Reporting Crypto Purchases on Your Tax Form

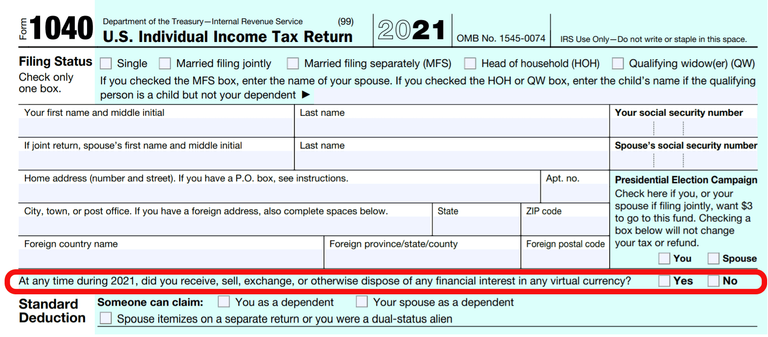

So this season there is a question related to cryptocurrency on the front page of your tax return. If you are one of the millions of Americans who is owning cryptocurrency then you have a key question to answer this tax season.

The question is,

"At any time during 2021, did you receive, sell, exchange or otherwise dispose of any virtual currency?

You can check Yes if you buy or hold crypto but you need to check the box in a situation if you sold, exchanged, mined cryptocurrency or have used it to purchase something, according to IRS.

In case of any activity that has taxes applicable, and one checked No then they may face some penalties, according to experts.

In case of any capital gains from cryptocurrency by exchanging or selling it at a profit, exchaning cryptocurrencies, cashing it out for US Dollars or purchasing something are considered as taxable events, according to Losi.

Now it's also mentioned that if someone is holding crypto for a longer term, like more than an year, then they may qualify for long-term capital gains rates which are 0%, 15% or 20% that depends on the taxable income.

Now I think it would probably be hard for IRS to catch up with the increasing number of crypto users as well as the transactions that happen in a huge numbers on daily basis.

Also the tax collection may also be facing hurdles with limited reporting from the crypto exchanges.

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

https://twitter.com/eddiesun4u/status/1491448621187080192

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.