What The Crypto Markets Are Telling Us

While there has been greater push back from CEX to DEX there's still powerhouses that people love using like Coinbase and that most likely will never change as people love simplicity and to have someone else responsible for their funds. IDK if they don't trust themselves or what it is but it seems crazy you wouldn't want to be in control of your own wallet. But we are in a world were no one likes to take responsibility and simply blame others for their own short comings.

That being said we can still learn a lot about the crypto markets when it comes to CEX such as Coinbase. Love them or hate them Coinbase has lead the way in the USA for one of the largest onboarding ramps for crypto then any other platform.

Coinbase Earnings

Coinbase used to only make money from fees collected on trades. However if the markets started to stagnate meaning no buying or selling then the company really ended up doing not so great.

This is when coinbase started to expand operations into other areas such as staking rewards. Staking rewards allows them to take the bought tokens and stake them for people while taking a cut. This cut is normally somewhere around 1% which might not seem like much but adds up to a lot when you're talking about 100,000 ETH staked. Just that alone would rake in the company a solid 2.3 million dollars in pure revenue.

At the moment Coinbase currently has roughly 8 million users who constantly transact on their platform.

They also launched their own Coinbase card supported by visa. It allows users to use the card to spend their crypto just like a visa credit card which is one of the most widely accepted. I'm not sure why you would want to spend your crypto but to each their own!

Not only that but Coinbase also has subscription services, they are custodial wallets for ETFs and yes they even have their own "blockchain" called BASE which has performed rather well.

How Did Coinbase Perform

We can directly see how the company does in terms of revenue because it's a publicly traded company so these records are available for all to see.

From Q1 to Q2 Coinbase made$781 Million in transaction revenue which is actully down by 27% quarter over quarter. It's also made roughly 600 million on subscription fees. When you take that into account and see that the company had an expense of 1.1 billion you can see they actully made a few hundred million dollars in profit in 3 months. Showing a rather healthy crypto company economy.

Q3 For Coinbase

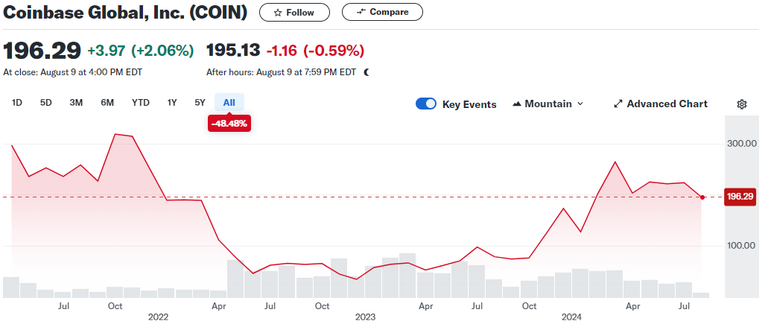

So far things are actully looking on the up and up with coinbase. With a increase in user base and more subscription fees and other fees coming in the company is looking strong rolling into Q3 meaning we should overall see the stock price continue to rise.

With ETFs especially Ethereum now being approved and live Coinbase stands to increase it's fee earning once again in a great way. On top of that as we reach closer towards elections there's still a very real possibility that crypto takes off when governments start approving it and stock piling it themselves.

Posted Using InLeo Alpha

The masses ALWAYS do the wrong thing, until it collapses