Bulls are coming!

"Wall Street Bull Behind Bars - Illustration" by DonkeyHotey is licensed under CC BY 2.0

"Wall Street Bull Behind Bars - Illustration" by DonkeyHotey is licensed under CC BY 2.0

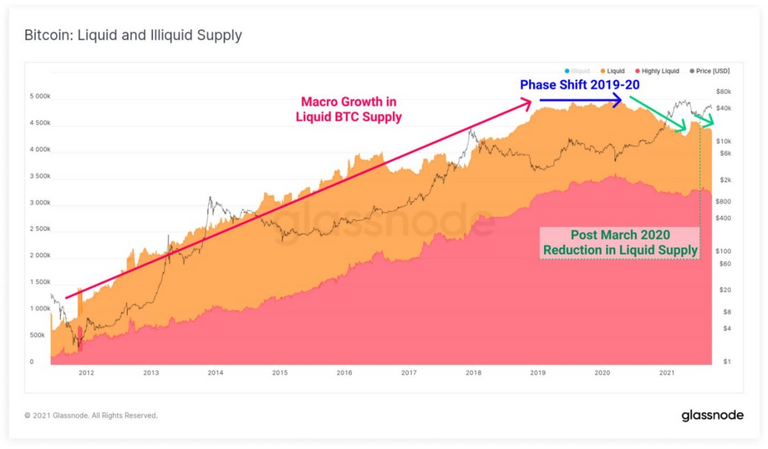

This week's Glassnode metrics show us how spot investors (who trade cryptos and not their derivatives) have reacted to volatility in the derivatives markets, showing that the long-term accumulation trend remains intact. I have waited a few days to better analyze the market trend, which is upward starting this weekend.

In summary, nobody dreams of selling, even in front of sporadic price drops!

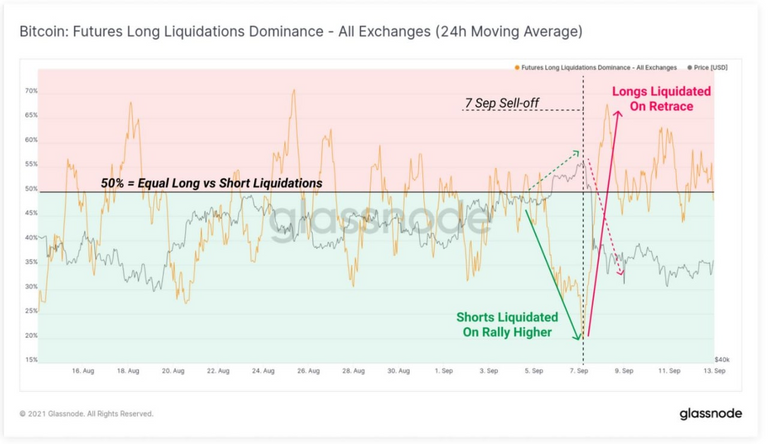

First of all Glassnode shows that in derivatives, before the sell-off of last week, there was a short squeeze that brought the price of btc in some exchanges up to 52,000 dollars.

Immediately thereafter, there was a wave of selling of long positions that dropped the price by about $10,000. These were purely speculative movements.

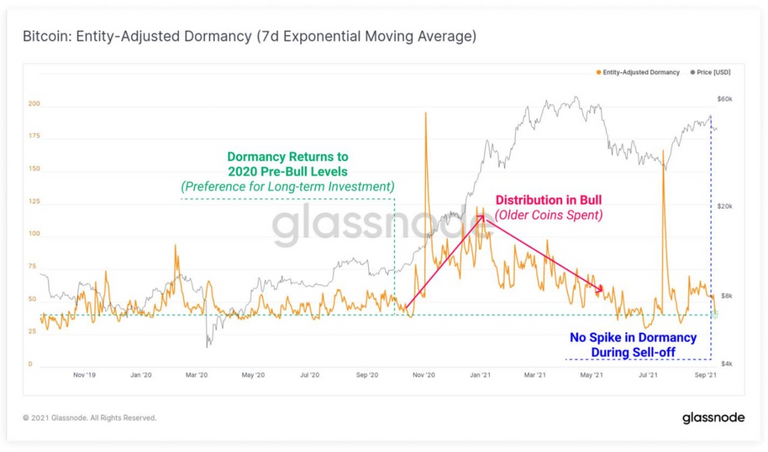

During the sell-off (vertical blue dotted line) there was no increase in "older" coins sold. On the contrary, the age of the moving coins dropped further, reaching the level before the 2020 bull market.

This indicates a strong trend of not selling coins and a firm long-term view. As we will see in the next charts.

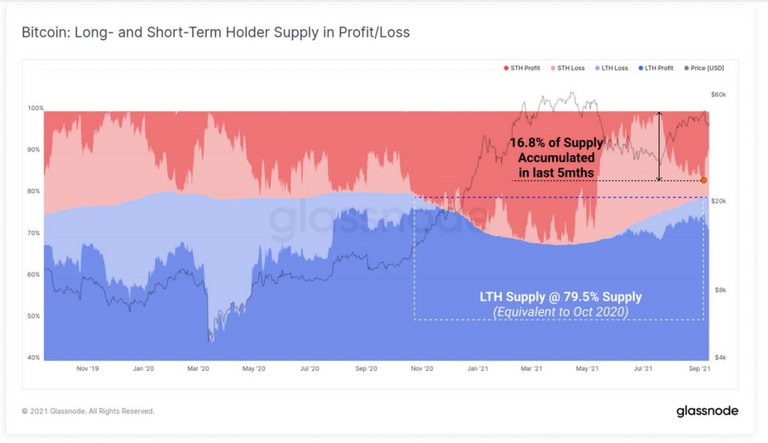

The level of coins held on long-term deposit has reached 79.5% of all available bitcoins. That's about the same value recorded in October 2020, before that year's blull market. And it's also high on a "historical" level, meaning the amount of coins held long-term, at 12.97 million, is the highest ever.

Spikes in the amount of coins held long term can cause liquidity "crises" that trigger bullish cycles. That's why they are usually present between the final stages of bear markets and the initial stages of bull markets.

What makes this phase of the market really unique is the fact that there is a quantity of btc purchased at prices much higher than the current ones (between 50 and 64 thousand dollars) that has never been sold in any of the episodes of price drops.

The volume of the ratio of long term to short term holders has always remained positive (the dividing line between the blue-blue and reddish fields has never collapsed, as happened for example in March 2020 on the left of the graph), but remains in balance.

This indicates that investors have an unshakable confidence that prices can rise much higher than the highs reached in April. So they don't create any "panic selling" phenomena and are quietly holding their coins.

In fact, the availability of liquid coins (i.e., present in the exchanges) has already returned to pre-2020 bull market levels.

If it were not for the inconclusive turns of the derivatives market, this situation would already be reflected in the price. In any case, it helps keep prices from crashing during these sell-offs.

Conclusion

I think one of the reasons for this "confidence in the future" is that, as we saw last week, much of the trading in this cycle is done by large institutional investors, who have a much less pronounced reactivity, compared to ordinary traders.

This is another confirmation of what I have argued in my previous posts, that is that institutional investors are holding up prices in this phase, which we cannot define neither bear market nor classic bull market.

In conclusion, abstracting from the background noise of derivatives, the situation remains the same as in the past weeks. On the contrary, it is becoming more and more mature, as the ever lower levels of liquidity are now very similar to those preceding new upward cycles.

Thanks for reading, feel free to write me your comments on this analysis, a welcome moment to exchange ideas and opinions.

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points, by @cryptomaster5.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more