it. This strategy is superior in almost every way, as not only can you easily get a better APR than 25% with a credit card, but also a credit card has zero risk of liquidating collateral because your collateral is your credit score (usury). Meanwhile, if Bitcoin crashes again I'll lose my $1200 in collateral.

The only advantage of margin trading on Binance is that it is a permissionless loan. It is automatically approved no matter what my credit score is. Considering I recently applied for a credit card and got rejected, this is actually a pretty big advantage. On top of that, if I'm right about this mega-bubble Bitcoin is going to increase over 500% in the next three months, so the 7.5% interest I pay for longing the market is largely meaningless. It is also possible to buy Bitcoin with a credit card and then use that debt to margin trade with... which is obviously even more risky but worth noting.

It's also noteworthy to mention that margin trading on Binance is interesting because there is an option to pool all your collateral together, giving users the option to borrow and dump any asset that they desire with x3 leverage. The non-linked margin trading pairs allow x10 leverage, but I haven't figured those out quite yet and perhaps never will. Being able to pool collateral is a big advantage.

Figuring out how to margin trade on Binance also made me realize why Coinbase often shut down service during big dumps in the market. Back when they allowed margin trading they needed liquidity to liquidate the bad debt of margin trades in the red. If they allowed other users to dump in front of them they'd lose money, so they denied service to others in order to dump in front of them. I'm kind of surprised that's even legal... maybe it's not. Maybe I'm way off base but it makes sense to me if that what was going on all those times that they shut down during high volume dumps.

Conclusion

It's good to be back and a lot of developments have happened while I was gone. I still busy settling in so I'm gonna kill it here. However, I should have enough time to get back to writing one post a day. The grind continues.

Posted Using LeoFinance Beta

Glad you are back.. It's always good to consider how you can access accounts if you are gone.

It's an interesting time, where we have to learn lessons as we go.

Posted Using LeoFinance Beta

The Mandala exchange is Binance without the KYC threats. It still has the higher limits too. I moved all of my assets that were on binance over to Mandala. So far so good. It is still centralized etc, but it is still a good tool to have in my belt.

The after effects of the V2 migration sure is interesting. I moved a few hours after it went live...but maybe I should of thrown down everything to make the move right away.

Posted Using LeoFinance Beta

Glad the move has mostly worked out for you!

With a credit card... if you were basically right but timed it wrong, you could just pay the interest to cover yourself for another month? Or am I missing something here?

It looks like a lot of the crypto that was sold in this last Sept dip was crypto that was less than a month old... ie, people who recently bought in got nervous and sold... crypto that's been sitting around in wallets for a while didn't budge.

Hope you're right about the next 3 months, that timeline actually fits perfectly into my plans... which should worry everyone.

2,600 CUB in a week isn't bad at all even with that missed time. That some serious income honestly. Markets are about to start warming up again and the amount of projects going to be launched over the next three months should be HUGE. Glad to have you back and glad you had a safe trip.

Binance makes me laugh because they where so big about how they where going to stick it to the man and that they didn't need to do any of this extra stuff like KYC. Then they went a step to far and started allowing buying of stocks with crypto. That was a clear indication that the SEC and governments now have every right to go after them as they tied their product to a regulated product. UH NO! We need a truly decentralized and anonymous platform because in all honesty the government is increasingly overstepping laws that are not in place and still acting on executive orders that went into play since 2001 after the attacks that should have only been temporary.

Posted Using LeoFinance Beta

Good too know that you are back to continue grinding, and thank God you didn't lose more than you did, the truth is you will definitely recover the losses.

As for the Bitcoin prediction, I would say the last dip, china banning crypto had a large roll to pay, because from my understanding of the market, market work with sentiments and reactions. The way some trader's (newbie's) that don't have the long term mindset reacted to the China crypto ban news, in my opinion caused the dip.

I see that there is a good progress and this is very promising when we continue in the upward trend despite the attack from the governments.

Posted Using LeoFinance Beta

Welcome back and looks like you have some really good lessons to teach us, I too noticed the KYC of Binance which was frustrating as I attempted to deposit some crypto but it kept making me KYC which I cbf doing. I already use a centralised Aussie exchange as it comes with protections. I'm not sure what Binance is offering me for KYC.

Either way, there are a few other exchanges that have become KYC also. This is going to be an interesting time. I wonder if wide spread adoption will also follow.

Can't wait to pay my rent in Leo or Hive!

Welcome back, always enjoy seeing how your mind works

Have to agree with @theb0red1 & 2nd what he said!! You sure make moving look easy!! I'm moving too. Talk about the wild west! Hope you're happy with your new home!!

Welcome back! Hope the move wasn't too bad, I know it can take a while to get truly settled in after a big move.

Glad to see you are back. Margin is meh IMO :) But it is ok for some fun :P

Real shitcoins doesn't need leverage to generate life-changing money in days :D

I hope CUB releases will make some demand for CUB. Btw, i told that month ago, CUB has a math problem ( to make it useful). Staking CUB should have higher APR than any other pair. Otherwise, it would never be the first demand token.

But yeah, it is what it is. I hope poly exchange will do something.

Hope you are right with the mega bubble, my feelings about that are different :) but this doesn't need to mean anything.

I will take your advice not to put all your eggs in one basket, I think the crypto market is even more beneficial in the long run.

This is sure not legal but also not illegal, that makes them the room to do so. Financial markets have been doing that for a long time. This is time for permission less DEXES. Thorswap is running again without ETH for now. I believe they will be able to tackle this once mainnet is launched. It's still early....

Thanks

Binance has always been a bit shady. (And the reason China is cracking down on crypto is because they're going to issue their own official Chinese digital coin which will be pegged to the renminbi. They're already trialing it in some towns).

I wish Hive could get listed on a western exchange like Kraken, especially as the user base is western.

As much as I love the idea of no middle-man, I can't expect a majority of people to get used to that, and I don't think I will either when it comes to storage. The idea of keeping all my crypto in hardware wallets in my immediate possession freaks me out. I try to spread it out as much as possible just in case something happens. Getting rid of the middle-man for transactions though, fuck yeah!

Welcome back BTW! I'll be moving next week, though it's across the street, not across the country.

Do you think Cub has a chance to catch the momentum once the market starts pumping?

I though we had a strong support at $0.5 but I guess I was wrong.

welcome back! It is definitely problematic to see that binance has to "bend their knee" in order to stay in the game. Maybe it would be a good idea to start an exchange in a crypto friendly country (or does that already exist?)?

Btw I still think you should reconsider your early market run up idea.

https://peakd.com/hive-167922/@tobetada/crypto-analysis-or-btc-correction-confirmed-update

So interesting to read all this.

Read how this all have started with Toruk

Posted Using LeoFinance Beta

And once again...

Good to have you back. Good luck settling down and looking forward to reading your posts again

Posted Using LeoFinance Beta

Glad ya made it safe. Game on!!

Excellent insight and personal observations. I will say that this one piece caused me to gasp out loud,

I'm glad your trailer and your Trezor with your crypto made it safely to your destination.

Welcome back! Glad your move was successful. I agree, Eat My Ass Binance.

Aye! Good to have you back.

Margin on Binance, I haven’t been able to wrap my head around it I just always avoid it.

@edicted! This post has been manually curated by the $PIZZA Token team!

Learn more about $PIZZA Token at hive.pizza. Enjoy a slice of $PIZZA on us!

Welcome back, I'm new here and can't wait to learn from your write ups. However, you can device sometime to check your account here while you are away.

With the fact that Binance supports the mostly commonly traded cryptocurrency and support services for user to earn interest or transact using cryptocurrency, it enables miner to optimize their income and make decision.

I like that of it has the lowest transaction fee for crypto exchange as it is highly liquid. However, having much of it's functions being disrupted by decentralized option and not feeding it's user with daily market analysis is not encouraging.

We are glad to have you back.

Margin trading is scary and I haven't really invested any time into learning it, the ins and outs. I'm really not sure if I want to do it honestly. How long did it take you to figure it out, any good guides on it you could share?

Posted Using LeoFinance Beta

I had a little bit of experience using MakerDAO and minting DAI with ETH collateral.

If you're using Binance they have a tutorial/quiz you have to pass in order to even be allowed to do it.

At the end of the day it's all about collateral value vs debt incurred.

If your collateral value ever drops to how much you owe back (debt) it gets liquidated and you lose everything.

Not recommended for the faint of heart.

Basic principals:

Borrowing against the assets you've put in. Hoping the value of your collateral doesn't dip below liquidation levels. I know snippets about it just by reading trading stories. I dig your basic principles on going long vs short. Thank you.

Humm. I'm so torn. On one hand, I'm not much of a gambler, I've read lots of articles that say "just buy and HODL, don't be stupid" and I have a pretty good understanding when I don't understand something. All that combined leads me to not venture into those waters.

But then I read this article by kevinnag58 and I recognize that might be an act of risk aversion.

That very well could be me. That said, knowledge is always useful. Thank you.

As a rule of thumb your gut feeling is 100% correct.

It is foolish to increase risk/reward given the most risky asset class there is.

I would only recommend margin trading Bitcoin (if anything), as it is the easiest crypto to predict.