Insider Trading

What is "insider trading"?

This is a term I've used in 26 unique blog posts since 2018, mostly to describe shady activity in the legacy economy and the actions of the FED, but once to describe how I think things will play out in the future of crypto.

Insider Trading to Become Acceptable Business Model?

In this post back in September I talk about what how we think about insider trading from a common-sense perspective, and how it will become commonplace within crypto. Essentially if someone is getting an unfair advantage within an industry, and then they choose to place a bet on that advantage within the market, we think of that as insider trading... but is it? Or is that just alpha and completely fair game within the PvP day-trading world?

In order to establish a verdict one way or another, we have to define what insider trading is to begin with. Once we understand that it is largely a legal term and has nothing to do with common-sense, things can become convoluted and confusing, as the law always is. Of course I am not a lawyer, so perhaps none of what I'm saying is actually true. Perhaps there are actual lawyers on Hive that will make an appearance in the comment section. I'll be the first to admit that some of my articles have comments threaded within them that are far more valuable than my original post.

The most obvious place to check first is Google:

Illegal insider trading refers generally to buying or selling a security, in breach of a fiduciary duty or other relationship of trust and confidence, on the basis of material, nonpublic information about the security.

And an even better one from a government website:

Illegal insider trading refers generally to buying or selling a security, in breach of a fiduciary duty or other relationship of trust and confidence, on the basis of material, nonpublic information about the security. Insider trading violations may also include "tipping" such information, securities trading by the person "tipped," and securities trading by those who misappropriate such information.

Are we seeing a pattern here?

- All cases of insider trading involve a security.

- All securities have four unique features:

- An investment of money.

- In a common enterprise.

- With the expectation of profit.

- To be derived by others.

Wow I recited that from memory: sad.

I've done way too much research on regulations and securities.

Why should we care what the government thinks?

Oh right because they'll threaten us with death if we resist.

Details.

WTF is a "Common Enterprise" anyway?

My post on the Howey Test can answer this easily.

No, not the Starship Enterprise... common enterprise.

Here's what Google says:

Common enterprise, in relation to an investment contract, is a way for common objectives to be followed by two or more firms. It is when the profits (or fortunes) of the investor are combined with and depend on the success of third parties that are hired or those offering or selling the investment.

As you can see that is actually kind of confusing.

You can totally read that statement and still not be sure what it is exactly.

Law Insider has a better definition:

Common enterprise in this definition means an enterprise in which the fortunes of the investor are tied to the efficacy of the efforts and successes of those seeking the investment

See that actually makes a lot more sense and then it goes on to get more technical and give examples and such. It's all about the investment contract. It's all about one group of people looking for seed money to fund a venture that will make everyone involved more money in the process.

- If we buy Tesla stock, the common enterprise is electric vehicles.

- If we buy Facebook stock, the common enterprise is social media.

- Or perhaps even targeted ad revenue and data monetization.

- If we buy Amazon stock, the common enterprise is logistics.

- If we buy crypto, the common enterprise is... is... ???

We can see quite quickly that regulators, and in particular the Securities Exchange Commission, are really just making this all up as they go. Regulation by enforcement; making the claim that they are needed when they clearly are not.

Even XPR is not a security.

How do I know? Because Ripple Labs has no control over XRP except for the massive premine that they minted for themselves. Even though the network is heinously centralized and arguably garbage (for now) it still isn't a security, and I'll explain this more in detail with an example.

Something I just realized the other day is that a cryptocurrency company can be guilty of securities fraud without the security existing. Sound pretty ridiculous, right? Well imagine Ripple did engage in an investment contract. Imagine they did sell XRP to a million investors who all expected a return on their profit based on the work done at Ripple Labs. Imagine Ripple has no XRP left after selling it all to investors, and they just decide to take the money and run. They are guilty of securities fraud.

However, even though they would be guilty of securities fraud in this unique hypothetical situation, the security no longer exists. Instead XRP exists as a fully decentralized crypto owned by a million users. It's no longer a security even though it was a security when Ripple was selling it to investors. That's the thing about crypto: it can legally transition from a security to property to a commodity to a currency. It's programmable money, and can do whatever it is programmed to do. The truth of this statement is undeniable.

And yet the legal system HATES that crypto can do this. The legal system has no idea what to do when a thing can transition fluidly from one thing to another on a legal basis. There are no laws that can possibly handle something like this. They refuse to call it a currency because they want to tax and control it. There are so many variables in play it is hard to keep up.

A regular stock is a security.

A stock could have the exact same stakeholder distribution as XRP, but XRP still would not be a security. Why? Because XRP can't be printed out of thin air. The community will not allow it. Ripple Labs has a huge premine, but once they run out of tokens, that's it, they're out of the game and they can't print more. Compare this to a corporation: they can always print more as long as they go through the proper channels.

This is a huge distinction between XRP [all crypto] and securities. The code does what the community demands it to do. If someone tries to change the code, the community does not have to allow it. Again, this is the complete antithesis of how stocks and securities work. A stock is unilaterally controlled by the company. Crypto is not, and regulators are going to be completely baffled by it until they no longer exist.

Conclusion

It is not possible to insider trade many cryptocurrencies because insider trading only applies to securities. Imagine how many cryptocurrencies are not securities assuming that Ripple's XRP is not a security. I'm quite sure this is the case: common sense be damned; the actual law is pretty clear, despite regulators acting like it isn't clear because they want as much control as humanly possible. This is why they regulate by enforcement: because if they didn't they'd have to create definite rules, and all of those rules would be completely contradictory and nonsensical.

Taking Hive for example: something we all know isn't a security... imagine someone were to build a killer app on Hive, and right before they launched it they bought as much Hive as they could. Imagine they also leveraged this move and borrowed more Hive using Hive collateral. Imagine they 10xed the value of their stack due to their "insider" knowledge. Because anyone on Hive can do this, is it not insider trading. No one is in control, and there are no insiders, and it isn't a security. Insider trading is impossible. All definitions of insider trading confirm this conclusion. Period, the end.

This is why I find it so comical that the SEC has rejected dozens of Bitcoin ETF proposals. Why have they rejected every single one? They claim they're worried that the market cap of Bitcoin is too small and it will lead to manipulation and "insider trading". But the SEC has already admitted that Bitcoin is not a security, so how can it possibly be insider traded? We have to assume that they are lying, and that the real reason they've rejected every BTC ETF remains shrouded in speculation. They've been caught in a web of their own absurdity, and it shows.

Posted Using LeoFinance Beta

Here is an actual example of insider trading (not)

ExtremelyRichGuy01 tells his brothers and sisters, nieces and nephews to buy XYZ stock.

Jim Cramer (employee of Guy01) goes and talks about how XYZ stock is the cats meow, and everyone should get into it.

Those family relations sell XYZ stock.

However, as we have seen from the lawyer speak term, this is not insider trading.

And can't even be prosecuted because it is at least once removed.

But this IS fraud or the highest order.

Everything i have heard from the SEC is similar to listening to some shut the barn door after all the animals escaped. (sometimes shutting the barn door while the barn is on fire)

They haven't protected anyone.... except the people committing the fraud.

GATA anyone?

Sooooo, my supposition is that the SEC is trying to prevent competition to "their employers" (the ones who pay them fines - profit sharing)

... and soon, the SEC will lose their case against RIPPLE at the exact time all the "investors" are in at low prices, and it is time to run.

I am not a trader not a financial adviser nor have enough knowledge about inside trading in crypto and future crypto but reading your post from last couple of weeks makes me analyser and good understanding. Thanks @edicted keep shining and writing.

It's only bad when others do it 😄

Lol

based

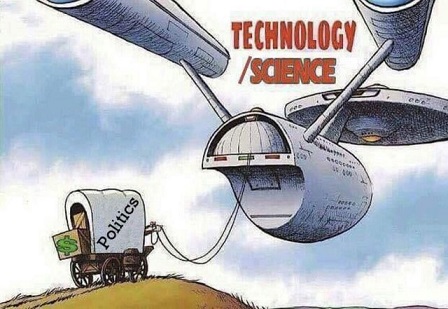

Money Market Speculation =

Highly Addictive Legalized Gambling.

Period!

its easier to do than trade stocks bc you have mroe info and patters tend to work more. Ive made much more trading crypto even if it was a scam im in and out making my money i dont care what it is i care if i can dertrermine direction of it.

Your post is very educative. Thanks you very much. More ink

Many countries are banning crypto.

What is this an AI bot?

🙃

shit that makes you rich like jasper will starting today 100 - 200 nice posts will be posted to hive optimixzed to max votes then u copy and past steem max tags votes then about 10-20 morechains and offer curation delgations author and cjurator here to anyone and steel all the delegations

Doesnt mean you need to listren ny bans 95% ofg hat i trade lol ise dexes and vpn

I really hope this is not the case. part of the reason why so many people are into crypto is because of its independence from central bodies, if insiders trading is accepted who is to say the extent to which the value of securities will be affected and with so many influencers already involved in rug pulls, it is effect will be massive.

What I'm saying is that it already is the case.

It's not even possible to legally prosecute someone for insider trading because most cryptocurrencies are not securities, and in order for insider trading to occur it has to be a security. The SEC doesn't really care and they are prosecuting people anyway: regulation by enforcement. However the chance that they lose the Ripple lawsuit is significant, and then they will have to seriously consider a new strategy going forward.

Even if insider trading could be legally applied to crypto, we wouldn't want it to be because that means the government is still in control. The entire point of crypto is that it governs itself, so the system isn't working if the government can come in and tell us how to operate.

I'd like you to consider the example I actually gave within the OP.

Don't focus on rug pulls (taking money out of the system), focus on the opposite: pumping money into the system on purpose when you know a wave of FOMO is coming. When you load up on debt and set up a long position right before a token moons, and then pay back the loan at the top and crash the price, that person just siphoned everyone's money into their own pocket who bought at the top. Is that illegal? Or is that just "alpha"? The law clearly implies that it's fair game, and I see no reason to contest that. In fact if they use limit orders to sell instead of market orders, theoretically no one loses any money in that moment and the seller is just supplying the demand that they correctly predicted.

Lol, okay in that case I see your point. We are all just speculators in the market anyway and the people pumping money into the market may still end up losing if they are not careful. It's sort of like if everybody is doing it...then no one really is doing it. People might get hurt though but who doesn't in this crypto market...

Are we on the same page?

Regulators allow penny stocks crypto should not be touched penny stocks pink sheets are mostly shit and casiinos guaratee u lose so i choose to ignore any rules on the investor side about accreditation and jsut lie bc i have been for 15 years and every deal now im accfedited but before 20-40% and i was like now i get it why it s blocked lol so if you want in its 506(B) just say yes tey dont verify

One important question we should ask ourselves: if we were in the position to do it, would we do it too?

yes we should bc i get shit for voting are team to fund are selves with are capital and turns out thats how alot of the tokens make moeny lol resumed my activities they hurt no one and everyonewill get a air drop from this to lol

You forgot that to a man armed only with a Hammer, the world looks like a nail.

A very bright man, appears to yield a single tool, with a single vision of the world.

A very sad outcome for a promising life, and career.

I hope for growth in that person to change them into something more matching their full potential.

Posted Using LeoFinance Beta

I still believe the reason they won't approve an ETF is because ETF's are, by law, required to back their "shares" with 100% of the underlying asset. Thus, if ETFs existed it would take that much more Bitcoin out of the markets and lock it in cold storage. This would lead to a very obvious fact: way more Bitcoin is trading hands than actually exists. The short squeeze that could happen would be epic. Like, Bitcoin to $1M epic. With only futures out there, the legacy markets are able to manipulate the paper to control the price. This is what has happened to silver and gold. If there were ever an event that could force delivery of the actual hard asset, the entire world's financial system would blow up. But they won't allow it. Every time gold makes a run, somebody "shorts" a bunch of gold on paper to keep it from making a run. In the meantime, more gold is being pulled from the ground so the supply can eventually offset the upwards pressure, and then some economic event can give them all a chance to get back to zero. In the meantime, mom and pop holding gold get nothing. It's all a scam but it's "too big to fail" because all the big money is in on it.

Posted Using LeoFinance Beta

There's still apparently some pretense that any government agencies aren't simply vectors for crime. I'm really bad at pretending, so I plainly state that every government agency is simply a mechanism that enables criminals to commit more profitable crimes. While I know people at high levels in USG agencies who are not corrupt and am sure there are many others, the administrators of such agencies are appointed because they are corrupt, and are good at discreetly profiting from enabling crime.

So I am informed by folks trying to fulfill the stated purposes of government agencies, whom are frequently prevented and their works completely countered by blatant corruption undertaken by their superiors.

I suffer my gag reflex being triggered by the mere contemplation of the SEC, whose capture long ago has surely enabled the worst kinds of corruption and criminal harm committed against civil society that government agencies are capable of.

The sooner these vile atrocities are consigned to the dustbin of history, the better.

Thanks!

Yep there are a lot of good people in government and whatever,

but the system itself is systemically corrupted to the core.

Doesn't really matter if they have good individuals inside them.

This is the same view as people that say ACAB (all cops are bastards).

Rotten to the core.