Bull Market or Greatest Depression?

Hive is undergoing a massive trend reversal.

This trend reversal is happening on Bitcoin and even the stock market as well, which is pretty surprising considering the current economic situation. Bears are in disbelief.

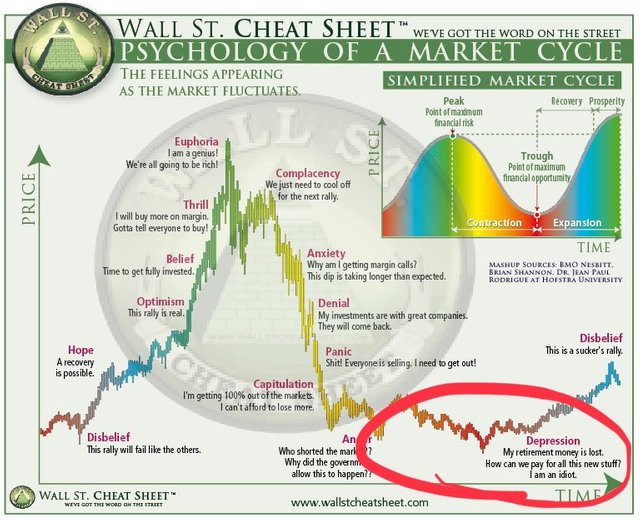

It is quite obvious that the FTX collapse was the ultimate 'anger' moment.

Even though BTC only crashed 24%, everyone and their mothers were absolutely furious and totally irrational. Pseudo legal "experts" were popping up on the scene to tell us that given the "evidence" that Sam-Bankman Fried deserved three consecutive life sentences. Seriously does that sound reasonable to anyone? He's just some dumb kid that flew too close to the sun. You would have done the same. Most people are Bronze League Heroes. That's the standard.

That situation was so grossly misrepresented in so many ways. It's still being reported that he intentionally defrauded the people and even the government. It's pretty obvious that's not how it went down, but this post isn't about FTX or SBF... so.

The point is that the most clear signal we've ever seen for 'anger' (potentially ever given all bear markets) was November 9th, 2022. Now all the bears see the current "bull trap" and are still somehow convinced that we are going to crater back down to $12k. The bears are delusional. We completely skipped the "depression" phase and moved straight into "Disbelief", as is often the case. It's actually ironic because the bears point to "depression" like it's a given, but this is actually just even more signal that we are in the "disbelief" phase of the cycle.

I would challenge anyone who reads this assessment to show me on the Bitcoin chart where 'depression' is. Bitcoin bear markets have NEVER like the Wall Street "cheat sheet". Never. Ever. Liquidity in crypto is thin, and the low is always made immediately during the anger phase. It happened in 2014, 2018, and 2022. There are no exceptions.

2014

ALL

We can see that never in the history of ever has the price of the market moved in the way that bears are currently deluding themselves into thinking it will. Combine this with the fact that all Bitcoin bear markets pretty much last exactly 12 months and the spot price is still wildly oversold under the doubling curve ($55k) and it's not hard to see that even though the economy is shit that doesn't magically mean we are going to make a new low. Markets are irrational... and even if they weren't it would still be smart to buy Bitcoin in this environment. The system is failing, and crypto is the answer.

Threats of recession

We've already been in a recession for over a year. Average bear markets (stock market) last 18 months. The current administration refuses to accept that that we are in a recession because their approval rating is abysmal and the current situation is largely their fault. Ignoring these inevitable dead-ends, the threat of another Great Depression is highly unlikely. I used to write blogs about how the GREATEST DEPRESSION was coming. But honestly we have to think about it logically... how would that be possible?

The Great Depression happened long before the Internet existed, and shortly after the Federal Reserve came into existence (what a surprise). Since then technology has accelerated out of control at a rate that leaves those from The Greatest generation in shock and awe. Old people are completely bedazzled by new technology and business models popping up. Just ask Charlie Munger.

When money can be printed on demand and thrown at any problem under the fractional reserve system... the systemic risk of the Greatest Depression goes down, but such events keep chipping away at any ability for the population to thrive and have the life that they want.

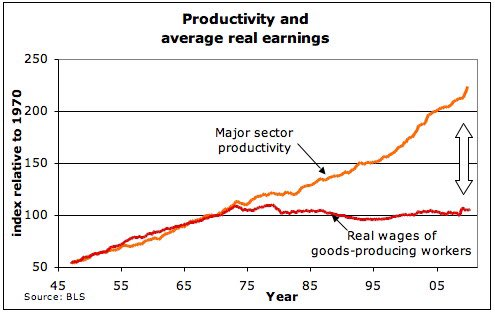

Central banking combined with the fractional reserve system have been siphoning the gains of technology since the inception of the Internet. We can see this on the charts of wealth generation vs the average wage for workers.

The divergence here is staggering and obvious.

We can see that right around the birth of computing and the Internet that pretty much all of the exponential gains of technology have been syphoned into the pockets of the elite and their cronies. Instead of sharing with the middle class and building a Utopia: greed did what it always does. We can count on that. This is why we can't have nice things.

However, the very important thing to derive from this information is that a GREATEST DEPRESSION is not possible. Why? Because a GREATEST DEPRESSION is bad for everyone, including the elite. They know it would be better to simply dial back the siphon a bit rather than blow up the entire economy and leave everyone fucked. There's no point in lording over an Empire of Dirt. But don't worry about them... because that UBI they give you is going to come with infinite surveillance and a social credit score to boot. They'll be just fine.

When the Great Depression happened, there was no such buffer. Once too much value had been siphoned out of the economy by the elite everything crumbled and there was very little that could be done about it. This is simply not the situation we find ourselves in today.

https://twitter.com/CryptoCapo_/status/1593904655867658241

https://twitter.com/CryptoCapo_/status/1615369824204427267

https://twitter.com/CryptoCapo_/status/1619620361678770176

https://twitter.com/CryptoCapo_/status/1626143941853675521

Okay well he shorted TRX so at least everyone on Hive can respect that.

This Capo character has become the laughing stock of crypto Twitter

People can't get enough of making fun of this guy as clear and obvious trend reversals kick in exactly during the time in the 4-year cycle that we would expect them to kick in. Such a punching bag. Too easy. This is why you don't short assets that move up exponentially over time. Shorting crypto will always be an uphill battle that should only be done during the proper bear-market year. That year has passed. These people are going to get wrecked.

Conclusion

Bears are in disbelief, even though Bitcoins 4-year cycle has yet to fail us. 3 years on, 1 year off. Over and over again, Bitcoin's 4 year cycle continues. And yet there are still bears who think they can get the upper hand by continuing to short even after 12 months of bear market. Why? Because the legacy economy looks like it's in trouble. Is that really a reason to be bearish on crypto? Isn't the entire point of crypto to eventually replace the broken system?

Crypto is both technology and money at the same time, and it is absolutely flabbergasting the establishment at this point. They no longer have the ability to siphon the exponential gains of technology using archaic forms of currency, because cryptocurrency is currency and will not bow to lesser forms of money.

That doesn't stop the elite from trying to classify it as anything but currency. It must be property! It must be a commodity! It must be a security! It must be anything but currency, because if it was legally currency they'd completely lose their grip on their ability to control money. They can slow down this process to a crawl, as we have seen, but they can't stop it from happening. It's only a matter of time.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

It's brutal that we're all so productive now that 1 in 1000 can produce enough to keep the other 999 comfortable... but instead we're all fine with a system that just keeps sending all that value right to the top.

I disagree with SBF just being a dumb kid, he used his customers funds to gamble. That's not accidental.

More accurately stated: It's not... not on purpose.

Co-mingling assets is something that is done all the time.

The bear market became a slippery slope in which he was forced to double down and triple down in an attempt to stay above water.

Not not on-purpose is different than on-purpose.

SBF obviously didn't go into the business thinking he was going to defraud investors.

It very clearly happened much more organically than that.

It's the difference between first-degree and second-degree murder.

One has intent and one does not.

There was no intent here; more of a crime of "passion" and "in the moment".

I think that's pretty safe to say: but it's being reported as a first-degree crime.

It's not.

I think it's really hard to know what anyone's intentions are... but while I can agree it might not have been on purpose, the FTX Terms of Service stated that the funds wouldn't be co-mingled... so at the very least it was criminally reckless.

Customers assets shouldn't be co-mingled, especially if you specifically state that they won't be.

Yep 100%

It's such an easy concept that so many who run custodians just can't help themselves.

Trusted entities co-mingle assets all the time.

I know someone who's doing it right now.

It's fine until it spirals out of control because the wrong assets were shorted.

This is the main reason why i agree that we will not see a "great depression" again.

BUT!!!

I do not know what to call what we are going into.

For many it will be the greatest depression.

For others it will be the greatest time of inventions and freedom

On one front you will see people standing in line for food and worrying about their credit scores.

On another we will see personal food production flourish with the help of robotics and new planting methods that grow 3x as much with 10% of the time.

We will see Tesla cars die and people trying to nurse along old ICE cars to continue to go to work...

and we will see people working remotely and enjoying flying cars.

We will see the end of govern-cement socialism/communism

and the end of crony-capitalism.

We may also see the end of capitalism. (as in having to gather capital)

And what comes next is probably something, not even futurist authors have written about.

Maybe, "And Then There Were None" by Eric Frank Russel

Ah yes...

The Age of Dichotomy.

Hm

whatever the case may be, it will always be wise to buy a great investment like bitcoin...

And even if the great depression is upon us, will it last forever?

Crypto has come to stay and it will take a lot for it to fully bloom but as at now I feel it isn't doing badly at all

Lol someone was expecting BTC at 5k even, I can't imagine the huge disappointment that will be not to be able to see it at 15k. I told him "keep waiting", poor guy.

Good one!

Thank you for sharing your perspective, @edicted. Regarding the possibility of a Great Depression happening, it's crucial to note that there are key differences between the current economic climate and the factors that led to the Great Depression. The global economy is much more interconnected and diverse now, with advanced technology and a range of tools available to mitigate risk. Ill also like to think that policymakers are more experienced and equipped to respond to economic shocks, so if at all we are perceiving of such I feel it must be purposely orchestrated.

Posted Using LeoFinance Beta

Shorting in Uptrend is worst way inviting depression.. !LOL

Capo and bears in disbelief is giving bulls more confidence... Tho, I see there's politics going on SEC crackdowns coming from US is more like trying to trigger and pullback to Low meanwhile china ain't coming slow.

Weak hands are giving to strong hands and later they'll jump in the end.. holding tightly as all possibilities are indicating upside.

lolztoken.com

But CAT scan.

Credit: marshmellowman

@edicted, I sent you an $LOLZ on behalf of @idksamad78699

(2/2)

Posted Using LeoFinance Beta

I think we are still in depression, we probably have another dump after testing 30k but at this point we really closer to the bottom than the top, ppl still want 10k BTC but I dont think thats going to happen so if it stays over 20k - 19k at least for the next three months, i think it will, then bear market is over, thx for sharing ✌️

Crypto doing what crypto does

Tik tok! ...this is a very exciting wave to ride. Look at us go!! All i know, is Go Hive!! :)

Posted Using LeoFinance Beta

Good to know that we are seeing the market slowly grow. I hope the bears don't end up swallowing the market as they intended to do. Times are not exactly awesome but they are definitely better than before.

No doubt most things will include that extra soon 😢

And that's why it was called a threat to national security...

Fake bull run. Maybe fomo cuz of BTC halving in March 👀.

I'm certain that the Greatest Depression would occur regardless of what actual numbers tell or whether living standard and economic security is going to be better than 1930s or not. The point is that Millennials and Zoomers are going to experience hardships they were not psychologically prepared for and that would leave lasting traumas incomparable with what Greatest Generation endured and simply brushed aside.

Posted Using LeoFinance Beta

I'm one of the former sky is falling people but I have had to adjust my position over time. If the whole fragile economy leading to greatest depression thing didn't develop because of lockdowns then it's not all that fragile, is it? The x factor here is the exponential growth in technology I think. Whatever stupid things the government and the banking system are doing that would normally result in economic devastation is being outpaced by the economic growth being spawned by these new technologies. The old building airplanes faster than they can be shot down thing that happened in WWII. I remember having this hypothesis back in late 2009 and then promptly forgot about it after reading some books. Books by doomers who seemed pretty smart because they predicted the real estate crash, but turned out to be broken clocks that were never right since. I missed out on the first half of the longest bull market in history because I listened to them instead of what turned out to be a pretty prescient thought about the future. Getting into Bitcoin and crypto is the only thing that salvaged that for me. My own prediction came true, right down to the rough timing of the final pullback, the lack of a deep recession when it did, and the levels at which it did (it overshot a little at the end there due to the stimulus). Sometimes I'm afraid I'm going through the old "this time is different" psychological trap right now too but as you said, the timing on things is just not right for further economic collapse. The bear market cycle is drawing to a close if these patterns repeat, which they usually do. It would have been much worse, much sooner if we were going to have a really bad economic collapse.

Evidence for the exponential growth in technology:

I can't even keep track of the new things coming out even in the few disciplines I'm either a professional expert in or an advanced hobbyist in let alone the rest of the world. Hell, I can't even keep track of the new developments in Hive.

Also, I'm learning about things and doing things at a level that I never thought possible. I've recently gotten into web development, crypto mining, precision milling and lathe machine work, fabrication, more advanced auto repair and modifications using computers and I've got a half dozen other things on the back burner because I'm trying to focus on building a business right now. The amount I've learned about that subject alone, building an e-commerce business with my own website, built by me, was been unfathomable to me just 5 years ago. I'm doing things this year that seemed impossible last year even. This experience of mine has all been driven by this technological growth, and most of that happened years ago. It seems like with AI facilitating these new developments the sky will be the limit. It will further accelerate from here.