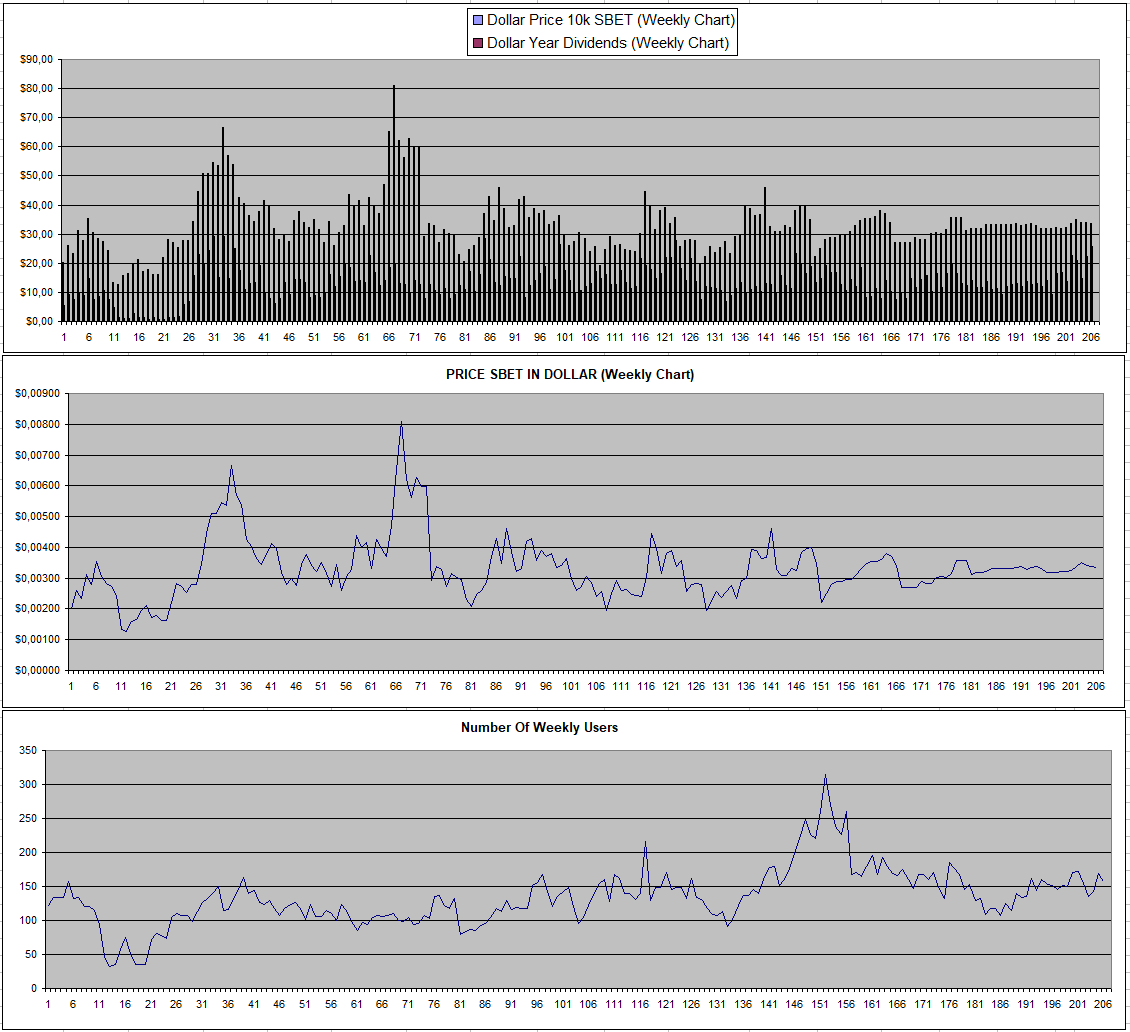

GambleFi Portfolio | SBET +77% APY Currently!

Slowly but surely the overall dividends from this portfolio are on the rise with mainly SBET which is my biggest bag doing really well last week sitting at 77% APY.

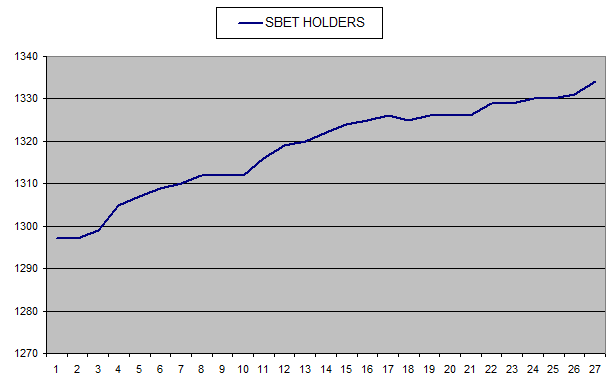

Sportbet.one (SBET)

In the past, when APY got to a point avove 1%, it usually causes some buying and the price of SBET to increase. It however is pretty isolated in the crypto space sitting on the EOS chain and only 1 exchange over at coinstore.com. The number of holders also continues to go up slowly now at 1362 adding 2 more compared to last week.

So if the returns keep up or even go higher, there eventually should come more investors pushing the price up as not that much is available with 12 Million on Coinstore out f 500 Million coins with all others staked and 75% held by the team as they need it for their own revenue.

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

Rollbit also continues to do well with a nice dividend payout last week and a very high burn near 20% of the supply expected yearly. This has my balance now fully in RLB whith an eye to sell once the yearly burn gets back below 12.5%-10%. (See Strategy)

The minimum suggested NFT prices also feel quite low and they are trading quite a bit above that.

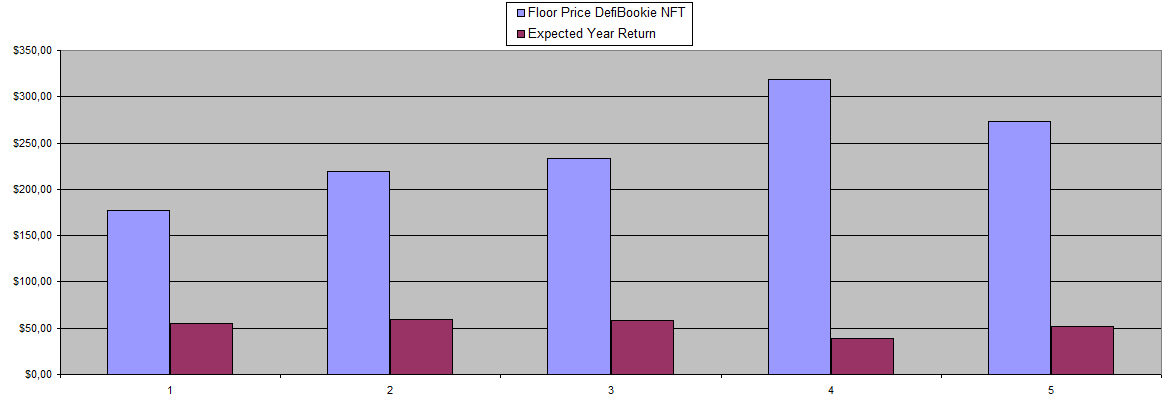

Defibookie (NFTs)

Bonk which is one of the tokens paid out had a big pump that increased overall returns a bit but the USD is one the low side at the moment.

Overall the main appeal continues to be the fact that the overall volume / revenue of this new project is still very low with the potential to go up a lot as the bull market progresses. This also comes with the risk of it going bust somehow in case sharp money manages to crush the bookie which is not unthinkable. I have my investment set and look to recover what I put in first working toward that week by week.

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.524$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.945$ | 65.727$ | 4.62% | +2016$ |

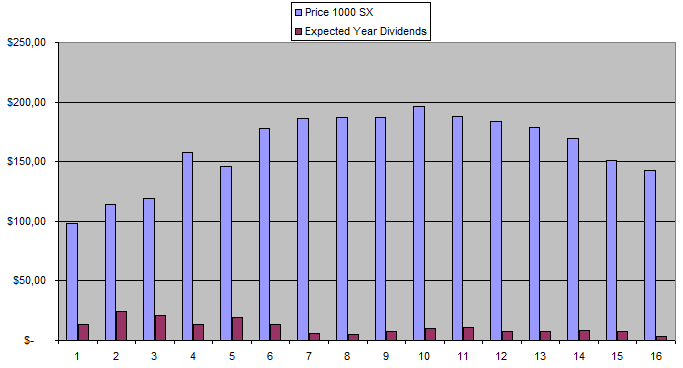

Sx.Bet (SX)

SX is kind of disappointing with no real increase in volume and users at the moment. last week they only did 650k in overall volume and dividends were very low with a result that the price (which was inflated because of hype) is also coming down.

This likely is the time to do some more research and see if its worth swapping Delegators and giving up a month of earnings.

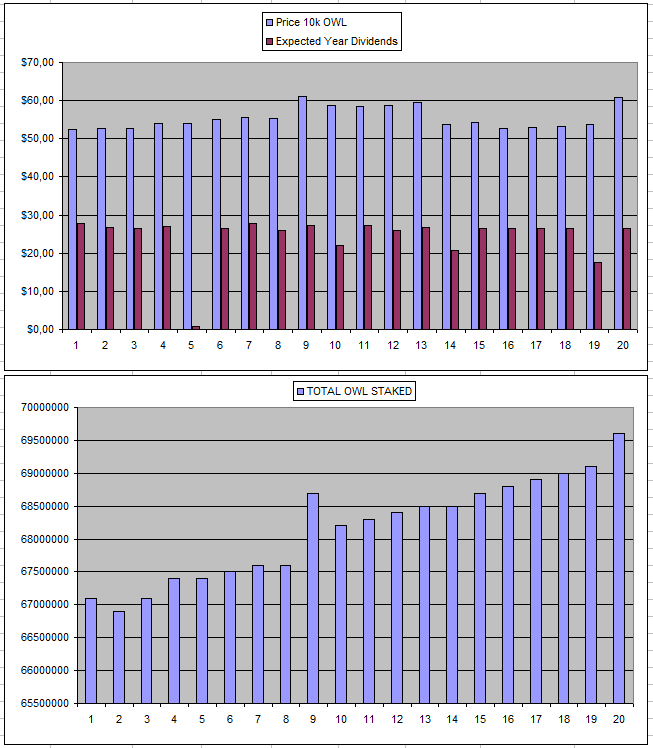

Owl.Games (OWL)

It looks like there was a buyer for OWL pushing the price up 13% which equals 500k OWL staked extra. I'm still waiting for the revenue share to be increased as it has been stable for a while.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82.1$ |

| 15/08/2023 | 400k | 2084$ | 1867$ | 20.40$ | 42.3$ | 2.03% | -171.1$ |

| 22/08/2023 | 400k | 2084$ | 1911$ | 20.80$ | 63.1$ | 3.03% | -106.3$ |

| 29/08/2023 | 400k | 2084$ | 1950$ | 0.55$ | 63.6$ | 3.05% | -66.7$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115.1$ |

| 12/09/2023 | 500k | 2636$ | 2454$ | 26.77$ | 110.67$ | 4.20% | -71.33$ |

| 19/09/2023 | 500k | 2636$ | 2449$ | 25.00$ | 135.67$ | 5.15% | -51.33$ |

| 26/29/2023 | 500k | 2636$ | 2699$ | 26.17$ | 161.84$ | 6.14% | +224.84$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +146.99$ |

| 10/10/2023 | 500k | 2636$ | 2582$ | 26.1$ | 209.09$ | 7.96% | +155.09$ |

| 17/10/2023 | 500k | 2636$ | 2590$ | 25.05$ | 234.14$ | 8.88% | +188.14$ |

| 24/10/2023 | 500k | 2636$ | 2624$ | 25.62$ | 259.76$ | 9.85% | +247.76$ |

| 31/10/2023 | 600k | 3179$ | 2947$ | 19.95$ | 279.71$ | 8.80% | +47.71$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8.14$ |

| 14/11/2023 | 600k | 3179$ | 2796$ | 30.55$ | 340.69$ | 10.72% | -42.31$ |

| 21/11/2023 | 600k | 3179$ | 2813$ | 30.65$ | 371.34$ | 11.68% | +5.34$ |

| 28/11/2023 | 600k | 3179$ | 2824$ | 30.53$ | 401.87$ | 12.64% | +46.87$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +93.99$ |

| 12/12/2023 | 600k | 3179$ | 3221$ | 30.42$ | 452.46$ | 14.23% | +494.46$ |

** the High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

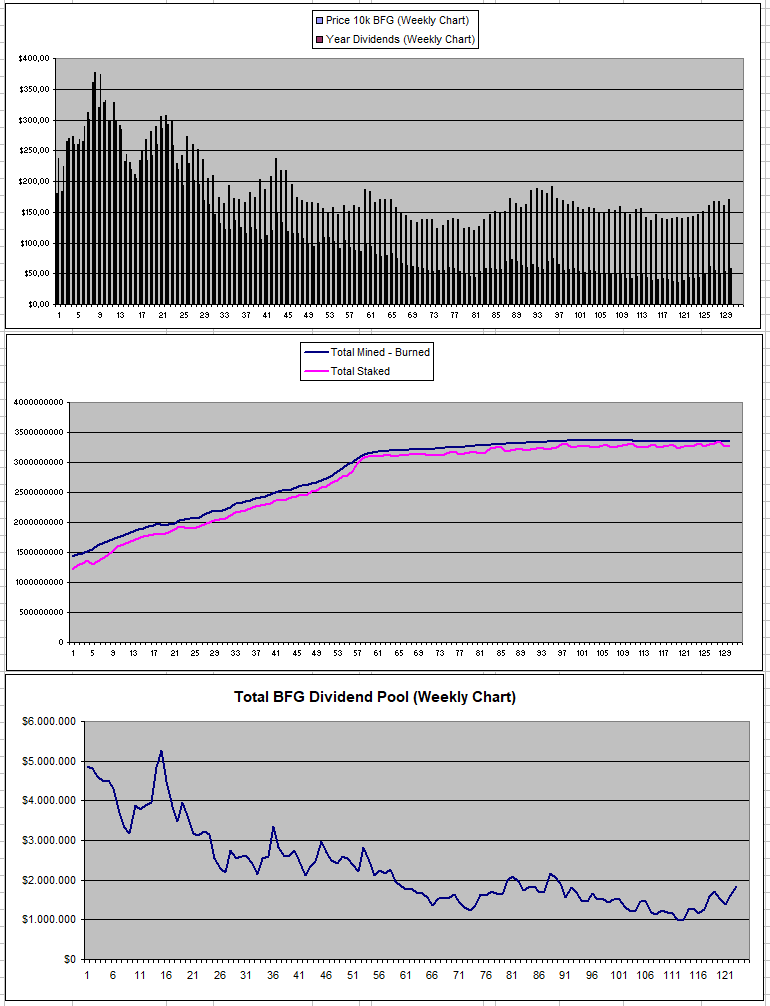

Betfury.io (BFG)

Some more BFG got burned (-0.11% Supply) last week and it looks like the dividend pool is going up again.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +76.96% APY |

| Betfury.io (BFG) | +34.70% APY |

| Rollbit.com (NFTs) | +52.06% APY |

| Owl.Games (OWL) | +43.39% APY |

| Sx.Bet (SX) | +2.57% APY |

| Defibookie.io (NFTs) | +18.95% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own.

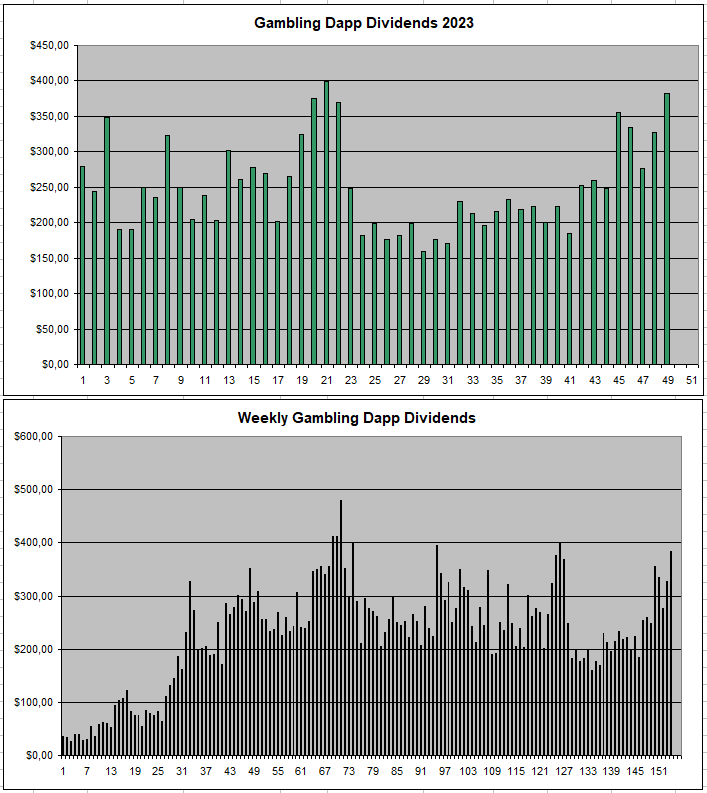

Personal Gambling Dapp Portfolio

I got a really solid 382.93$ in passive dividends this week from my GambelFi portfolio which has in it 5M SBET | 500k BFG | ~3500$ worth of Rollbot NFTs | 600k OWL | 25k SX | 3374$ worth of DefiBookie NFTs. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|