Daily CUB Report | Amount of HIVE and HBD Wrapped to BSC is Skyrocketing!

The first @cubdaily report went really well yesterday. Exciting to see that there is an appetite for something like this!

For those who don't know, CUB was like the forgotten child of LeoVerse up until recently. The team always said that they were testing and trying to figure out how to build sustainable DeFi with experiments like PolyCUB.

The real innovation was to always happen on CUB but none of us knew wen that would occur.

I think this led many of us to be confused about the future of CUB and uncertain. This led the CUB price into a downward spiral.

Was this the ultimate checkmate chess move by LeoTeam? See my focus of the day below.

MTB liquidity is entering the bridge at a rapid pace. Since I ran this report yesterday, over 12,000 HBD and 7,500 HIVE have been added to the multi-token bridges.

It seems that users are still finding out about the Multi-Token Bridge being live on BSC and adding liquidity to it.

As we see this liquidity grow, we may start to see that escape velocity liquidity that the team keeps mentioning. It remains to be seen but if more than $10k per month in revenue can be generated ($4k was generated last month), then we could see far more CUB being bought and burned by the CUB DAO than is sold by CUB LPs.

Follow along as I report daily on @cubdaily 🙏🏽

Focus of the Day

One thing I always wondered as a long-term investor in CUB was about the LeoTeam's vision for CUB.

It seemed that CUB was forgotten but almost in a strategic way. Did the LeoTeam know that they were going to innovate something like the Multi-Token Bridge and then bring it to CUB?

If they did, it seems like the ultimate chess move.

Look at how the bridge generates revenue and then buys back and burns CUB.

Inflation on CUB is highly predictable. The team could have calculated exactly how much inflation would be seen over the past year. Seeing that the inflation was out of hand in terms of $$, they could have decided that allowing the CUB price to bottom out was a strategic advantage.

How is it an advantage?

Well if they let it bottom out, then build a massive revenue engine in the form of the Multi-Token Bridge, then buyback and burn all of the last year's worth of inflation, then what effect would that have on the CUB price?

Instead of lowering inflation, maybe they lowered the price and then brought in a revenue mechanism that could eat away all previous inflation and start with a fresh slate to tackle new inflation.

I've always believed in the vision of the LeoTeam and I think this might have been exactly what they wanted. It seems like the cards fell into place almost too perfectly.

What remains to be seen is the bridge grow into their "Escape Velocity" liquidity - that is, generate enough revenue per month to burn more CUB than is issued and sold.

By my calculation, we only need to see MTB Liquidity 2x in order to see this happen. Remember that the Bridge generated $4k in revenue last month. If it can generate $8k+ in revenue, I believe we will see that "Escape Velocity" metric hit.

Users are not selling more than $8k in CUB per month. My analysis suggests it is somewhere around $4-5k.

If the MTB generates more than $5k in revenue in September, then we may see the CUB price higher come November. Remember that a Higher CUB price = higher LP rewards and general sentiment which may lead to more MTB Liquidity which thus leads to more burns in subsequent months.

Things are getting interesting for CUB. I'm excited to see what happens and slowly farming / accumulating as it occurs.

CUB Token

- Price: $0.02124

- Total CUB Supply: 17,082,807

- Total CUB Burned: 723,348

- Total Market Cap: $362,520

Multi-Token Bridge Stats

- bHBD-BUSD: $134,703

- bHBD-CUB: $72,485

- bHIVE-CUB: $88,245

- Total: $295,433

CUB Burns

.png)

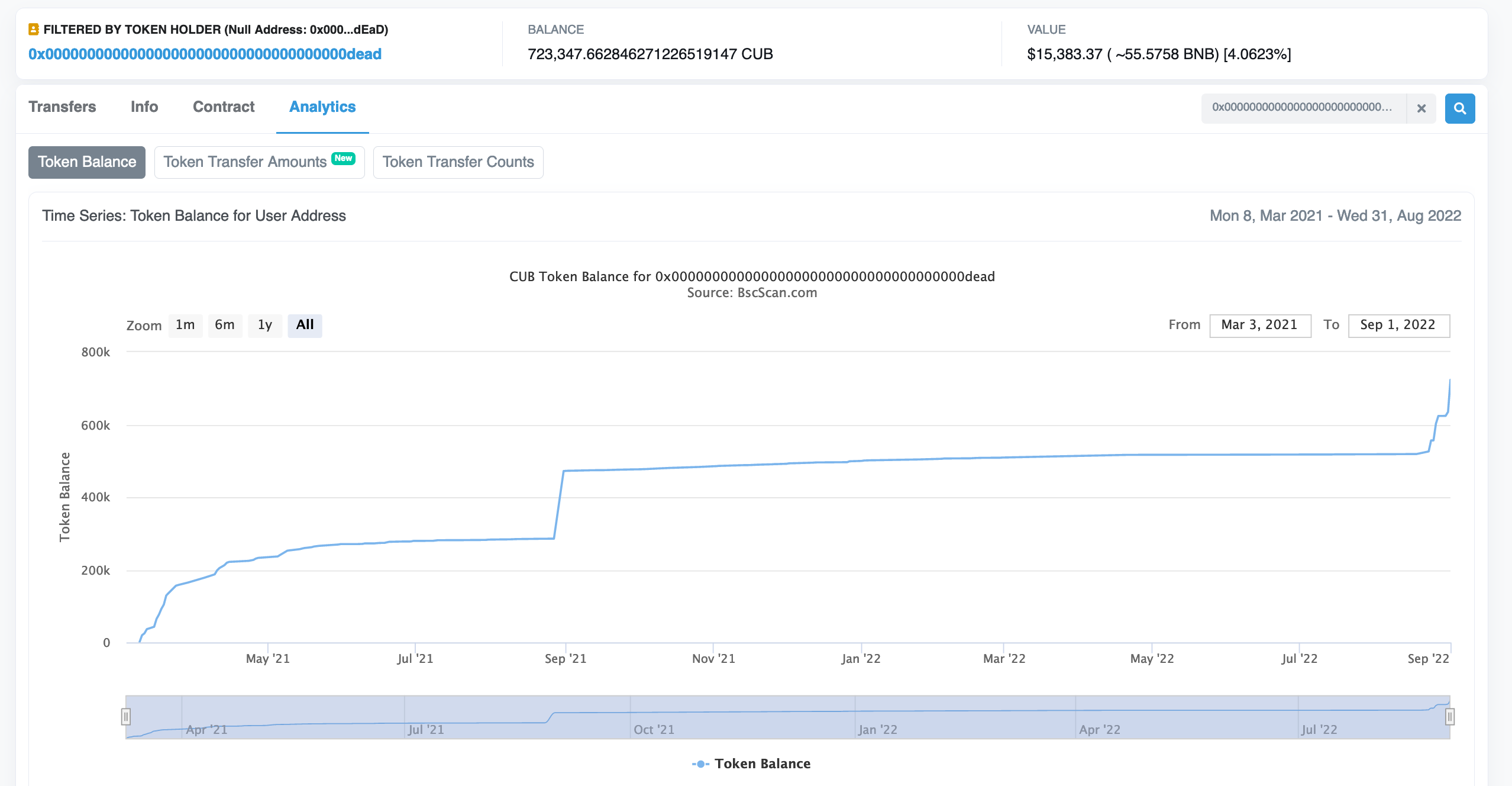

We can see this sharp increase in the amount of CUB burned. The first sharp increase in September 2021 was CUB IDO #1.

The second sharp increase shows even more CUB burned than IDO #1 and this is simply from the Multi-Token Bridge revenue.

We can expect a sharp increase throughout each month from here on out thanks to MTB revenue being greater than $4k per month. If we see it reach $10k+ things could get really crazy.

I'm excited to see 1,000,000 CUB burned. Do you think we could see the additional 280k CUB burned necessary to get a total of 1M? Leave a comment below!

Further Reading:

- Latest Reports From this Account: @cubdaily

- Latest CUB Burn Report From the LeoTeam: https://leofinance.io/@leofinance/cub-s-first-monthly-burn-report-or-august-2022-204k-cub-bought-and-burned-50-yield-on-hbd

About CubDaily

I'll be using this account to report on the CUB stats each and every morning. Together we'll track the growth of CUB under the completely revamped ecosystem that LeoTeam has built called the Multi-Token Bridge.

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

It is very likely, looking at the current statistics, that in the next month we will burn another 300k CUBs. 1 million CUB burned may not yet be enough to move the price, but the direction is undoubtedly correct! What will happen in the coming months? Bullish!

We should all remember that the $4000 of revenue wasnt even a full months worth as I think it new mtb was release mid month or something.

I remember the team noting in the monthly report that the mtb revenue was only a partial months worth so this month could be quite a shocking amount

Posted using LeoFinance Mobile

Congratulations @cubdaily! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 300 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!