LEO could use a big win.

Sure every crypto could use a big win.

That's the thing about bear markets, eh?

Everybody finds themselves in the same sad lifeboat taking on water.

Still, better than being the musicians on the Titanic.

Seriously though...

They had over 2 hours to prepare and everyone just sat on their hands instead of preparing for the inevitable. It's exactly the same thing we are seeing in the legacy economy today, except on a much longer timeline. Personally I'd rather be spending my time grabbing anything that floats and tying it together for the makeshift raft. Such is crypto.

Wow! That is ugly.

But it floats, eh?

It's been a wild ride on the high seas!

We got our Wyckoff pattern followed by the classic head & shoulders, and now we wait for the bottom, assuming it hasn't already happened. It somewhat blows my mind to see these valuations and watch everyone scramble and act as though it's all crashing to zero soon. Typical bear market. And yet, we already know that this is exactly how long it takes for the bottom to solidify. One year after peak. We made it, but at the same time the legacy economy looks so terrible it's hard to find any upside in this mess.

As we approach the end of the year, the doubling curve that I often use as a metric for where we should be is around $51k. Yep, I value Bitcoin around x3 the price it is now. Given this metric it's hard to grasp how the price can be this low and still money sits on the sidelines waiting for it to go even lower. With 3 of the top 10 coins by market cap being centralized stable-coins it becomes provably obvious that the money is there just waiting to reenter.

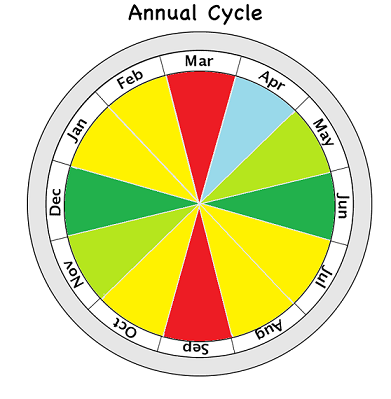

I often claim that February is a bad month for the economy. Gas prices are often at their lowest. Demand is down after Christmas and the back-to-school rush. Everyone is broke and often in a holding pattern. In the same instant, recent price movements in crypto have defied all the classic patterns, and once again we might see February be the start of something interesting. If 2023 rhymes with 2019, that certainly will be the case.

Perspective matters.

February is much different in the USA than it is in say China. The month of February in China is a month of celebration. They take the New Year very seriously over there, which is in February within the East hemisphere.

It will take months for the scared and scarred bulls of crypto to pop out of their holes and reenter the market. People still can't STFU about FTX and Sam Bankman. The chatter has been constant since the collapse. Move on. Sam going to jail isn't going to fix any of your problems. The judicial system moves at a snail's pace. Funny how people forget that as they compare the situation to other moments in history that took literal years to play out. The elite has no incentive to fast track the prosecution of white-collar crime. Think about it. Most are criminals themselves.

What about LEO though?

Yeah, LEO could use a big win. The last big win for LEO was listing wLEO on Ethereum, and it was all downhill from there. From a 2 cent valuation to 80 cents. The hack hit like a ton of bricks, but I'm guessing most have already forgotten about that considering the circumstances. CUB was a huge fail for anyone that invested directly in the token outside the LP. PolyCUB was doomed right from the start from the tokenomics I pointed out before it even launched. The math was simply not sound. It can still function as a testnet though.

But yet people on LEO are still diehard holders. Would be nice to get another win, and we will eventually, but the patience required for such things is the stuff of legend. CUB is making some much needed pivots, and the micro-blogging iterations will go live soon™.

Conclusion

Bear markets aren't fun, but that's how the diamonds are forged. The pressure of these situations is enough to weigh on anyone. It's how we handle the pressure that matters in the long run. Will we make the same mistakes next bull market? Probably! Hopefully not though, eh?

History shows that the bear market has bottomed. Unfortunately there is no history for Bitcoin that shows how it reacts to a recession, as it was created at the bottom of the last recession. Bitcoin was very little known at that time, so we have no metrics to follow this time around. Completely uncharted territory here.

But still, we have to note that the crypto bear market and legacy recession happened pretty much at the same time. Judging by the doubling curve and the x3 needed to get back to it, I have to assume that this market is wildly oversold due to the double whammy. It's hard to imagine another crushing blow coming because we've already spent our year in the gutter and crypto moves faster than any other market. Any kind of decoupling from stocks could send many retreating from the more volatile asset (stonks) and into crypto. At least that's the theory.

So here's to the LEO community and waiting out the winter for another victory. Development is a slow grind, but we'll get there.

Posted Using LeoFinance Beta

At this point LEO at $0.05 the sell point is over for me and it's only stacking and holding because $0.05 isn't worth the sell in my opinion. It's either write it off or stick it out. I fully agree that Polycub was a mess and made zero sense when everyone was preaching it was going to moon once the inflation died down and the massive lockups of polycub but that never happened. CUB did well I think however after it's fall in March I think we all knew it was a doomed cause at that point. Inflation just crushed that token to nothing and now we are attempting to still fight that same inflation. That inflation needs to be adjusted depending on market conditions. When things are in a bull market sure you could increase the print but in a long bear market that inflation should be reduced because of the reduced amount of fees and swaps happening.

If the UI, Threads and ad buy back don't start to fuel a little value in the token I most likely might start shifting my focus a bit more away from it. There's only so much one person or we can do. I'm hoping for big success but I feel even a small long win would be better and my hopes are we see that rolling into 2023.

So what economic signs in general or decisions should we watch out for that effect the financial global markets? OPEC? NATO? I have no idea, I'm just trying to learn.

All we can do right now is try to stack as much crypto as possible during the winter.

It's DCA buy time.

The tricky part is actually taking gains off the table during the bull market.

There are a dozen different metrics that paint a bad picture for legacy economics.

But we have no idea if crypto will follow in those footsteps,

as crypto doesn't have any zombie institutions to prop up.

Everything that was going to fail has pretty much already failed.

But the value of FIAT impacts the volume difference in the ability if crypto purchases. Macro Economics definitely play into the value. That's how people are traditionally trading goods and services, so it will even inadvertantly follow Legacy systems.

I got into Leo at .80 and then it tumbled down :-) Later I removed all at .50 and now again trying to build my stake just from the earnings and not with any investments. Though it's not a bad idea to make some investment.

Well said. And I agree with you about Bitcoin's value x3 the price it is now. And I think now is a good time to explore projects like LEO Finance, because once LEO Finance and Hive Blockchain come out of the Bear Market, it will be stronger than ever.

Posted Using LeoFinance Beta

selling pcub at 11 cents and buying it for KOIN was one of the best bear market decisions I made and I still lost thousands of $$$... but I made enough Leo rant posts, so lets hope for a brighter future!

This would be cool. Hope to see 100 dapps on HIVE one day.

So did they give up on polycub? I cant believe there is no word about it!

Nah there is no giving up but there is some drama with the emission rate. Some thing we should pause the halving events to maintain yields so all the liquidity doesn't leave. Like I said it's still a great place to test features that might be dangerous to cub like loans and bonds.

Posted Using LeoFinance Beta

March-April is when I'm expecting a change in trend. At least for BTC. One year prior to halving is when max pain is basically over and plebs(institutions too) start accumulating for the next bull market, triggered by the halving. It will happen again. I don't know about LEO. I have hopes and dreams but these don't usually work. I believe that CUB pretty much "killed it", but I might be wrong. Patience, it's all we got right now. At least that's the case for me as I don't have any more cash to buy more crypto. I wish I did, but again, hopes and dreams don't work.

Thank you so much for your support of my @v4vapp proposals in the past, my previous one expired this week.

I'd be really happy if you would continue supporting my work by voting on this proposal for the next 6 months:

Additionally you can also help this work with a vote for Brianoflondon's Witness using KeyChain or HiveSigner

If you have used v4v.app I'd really like to hear your feedback, and if you haven't I'd be happy to hear why or whether there are other things you want it to do.

Have you still got that million CUB lol?

What're your thoughts on CUB paying its own token to incentivise the bLEO:BNB LP at 37% APY and people still not touching it?

Posted Using LeoFinance Beta

Victory is sure. The bear market is an opportunity in disguise, those who didn't get emotional and bark off would have a better story to tell tomorrow.

The circular world had experienced recessions and the crypto world is in its early stage and recession hitting shouldn't force us out of the massive victory ahead.

In retrospect, maybe Cub and Polycub didn't need a token but that was an impossible discussion to have back then because everyone and everything had a token. The services they provide could easily tie into Leo and we could have one token to rule them all.

I guess that over time products will be built around them like the multi-token bridge on BSC but that is a very distant future it seems.

Posted Using LeoFinance Beta

https://twitter.com/1413161729106776065/status/1601986178080772096

https://twitter.com/1415155663131402240/status/1602111269255155712

The rewards earned on this comment will go directly to the people( @no-advice, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I hear you. Leofinance is such a fantastic project which ticks all the right boxes of community, utility, development, and known dev team. But it’s price means many influencers won’t even consider looking at or Hive.

Tough crowd.

Posted Using LeoFinance Beta

Haven't checked PolyCUb in a while to be honest... I did stake what I got from the airdrop but never invested in it directly. I did invest a little in CUB though so yes, could use a big win there. Same for LEO... I think the pieces are being put together so we will get there eventually but as you say, it's a patience game

Posted Using LeoFinance Beta