Crypto is heading toward a spring-loaded bull market.

My prediction over the last month is that Bitcoin would dip to support at $20k and then spike to $25k before crashing. I also predicted that these moves would continue to move with the weird 2-week moon cycles that we are seeing.

My $5k range ($20k-$25k) ended up being correct, but support was $19k and the local top was $24k. Now we are back at $22k. The new moon is coming on the 28th, and the FED meeting is coming on the 27th. We have a few more days left of potentially bullish action but... we also have to expect people are going to insider trade the FED meeting as well as has often been the case with these things.

None of that matters long-term.

Crypto is actually spring loaded and ready to spike up aggressively at any moment. My guess is that we only have one more dip to go before we've hit rock bottom and can only go up from there. The FED thinks they can get away with raising interest rates again... and they certainly can, but they can't get away with raising rates twice in a row. I expect the CPI data and the combination of other factors is going to lead them down the wrong path of raising rates again soon.

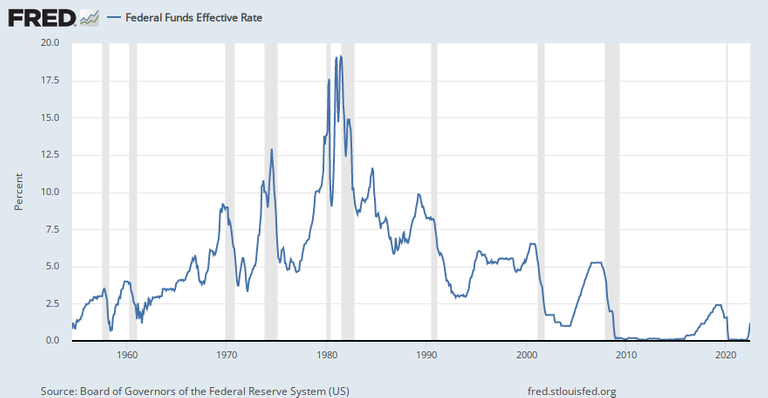

When this happens, the economy is not going to be able to handle it. The FED is going to raise rates again and the economy is going to start imploding from the pressure. To be fair the FED is out of options. The economy (central banking) is a pyramid scheme that's been operational for a hundred years now. We can see from the interest rates chart that they have zero buffer left to create any kind of "soft-landing".

Wow, the 1980's though

Right around the time I was born the economy was peaking. Everyone was making money (most of all the banks). The birth of the personal computer and the internet fueled the scam known as central banking. Central banks sucked a lot of the technological gains away from that era. It will not happen again. Money is the new technology.

But also we can see that it used to be sustainable to have like a 10% interest rate. Now when things get bad it just goes straight to zero. There's simply no buffer left. There's nothing the FED can do really at this point. Everything is pretty jacked up. Which leads me to my next point:

Risk-on; Risk-off

Crypto is seen as a "risk-on" "investment". Crypto is neither risk-on, nor an investment. This is where we see problems come in. This is when perception can temporarily become reality. Sooner or later reality kicks in though... like a ton of bricks.

Crypto is the solution to almost all the world's problems at this point (at least the biggest ones). It is a silver bullet. Putting our value into the solution to the problem is not a risk-on investment. It's the only reasonable thing to do. Crypto is a way of life. Those of us who have been around for a couple of years know this very well.

Imagine calling cars a "risk-on" asset "horse hedge", or calling the Internet a "place where people do email". Like, people do not understand new technology, but we do. We know better.

We know crypto is not an investment (unless the investment is freedom from tyranny and debt slavery). An emergent cooperative economy is not an investment. It's not high risk. It is the future.

The problem comes when people get greedy and overextend themselves. Rather than put in $1000 and become a millionaire in ten years, users put their entire net worth in thinking they are going to be a millionaire in a couple months. Yeah, that's ridiculous and stupid. Crypto will ALWAYS net a positive return after 5 years. We need to think on longer timelines and be patient.

Market slightly dips on Tesla's BTC dump declaration.

Funny how emotional the market is. Tesla sells a billion dollars worth of Bitcoin and everyone flips out? That's BULLISH. That money was a liability. Telsa sold at an average price of $28k. Now we have the opportunity to buy at $20k and everyone is mad about it? You can only be mad about it if you were grossly overextended and are trying to extract value from the community. Stop being greedy. It's not hard (it is).

Doubling curve trendline will be at $50k EOY.

2022 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $27733 | $29867 | $32,000 | $34133 | $36267 | $38400 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $40533 | $42667 | $44800 | $46933 | $49067 | $51200 |

Imagine what happens if Bitcoin spikes back up to the doubling curve by the end of the year. People are going to call that "an epic bull run". Bro, that's not a bull run, that's par for the course. That's the same boring trendline we've been on this entire time. We just had to get past a legacy recession first.

Crypto moves faster.

By the time the current recession we are in is bottoming out, crypto will be spiking up. The "correlation" between crypto and the stock market has never been higher than it is right now. Both are bleeding at the same time. However, we can already see the history of the correlation, and it can change on a dime. The fact that the correlation is very strong right now only signals to me that we are going to get a snapback flip at any moment. Such is the nature of crypto volatility. Just when it looks predictable it becomes completely unpredictable.

Conclusion

Even though crypto is very volatile, it is much more robust than these legacy systems built on a house of cards. The second the FED is forced to reverse course because everything is crumbling around them... well that's when we get an automatic spring loaded bull market. By the time that mainstream media admits that we are inside a brutal recession, crypto will already be spiking up and negatively correlated to stocks (or perhaps even zero correlation).

Bitcoin is massively oversold. It's not a risk-on asset. It is the future. The world is waking up to this fact quite quickly. All we need now is fiscal policy to loosen so that this spring-loaded market can bounce to the moon. Will we have to suffer another dip to $18k (or maybe even $15k?) The chance is high. Who cares? We're playing the long-game here.

Don't fight the FED.

Wait for the economy to implode before going all in.

Posted Using LeoFinance Beta

I really like your assessment at the last line.

If you turn the market right you can buy it back for pennies on the dollar.

The rothschilds used insider information to buy up England for pennies on the dollar.

Absolutely we really hope so!!!! It's going to be an amazing day.

Just keep accumulating more crypto.

i like it but im not sure you see the elephant in the room. Normal people are skint, they cannot afford to eat or heat the home, let alone invest money. Everyone is risk off in this situation, exactly why Elon dumped. Smart money are like sharks they know when money is going to come in and excitement will come. Personally im not expecting any kind of big moves in any direction.

Valid points, there don't seem to be any dust in plenty anywhere to invest, there's quite a lot happening right now

Crypto benefits people that don't invest in it.

Maybe I should do a post on this.

It's too long of an explanation to put in a comment.

only if fomo and greed.

in the short to midd term its more about surviving for the avg.

Maybe currency collapse and crypto go to super moon. But we would be not happy about that too :D

Exactly the game for an investor now is to try and not lose as much as possible.

protection :) and take some opportunities.

More panic more dump. Macro around the world becomes terrible at end of the year.

Europe will face energy and maybe some currency crisis.

Inflation is sky high.

And rate increases add additional pressure :D

I'm not expecting any sharp moves in either direction, either. Most investors realize Bitcoin is quite oversold at the moment and will not want to part from it unless forced to. On the other hand, there is not much loose change sloshing about right now.

It is time to build and accumulate.

i usually use the ball hitting the ocean analogy, at 20k we are kinda under the water and it may gravitate back to 30k and sit on the water before it starts to inflate with helium again. May do but excitement has gone away and people are scared. What happened to Luna will stick in peoples minds for a long-time yet. Crypto has and always will be sort of binary.

There is no way to calculate the value of these protocols and thus the token values. Hence, the token valuations are speculative. Market psychology.

I trade using mainly psychology. :)

I can not agree more on this one. Personally, I believe we will be grinding between $20k and $30k for the rest of the year. Not expecting much to happen in 2023 either. The real deal shall once again near the halving.

I don't understand why the halving would matter anymore.

Over 90% of all Bitcoin that will ever be minted... already has been.

Cutting inflation in half isn't going to make that big a difference.

Miners no longer control the market.

This is a singularly important and new thought, although I suspect you have written about it before?

It makes sense once you read it.

We can move on from the halvings being huge moves, except they may affect peoples psychology, and that may effect their behavior and the market...?

But knowing that 90% of all the Bitcoin that's been minted, has been minted, really makes you step back and say Hmmm... that's really not a thing anymore, we need to focus our thoughts on things which matter numerically, and this isn't one of them.

Posted Using LeoFinance Beta

Maybe it won't matter as much mathematically as before, particularly because miners can raise capital from sources other than selling their coins. But sentiment-wise the halvenings will still matter for quite some time.

Though wave counting is very challenging, I also see the same pattern evolving. I am waiting for that last leg, the 5th wave of Intermediate Wave C to complete Primary Wave 2. Once done, I am anticipating the resumption of the bull market that started in 2017.

Source

Posted Using LeoFinance Beta

Great thoughts here. Can we say an investment for the future?

Posted Using LeoFinance Beta

I want lower! 15k please so I can get more bitcoin lol.

Posted Using LeoFinance Beta

I believe we will break the $17,800 low of last month. The liquidity suck is real and we need at least one more dip to a new bottom.

Given the state of the economy this sounds correct.

However, given the state of Bitcoin it doesn't make a ton of sense.

All the biggest longs have already been liquidated.

Over a dozen exchanges insolvent.

Multiple stable coins crashed to zero.

These things already happened.

It's very likely we won't/can't make a new bottom.

We shall see, I believe not all the damage is oit on open yet. When rates are higher and stock market and economy crash I believe more damage will be shown in our space. Mainly De-Fi I believe will have problems but I assume we’ll see everything lower.for a time anyway. Bit eventually the good stuff finds a bottom even in a total economic breakdown

this is just a rally towards $27k lol,a further downward move is excpected.

I'm not satoshi though (lol) but btc should kiss $6k before a V shaped recovery.all fingers crossed till the next bitcoin halving 2024.

Definitely, we all hope something good comes out after this long bearish we have experience, but base on my view and according to stat this morning, it might still take a while before it finally regain it strength, but of all the bear won't last forever

Posted Using LeoFinance Beta

Dude with all due respect I think you are too optimistic about Bitcoin, its OUTDATED technology. Your analysis could be right about the best cryptocurrencies: HEX HEDRON ICOSA PULSE PULSEX and so on... but Bitcoin? Its probably at the top of its S-curve... its buggy outdated technology!!

See my comment is gold, but a ballhead ruined my hive account, please upvote so this REAL TRUE GOLD INFORMATION is shown probably at hive, more similar info here:

....i am waiting. :)

Time will tell. We shall see where this goes soon(tm). No doubt this is hopefully a new and better way for our suffering humanity. Something has to give!

Posted Using LeoFinance Beta