How have you been managing volatility and risk in crypto trading (Learn How)

Market agitation is worrisome for many traders because of the volatility which most times pose negative reactions and emotions for traders to control. One fact that cannot be erased is that market will keep going up and down. This is neither bread nor pizza that you buy today at a price and go back to buy at the same price in a few hours or the second day

Every investor in crypto or stock market has one time or another had a periodic loss, but they continue with the game even with the setback and the occurrences they least expect

The market condition can be managed and we can as well protect our capital from the market volatility and loss securing the little profit we've bagged from the market

Protecting yourself from losing your capital

1. We must first understand that the market is volatile. Until a mad man knows he's mad, he remains a mad man. If you believe you are capable to trade by ignoring the fact that the market is risky, you can run into a fatal loss. Understanding the risk in trading would allow you to trade with the capital you can afford to lose. So in your mind, you will feel losing is expected and if you make profits, you will know how to keep managing the market volatility to secure your profit and not have a permanent loss

2. Have some knowledge of some tools to analyze the market in other to understand the market sentiment. It helps to understand the emotions of traders on assets and also their attitudes towards them

You can use the funding rate statistics to analyze the market sentiment. Note that a positive funding rate signifies a bullish market, and conversely, the negative implies a bearish market.

Also, social media is a tool that can be used to analyze market sentiments. You can check google trends to know how much people are searching for a particular cryptocurrency. Just type the keywords and search. It will display the info. The more you familiarize yourself with the tool, the more you understand how to use it

Moreso, don't forget the crypto hype. It can help you know when to pull out your fund to minimize loss or when to ingest to bag profit. On Twitter, news flies every minute, and once you are always checking the news, it can help you decide on what to do. A single tweet by Elon Musk can change the market within a twinkle of an eye, so be vigilant

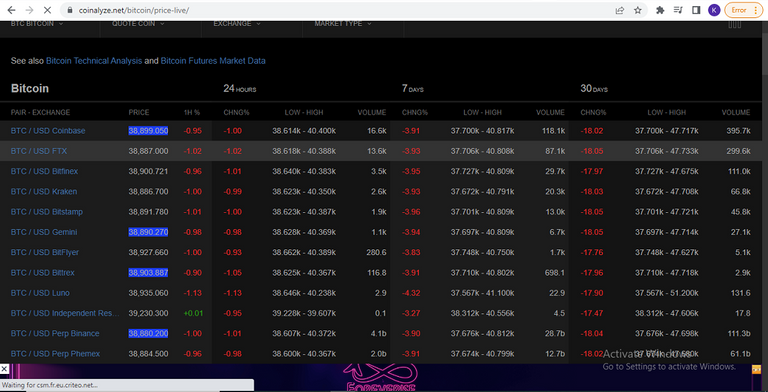

A single transaction made by a whale can impact the price of crypto so monitoring the way they move funds can help you decide what to do in other to minimize your risk/make a profit. You can also use the sites below for the same purpose

| 1 | 2 |

|---|---|

| Whaletrace.com | clankapp.com |

3. Deal with your emotions. As a trader, what kills us most times is our emotions which sweep us off balance. Our emotions can affect the patience we ought to have. Emotional trading can make a trader lose all his fund. We should understand that market volatility is a must in cryptocurrency, so once we've done our analysis and we see the market going bearish, we shouldn't panic. If we do, it can lead to poor financial/trading decisions

4. Knowing when to stop loss and take profit is also paramount. You must not trade with greediness. Once you've designed your trading plan, don't try to deviate. It might cost you your fund.

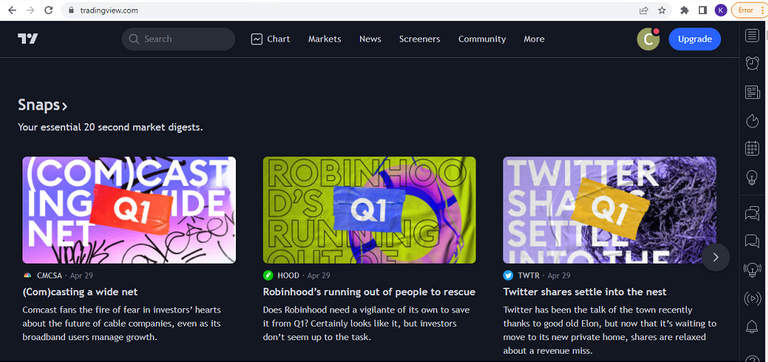

image source, tradingview

5. Don't put your egg in one basket. Learn to diversify your fund. Don't invest in a single product. Have different portfolio. If one didn't do well, another can compliment the other. It's a very good way to minimize risk

In conclusion, you can also learn how to use some technical analysis tools. They are available on exchanges, but I will recommend you use

You can create a demo account and use their paper trading to practice. You can then apply the strategy to your trading on other platforms like Binance, Bittrex, Huobi, and so on

Hope this helps.

Thanks for reading

This is ckole the laughing gas

One love

0

0

0.000

0 comments