Currency Tidal Wave Part 3: The Age of Exponents

Currency Tidal Wave Part 1: Debt and Inflation

Currency Tidal Wave Part 2: The Water Analogy

AKA: crypto fixes this.

After great pains, I have somewhat explained how fractional reserve debt operates and how the economy is a lumbering beast that no one can truly control. I've explained how currency is like water and it flows in a liquid state in a very strange and uncanny manner.

Now it's time to talk about the tidal wave.

- All fiat currency is unsustainable debt.

- All banks don't actually have the money they owe back to citizens and the FED itself.

- All assets in the world can be counterfeit.

- Crypto is not debt; it is owed back to no one.

- Crypto can be created by anyone and is borderless in nature.

- Crypto can not be counterfeit (first asset ever in human history).

- Crypto has no rules but the ones the community gives it.

Most people do not realize how novel cryptocurrency is.

What are Bitcoin maximalists constantly spewing about?

- 21M BTC supply cap.

- Gold 2.0

- Printer go brrrr!

- Five Pillars:

- Open

- Public

- Borderless

- Neutral

- Censorship Resistant

But Maximalists don't talk about how Bitcoin is 'impossible' to counterfeit.

(At least not very often.)

This is a really big deal.

It is a beacon of trust in a sea of lies.

More importantly maximalist don't seem to be talking about is how crypto IS NOT DEBT even though every single piece of fiat is debt. If you have fiat in your pocket you own the debt, meaning that someone eventually needs that debt in order to pay back their own debt. Those who hold USD become an extension of the FED: A lapdog even.

Another concept that is important to understand is this:

What happens when someone defaults on their loan? Hell, what happens when a lot of people default on their loans? Let's take the housing crisis for example. Banks gave out ridiculous loans to people who couldn't afford to pay back the debt. Property was purchased, and the owners of those properties received fiat debt in exchange for their property. This fiat then entered the economic river.

And now, a bunch of people can't pay back the loans to the bank, so what happens? The bank seizes the collateral (the houses) instead of getting paid back. They now have to sell the houses so they can pay back their debt to the fed, but they can't pay back their debt to the fed because the supply of houses has vastly increased and the value of the collateral (houses) has gone down. Now the banks are insolvent.

So what does the fed do?

Rather than force the retail banks to go insolvent and declare bankruptcy, they bail them out. Now the fed owns the banks in one form or another. That's what the fed wanted all along: to own as much as possible. That's what everyone wants. Capitalism.

What many people fail to realize is this: lol what happened to the money? The fiat currency is still IN THE ECONOMY after all these mass defaults. That's actually a good thing. After all that pain and suffering there is now fiat in the economy that isn't owed to anyone, it's just sitting in the river as pure value. That's actually a great thing.

Unfortunately, because central banking is so unsustainable, that pure value will be quickly reallocated to some other debt that needs to be paid back: but the end result is interesting. Defaulted loans allow money to stay in the economy as dwindling collateral changes ownership inside the bear market. This is a very important concept to keep in mind as we try to decipher what's going to happen when crypto goes mainstream.

With crypto, everything gets flipped on its ear.

All of the money and value we are creating here is raw money direct from the source owed back to no one. This is what is meant by "be your own central bank" (among other things). However, when most people hear this term they aren't thinking about how crypto isn't debt, they are thinking about security; How we must secure our own keys so that we own them and no one can take them from us or hack us (like a centralized exchange).

That's all well and good, but the fact that crypto isn't debt and every other piece of money on the planet is, is a huge deal that nobody seems to be talking about. Many people seem to think that crypto is going to destroy fiat (myself included), but we need to think about this more.

How is it possible that crypto could destroy fiat if fiat is a system of debt that requires collateral to print more debt? Crypto is the best collateral in the world by an exponential margin. It keeps going up in value exponentially. That is not a recipe to kill fiat; it's a recipe to empower fiat to unimaginable strength.

How is it possible that crypto could destroy fiat if crypto is open source and ANY entity can use the open source code to build value? CBDC anyone?

How is it possible that crypto could destroy fiat if the foundation of crypto is community? Fiat has the biggest community possible, and that community isn't going away anytime soon.

It becomes obvious that crypto isn't going to kill anything. Crypto is simply going to become bigger than everything, but all the "competition" is also going to gain strength from the coming tidal wave of money that is right off shore.

In the context of the water analogy: central banks are the undrinkable salt water oceans. But in the context of crypto what have we been saying this entire time??? Be YOUR OWN CENTRAL BANK. Meaning we are building an ocean out of a lake. Soon the lake will be as big as the ocean, and all the water will be drinkable. The rivers that flow from this ocean-lake are going to slam into the entire economy: breaking all the dams that the retail banks have set up.

What does that mean?

The dams are regulations. The dams are retail banks picking and choosing who gets a loan and who doesn't. None of that is relevant anymore. I can and have given myself a loan with MakerDAO. Do I now believe that MakerDAO and DAI are hammered dog shit? Yes I do, but DEFI is going to keep upgrading exponentially. All I have to do is wait (or build it myself).

What does it mean though?

Why do I need permission to get a loan if I can just give myself a loan? DAI and HBD have already shown us that we can create stable coins without actually holding any USD whatsoever. We are hijacking the system in the most aggressive way possible, and there's not a god damn thing they can do about it. By the time they even realize how big of a problem it is it will be way way way too late. Hive is already so grizzled that attacking us only makes us stronger in the long-term (just like Bitcoin).

Again, why do I need a loan if I already have hundreds of thousands, if not millions, of "dollars" in the bank? The craziest part? I don't even have to spend those "dollars". Because those dollars aren't dollars, they aren't debt: they are collateral. Meaning I can leverage that collateral into debt without even losing control of the collateral.

This is the system we are approaching, and no one seems to realize how insane it is. I don't need a bank to give me a loan. I AM the bank. This is something that many can not wrap their brains around because it is way too complicated and requires a lot of knowledge of not only how crypto works, but also how fractional reserve banking operates.

Everyone is worried about the bear market.

Bear market? What bear market? BTC crashes 35% exactly and everyone cries bear market? That's literally the exact amount you'd expect Bitcoin to dip during a healthy correction during a mega-bull market runup. Like, Christ Almighty. Grow up. Hedge your bets and balance your positions. You're bad at this. Society has bred a legion of children to be lorded over by debt-slavemasters. Break these damn chains and lets get on with it. I'm waiting.

Back to reality.

- We are living in the Age of Exponents

- Exponential data

- Exponential technology

- Exponential money

- Exponential environmental change

- Exponential extinction

- Exponential evolution.

Evolve: or DIE!

That's the only option we have. Humanity is sprinting full speed at a cliff, and if don't grow us some angel wings and fly away... we're done. Plain and simple. I accept my fate.

Wow, this is getting intense.

So lets tone it back down.

The future is chaos.

Step back to the present.

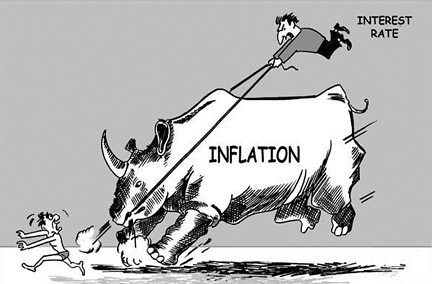

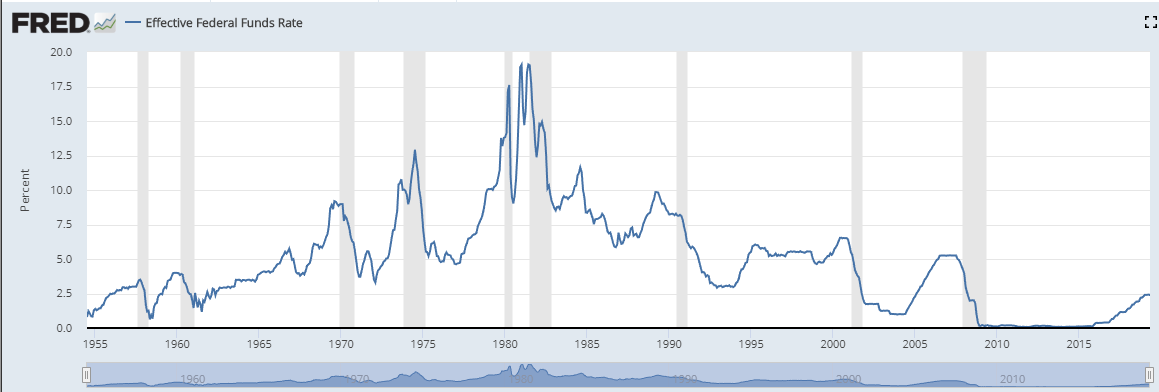

Bear markets happen because central banks are constantly siphoning value into their own pockets. Just look at interest rates in the 1980's. Almost 20 fucking percent? Are you shitting me? That means a retail bank had to charge more than that to turn a profit. Mindblowing. The FED essentially just didn't want anyone borrowing more at that point. They fully stifled the birth of the Internet.

Now it's basically zero because the system is 100% fucked. The central banks sucked all the value of the Internet and technology into their own pockets. They won't be so lucky with crypto, as crypto is money itself; a superior technology that sidesteps central banking given the proper infrastructure.

What happens when crypto becomes bigger than central banking? That's when things get very interesting. Once again we see that crypto is not in competition with anything; it's a permissionless system that everyone benefits from. The title of Andreas Antonopoulos' book is: The Internet of Money. Quite apt, but while he thinks that central banking is going to be 'disrupted' (it will), he doesn't seem to realize that even if 90% of banks die, 10% of them will evolve into something greater. Think Netflix vs Blockbuster vs Torrents.

Yeah, Torrents didn't win, did they?

Decentralization did not win: it simply forced the old system to evolve or die and compete in a way that they had never competed before. Why pirate movies when you can pay $5 a month to have access to content that's x1000 times better than more a more expensive cable TV? The chances that CBDC fails is low, because fiat needs collateral, and crypto makes excellent collateral. This is a disappointing revelation I've just made, but I'll probably be a billionaire by then so fuck it! Everyone wins: the Age of Exponents does not discriminate.

So how will crypto force fiat to compete?

Much in the same way that the Internet forced the entertainment industry to compete. Entertainment became free, and a small battle ensued where the legacy system tried to use the court system to stop it. This was an epic failure where the top 0.01% of offenders were put into prison. My advice? Don't be the top 0.01% that the prison industrial complex is looking at. I'm not looking forward to the day when theycallmedan becomes a trillionaire and then gets thrown into the Gulag.

Luckily the difference between pirating music and movies and pirating money itself is vast. Do you think that the person who "stole" 10,000 songs and was legally obligated to pay $10k per song in court had the money to pay for that fine. Those laws existed to stop corporations and profiteers from generating an income off other people's IP. Then the law's cannons were focus fired on people that had no money. That didn't work, did it?

So this becomes a double edged sword.

The war waged against crypto will be very interesting. There will be a lot of similarities between the war on pirating IP. But there will also be a lot of differences, and the devil is in the details.

Similarities

- Laws that were built to target institutions will be used against individuals.

- People who run a node may be under threat.

- Court fines will be very hard to collect.

- It's an uphill battle that can't be won by the legacy system.

- Only the top offenders will be prosecuted, and they will face harsh penalties because the court will want to make an example of them to incite fear in the rest of us. They will do this because they are on the backfoot and guaranteed to lose the war, but it's not going to be pretty until they pivot and accept the new paradigm.

Differences

- The targets of these lawsuits will be crypto rich and can afford insanely good legal representation.

- However, even if they lose the money will be hard to collect because it's crypto.

- Again, because the targets of these lawsuits are filthy rich they will have a financial incentive to hire lobbyists and bribe politicians to literally change the law in order to protect themselves.

- There will also be many favorable settlements where the targeted party can just pay a fine and get a slap on the wrist (talk about being your own central bank!). Think EOS and Block.One.

- The targets of these lawsuits have the resources and the infrastructure to rebuild community from the ground up and exit the current grid. Many will go into hiding when shit really hits the fan.

Synopsis.

We can see the the biggest and most glaring difference between the war on torrents and the war on crypto is the scale of it all. The stakes are exponentially higher. The war on crypto is a war over money itself; the biggest scale possible. The opposition will hit harder, but the defense will also have a much bigger shield. At the end of it all the legacy system will accept the new paradigm because the new paradigm makes them rich (even if they lose a lot of power along the way).

One final thought.

Remember in part 2 when I said the FED makes it rain, but we aren't allowed to collect the rain water? This rain then flows into the lakes where it only exists via the dam (regulations and retail banks). Well, with crypto, when it rains, we ARE allowed to collect the water. This is aptly called an airdrop, and I'm sure you're all familiar with this term.

Again, this creates a unique situation that most people can't even fathom the outcomes (no one can because the economy is too complex). When people hear "airdrop" they are just thinking, "fucking awesome: free money". But when I hear airdrop I'm thinking, "Holy shit non-debt collateral is just being gifted to people from the sky. This is something we've never seen before. How is that going to affect the economy in the long run?" The answer is: I have no idea, but it will be very interesting.

Conclusion

While everyone is QQing over a fake bear market that never happened, I am playing the long game. Crypto is creating a tidal wave of money, but more importantly that money isn't debt. This is a distinction that 99% of the population will not understand because it requires too much knowledge of how the banking sector operates. Trust me though: crypto not being debt is probably the best thing about it, and no one is talking about this absolutely critical vector.

Crypto is the best form of collateral, and society thrives on these beastly NFTs. Or should I say fractional NFTs? Better collateral means more sustainable debt. The banks are going to be forced to compete for the first time in a hundred years. How exciting! As far as "disruption" is concerned, always remember this: CONVENIENCE TRUMPS EVERYTHING. If it's not convenient then people won't use it. Welcome to mass adoption: where even CBDCs have their part to play. It is what it is.

A new exponential age is upon us. It's not going to be easy, but I prefer a difficult life over a boring one. The risk to reward ratio is this new environment is going to be a thing of legend. Hedge your bets, ladies and gentlemen. This flight is in for some chop.

Back to the real issue. Bitcoin is going to tank hard. Bitcoin is the worst blockchain. Check http://blocktivity.info/ and look how overworked the network is. Bitcoin is at max capacity, it can no longer scale up, the fees are bad, and the network is slow.

--- 2017 @edicted is not very smart.

Yet again

Well, you couldn't have stated that better. People should actually stop thinking about exchange rates against the dollar and just calculate in their beloved crypto. That would really make them their own bank... But I sense a change in the good direction the last few months. Great read!

Your writing has helped me gain some knowledge, great writing.

We'll have to build our way out of this, like ever always before. This is a global cultural turning point.

The laws are so outdated at this point in time and it never really catered to the digital world. We all know its there to benefit the rich and more powerful people to protect their own interests. I am wondering if the US government will target HBD if it grows big enough.

Posted Using LeoFinance Beta

What are they going to do? It is not backed by any corporation or company. Circle and Tether all have entities behind them.

Who is the CEO behind HBD? What is the company name? How is it created?

None of that is done by any individual, either person or company.

You, I, or anyone else can create HBD if we want. Simply buy HIVE and convert it. That is the epitome of community driven and decentralized. Nobody is in control of the supply.

Posted Using LeoFinance Beta

I think they might target it off the exchanges. If so, would this affect people's belief in the stablecoin? I guess we could always get $1 worth of HIVE back.

Posted Using LeoFinance Beta

Bitcoin is impossible to counterfeit but an unlimited number of forks can be made. This too is an inflation of a sort. As more and more cryptos compete for a limited number of other assets, whether fiat or other goods and services, their value is likely to go down (on average). Investment in crypto has thus far kept up with the supply but i doubt that will be the case forever.

Yes it is and something that, have you noticed is not mentioned often in cryptocurrency circles outside the Bitcoin Maximalists. How come unlimited printing by the central banks leads to hyper-inflation yet unlimited money printing in crypto will not? Actually, as the previous articles point out, USD is not printed or just created out of thin air. Instead, it is the union of lender and borrower which means it has more safeguards in that respect than crypto. Yet it is only fiat that is inflationary.

This is not likely in the digital age. How many NFTs are going to be created over the next two years? How many games with skins, weapons, fuel, and whatever else is pertinent to those games will people spend money on.

We are moving into a near infinite age with digitization. That offsets a lot of the traditional beliefs people had.

Posted Using LeoFinance Beta

In theory, this sounds correct.

In reality, what you are saying is that there is a cap on how much value humanity can create.

You are saying there is a cap on technology.

You are essentially saying that at some point humans are going to know everything and do everything.

Clearly, all these assumptions are false.

As long as we build up more collateral and tech the value we can create is infinite.

There is zero cap to the upside.

Except that value can never be entirely dictated by digital assets or tech. The worth of something used as a currency is ultimately determined by how much of it there is chasing limited, mostly physical, goods and services. Creating infinite digital items just drives their value infinitely downward relative to physical goods and services since they are by their nature more scarce. At the end of the day I need to pay for a place to live, transportation, food, gas, power, water, etc. and whatever other physical assets I want or need. While technology drives the cost of these things down (in theory, when there isn't a monopoly) over time, it isn't happening and can't happen as fast as new crypto can be created. Infinite crypto can't buy me infinite food though perhaps it could buy infinite song downloads or infinite games or infinite information. That says something about the value of digital assets vs. physical ones but both impact overall value. You can't just ignore physical limitations.

https://twitter.com/daomoirai/status/1471223562954592265

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

lol...you sir are a complex person

JK I was thinking yay free money the whole time

I'm just waiting for the mothership to pick me back up so I can tell them what I've learned.

A couple things to this:

The Fed actually pays the commercial banks interest, not the other way around. When the Fed takes some bonds off the balance sheet of, say, Bank of America, it replaces with a reserve. That asset (to BAC)/note (to the Fed) carries an interest rate (I believe it is 1%).

The bailouts the banks needed 15 years ago can, not from fractional reserve banking but, rather, their investment banking. They overleveraged to the point it blew any sensible risk models out of the water. Thank Phil Gramm for killing the Glass-Steagall that basically combined retail and investment banking.

When banks over lend, that is how the money supply contracts. Dollars are created when commercial banks lend and the reverse happens when people pay back loans. Of course, defaults only accelerate the process causing write downs of bad debts if they are still holding (which most sell off).

Posted Using LeoFinance Beta

Isn't this non-standard quantitative easing?

Funny how I say that the banks haven't developed anything in years.

They seems to be developing options... just not for retail.

The real development takes (took) place in the Eurodollar markets. That is where the true technology is. They had ledger based banking for 70 years, a reason why I am certain crypto will succeed. They operated bottom-up and designed complex systems outside the scope of central banks.

It is also why international bankers ran (run) the world. You will like one of my future articles, making money to make money.

What is really amazing is how far out of touch the Fed has been for the last 50 years and they know it. That is why they push the management of expectation policy because they know people swallow it up.

Dont fight the Fed!!!

The real money on Wall Street is using the Fed as the contrarian indicator. It seems they always get the opposite results from what they are saying publicly.

Posted Using LeoFinance Beta

No seriously though you were talking about QE right?

🤑

Yeah when the FED issued a warning that the economy might collapse I was like...

isn't that like... really bullish in the short term? lol

Yes that is the essence of QE which is going to be eternal in my opinion. Japan is engaged in perpetual QE and the ECB is not far behind.

The Fed foolishly believes it can stop. How many rate hikes will it do before the world realizes the mistake the Fed made in today's announcement?

They might not make it to the first one, but if they do, I doubt we see two. The data is not looking good.

Posted Using LeoFinance Beta

GM!

In the end, everything is short term voice. Sure I make my short-term plays, but in the end, only one thing matters.

Will it stay in 10 years?

Will it grow the next 10 years?

Will people use it?

If yes, why worry.

Sure I don't agree with the bitcoin maximalism, because I think at the end of the day I don't use a win 95 computer today, Bitcoin is that to me. Sure it gives more freedom compared to swift.

For me:

Utility matters.

Like Mc Donalds. Will it stay tomorrow? Will people eat that sh*t?

Yes?

Good hold.

I think crypto will not replace fiat anytime soon. But it will be an alternative money.

Like foreign currency.