5 Cryptos Making Technical Analysis Moves for 3/16/2022

For this 3/16/2022, we look at cryptocurrencies making waves from Technical Analysis Perspective.

Traders of different trading timeframe philosophies would agree that it is important to gain an understanding of a currency pair's price action. This importance varies among traders, but it still remains important as traders look to buy low and sell high. Every day presents new opportunities to examine cryptocurrencies and their price movement (technical analysis).

Let’s examine the cryptocurrencies that have made the most recent technical analysis moves with various indicators. This is not an exhaustive list, this is just a selection of cryptos that have made a significant movement or have made a shift. None of the below is financial advice, you are encouraged to do your research before trading or investing in any securities. Cryptocurrency positions carry risk of loss of investment principal.

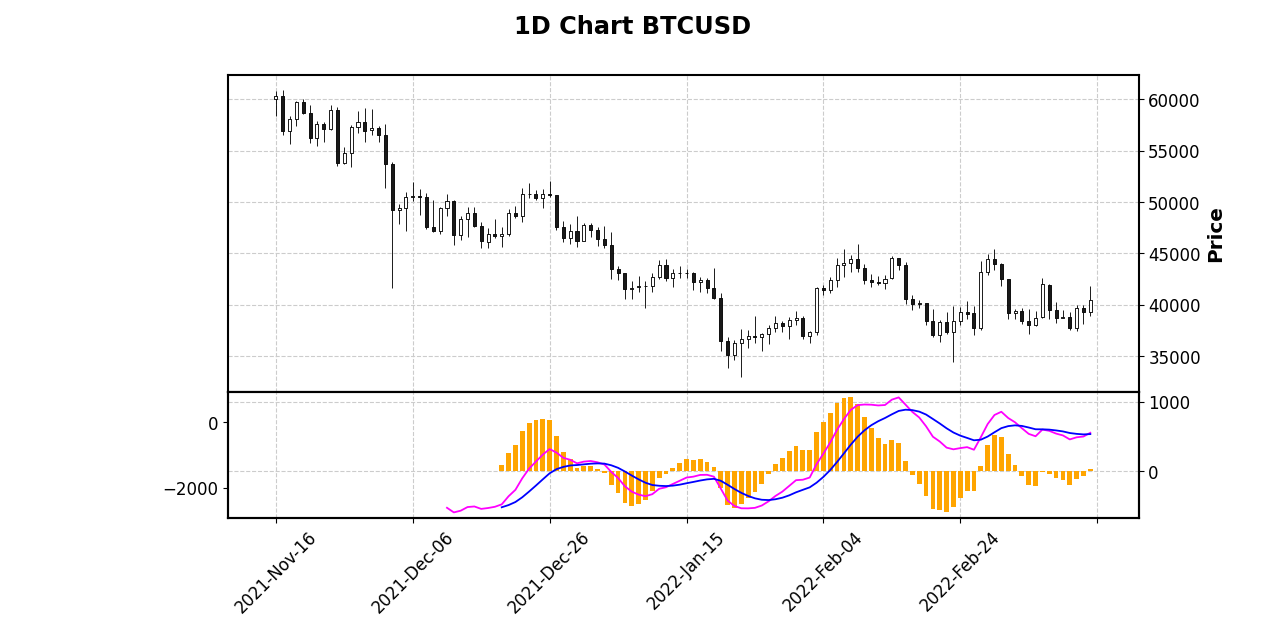

Cryptocurrency #1:BTCUSD

On the daily chart for BTCUSD, the Moving Average Convergence Divergence (MACD) is showing a bullish signal, the signal line crossed above the MACD Line and the MACD Histogram crossed above the Zero Line in the previous trading day on the daily chart.

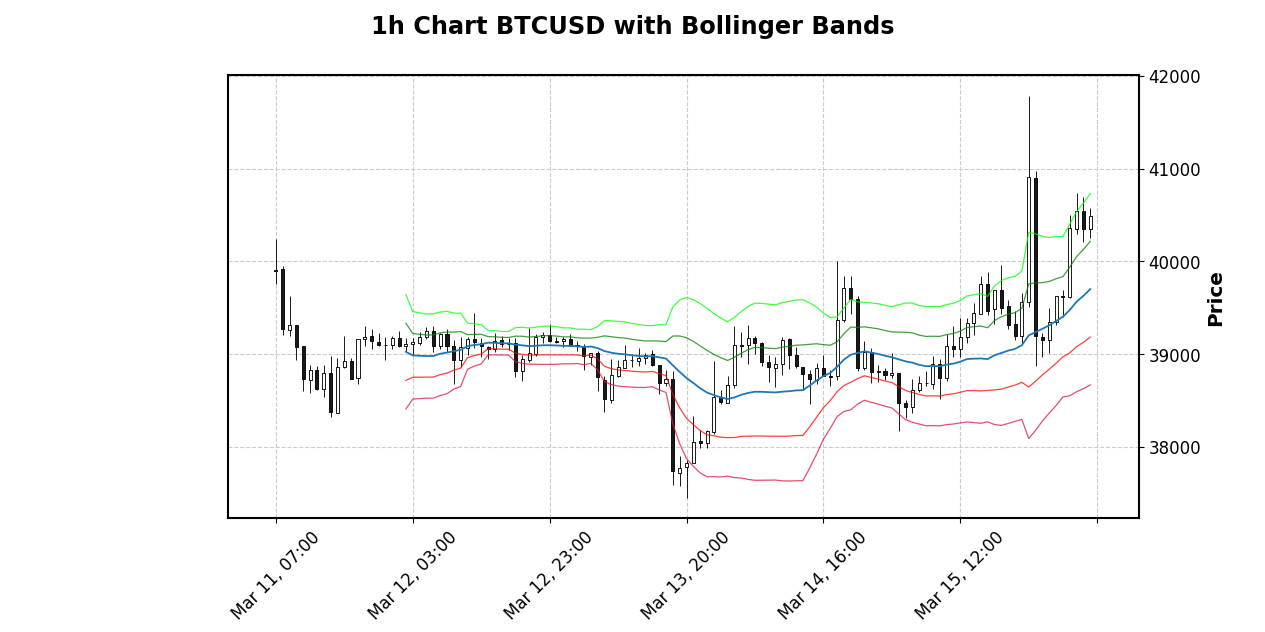

Right now, the hourly trend is an upswing and the Bollinger Bands help confirm it as the price is nicely contained within 1-2 Standard Deviation levels above the mean.

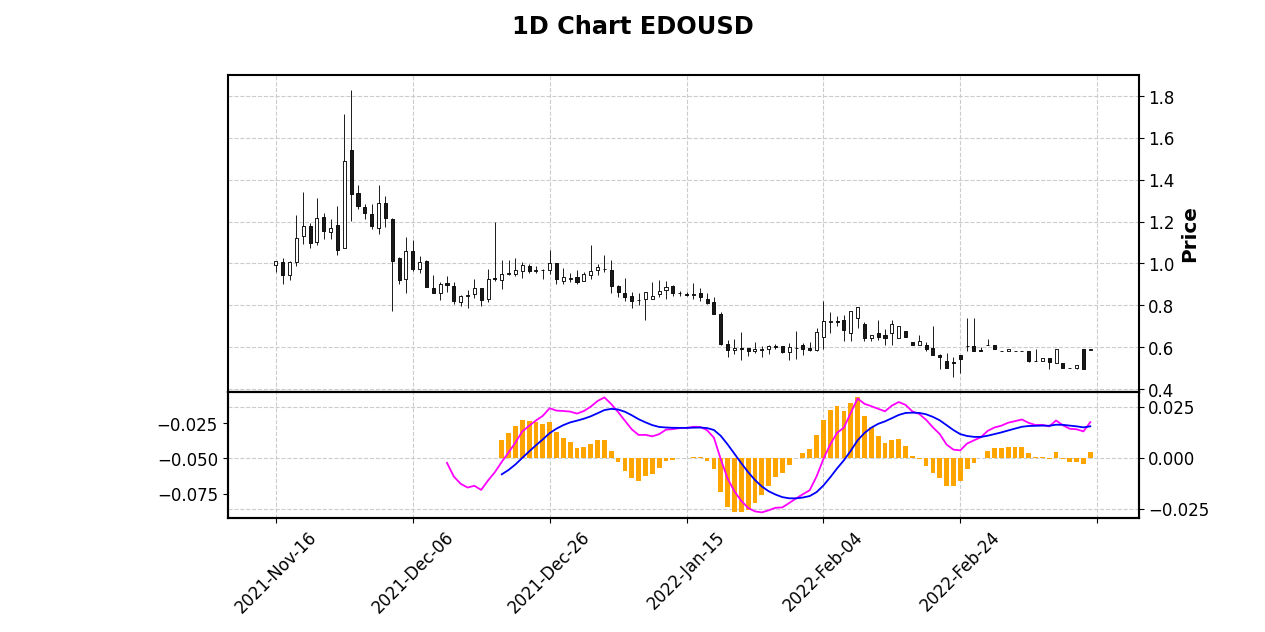

Cryptocurrency #2:EDOUSD

EDOUSD is appearing bullish according to the Moving Average Convergence Divergence (MACD) indicator on a daily chart with the common default settings of a 12 day Exponential Moving Average less the 26 day Exponential Moving Average with the 9 day Exponential Moving Average to be used as the Signal Line. The signal line crossed above the MACD Line and the MACD Histogram crossed above the Zero Line in the previous trading day on the daily chart.

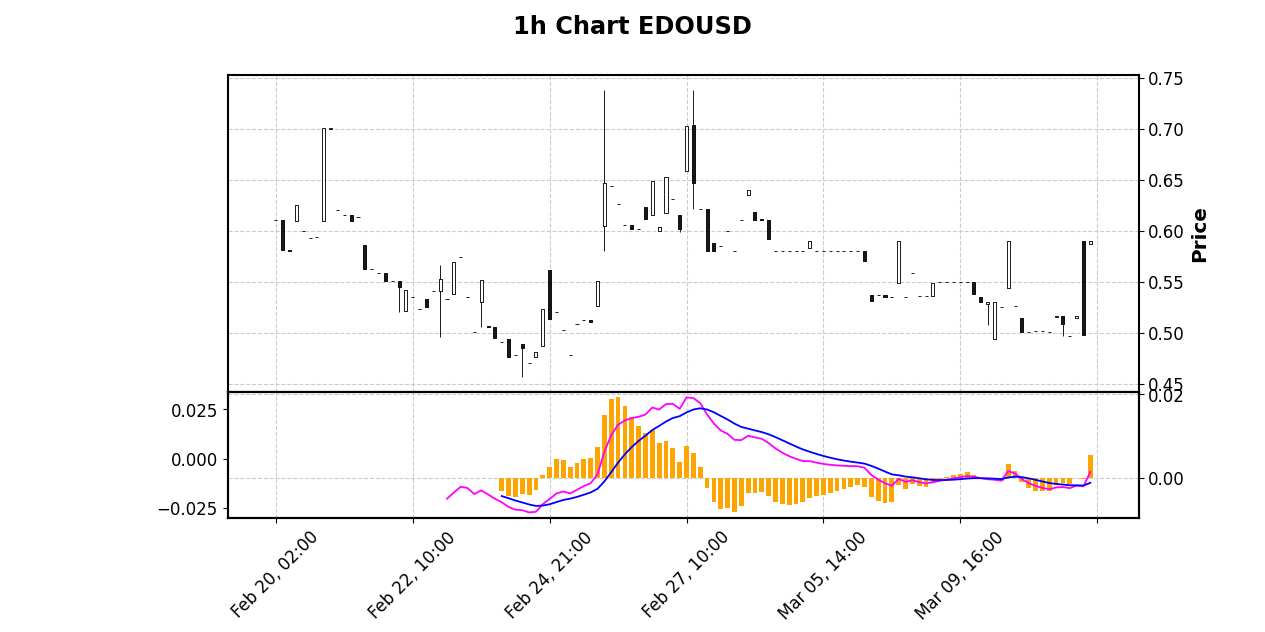

Examining the Moving Average Convergence Divergence (MACD) for EDOUSD, the signal line crossed above the MACD Line and the MACD Histogram crossed above the Zero Line in the previous trading hour on the hourly chart. This is a bullish signal, especially when combined with an upward price trend.

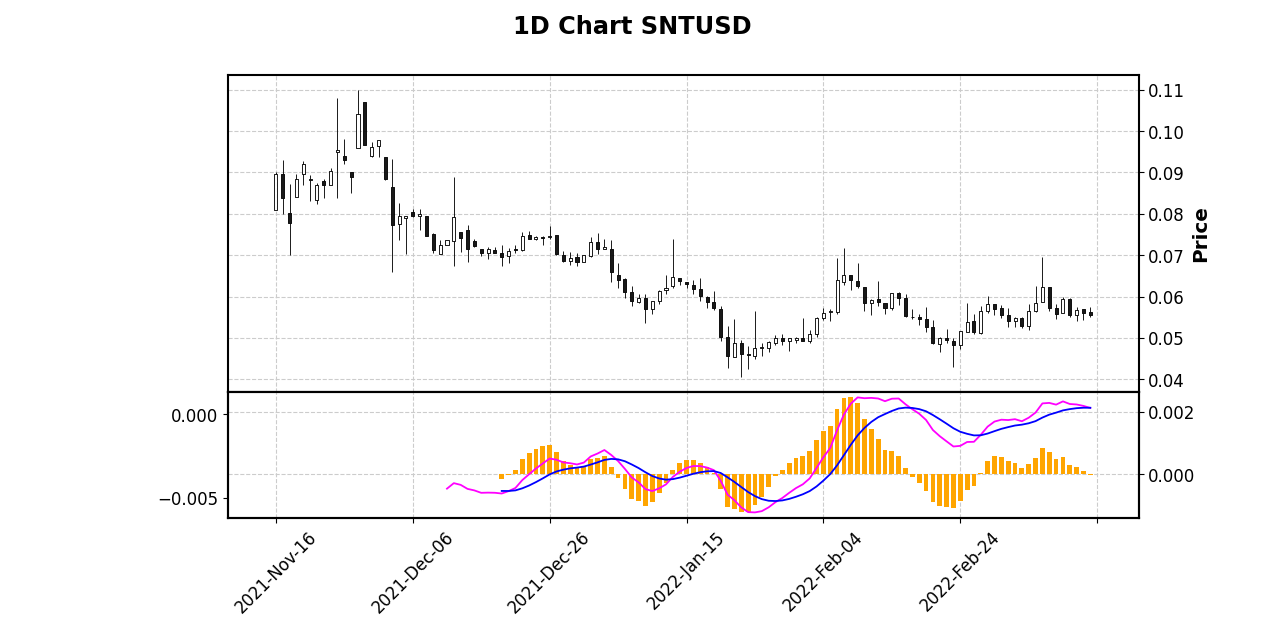

Cryptocurrency #3:SNTUSD

Examining the Moving Average Convergence Divergence (MACD) for SNTUSD, the signal line crossed below the MACD Line and the MACD Histogram crossed below the Zero Line in the previous trading day on the daily chart. This is a bearish signal, especially when combined with an downward price trend.

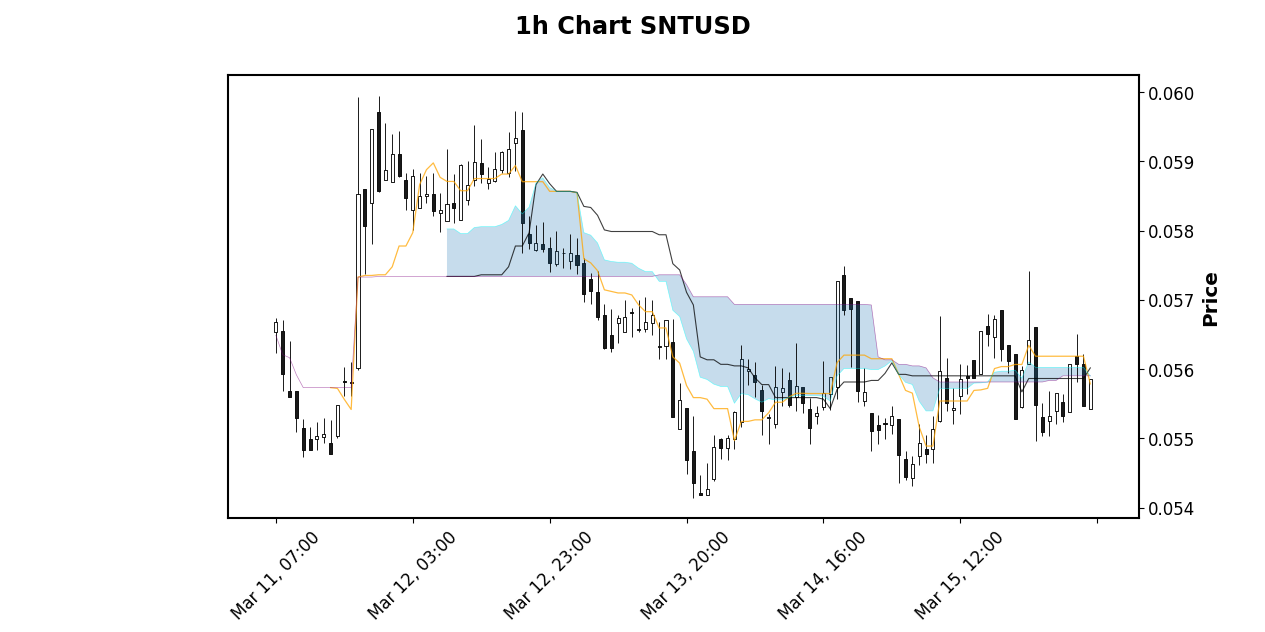

The hourly price is below the cloud (kumo), the price is below the Kijun Sen (a measure of the average of the highest high and lowest low over the last 26 periods, which happens to be hours on a hourly chart), and the Tenkan Sen (a measure of the average of the highest high and lowest low over the last 9 periods, which happens to be hours on a hourly chart) is below the Kijun Sen. All of this points to a bearish trend.

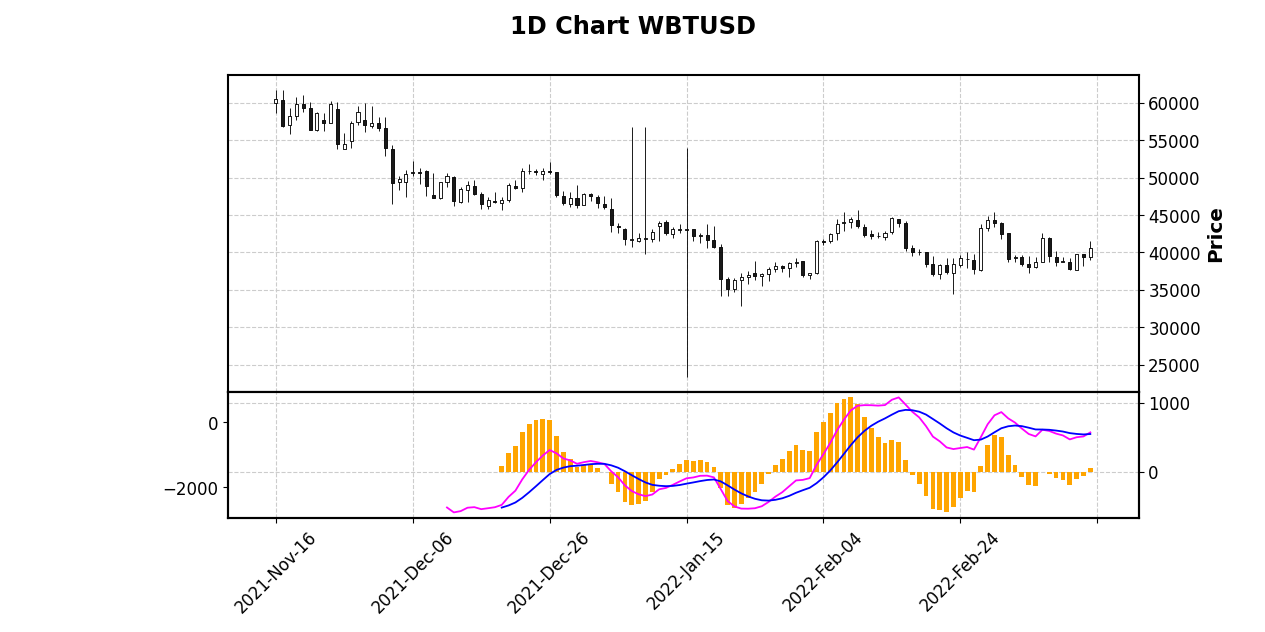

Cryptocurrency #4:WBTUSD

On the daily chart for WBTUSD, the Moving Average Convergence Divergence (MACD) is showing a bullish signal, the signal line crossed above the MACD Line and the MACD Histogram crossed above the Zero Line in the previous trading day on the daily chart.

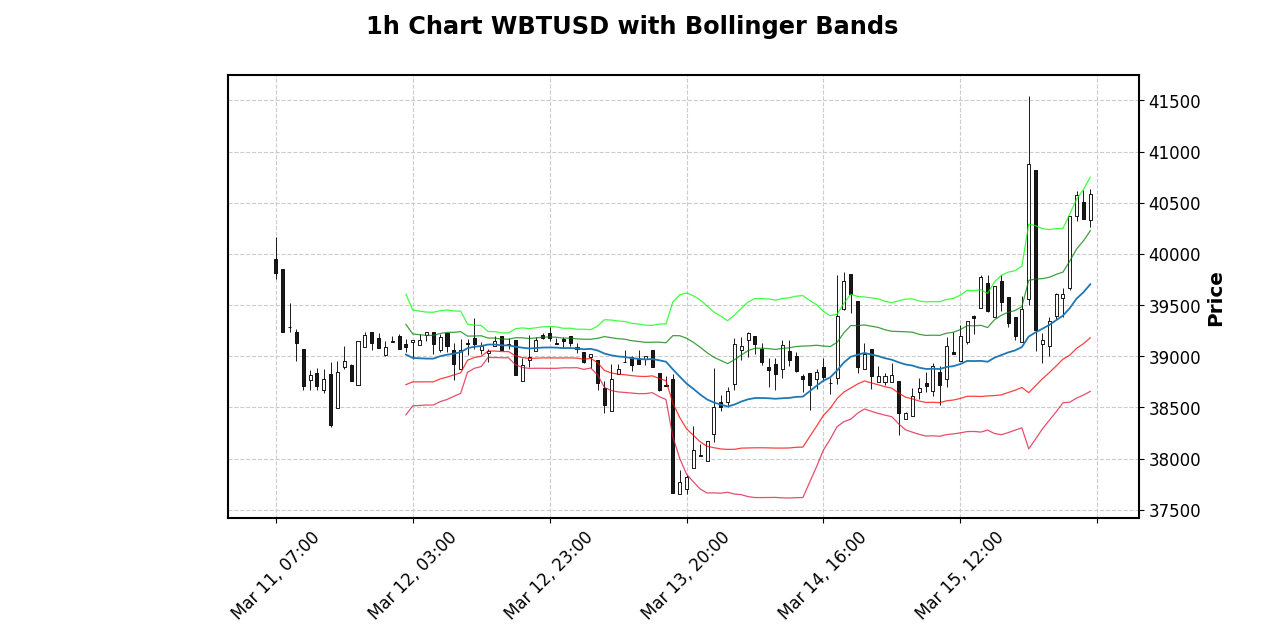

Right now, the hourly trend is an upswing and the Bollinger Bands help confirm it as the price is nicely contained within 1-2 Standard Deviation levels above the mean.

0

0

0.000

0 comments