Is DeFi Surviving? A Deep Look

It seems like DeFi was all the crazy a few years ago in the last bull market. However since then it's been battling consistent hacks (which to be fair have come down over time which is a good thing) Since then DeFi has been falling or at least in terms of what most applications are able to track. Many were not counting LST which are liquid staking tokens which became a hot topic and still are.

LST's are simply Ethereum or another token wrapped that allows for liquidity while the tokens on the back end are being staked to earn revenue. This allows you to earn on your staked tokens but also to invest them into DeFi giving you some rather impressive APRs.

So where do we stand today?

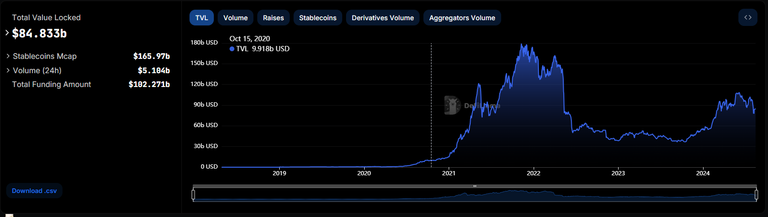

Still no where near where we did in the last bull market...

As we can see by this we are only at 84 billion which is a little over half it was during the peak of 2022 bull market run (let me remind you that was only 2 years ago which honestly crypto came back fast from!

The Cycle

So at the moment crypto is kind of in this bouncing trend for a vast part of this year so far. After the $BTC ETF rolled out there really wasn't much in terms of price action after this point. We touched 70k and then quickly fell to 55k and 65k which seems to be around our bounce area. This has been going on for months now with no real catalyst yet in terms of a bull market or a bear market.

While many currently are feeling that the cycle for this bull run is currently over it does feel like many are waiting as well. Currently however we are in this cycle of YoY (Year over Year) change which is showing us to be primed for a rather decent bull run. This time last year bitcoin was only worth 28k roughly and since then has peaked at 72k back in march and is now hovering around that 60k mark for a rather long time as we are coming up on 6 months now of bitcoin consolidating in this range.

Liquidity

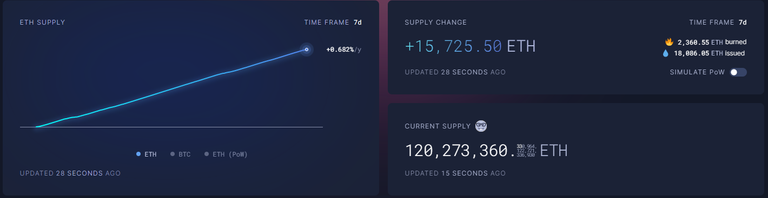

One of the biggest issues as of late has been liquidity for these tokens. With ETFs and other areas tying up these assets its been a rather big issue. However Ethereum is once again showing inflation once again. It might not seem like a lot only coming in at a inflation rate just shy of 1% but it's still creating a world in which there is more liquidity in the Ethereum space one of the largest pools for liquidity in the crypto space.

As this liquidity increases it also sets things up even better for something I talked about the other day and that's the alt coin season many have been waiting for.

You can read more about that here Are We Primed For Altcoin Season

From all of these I'm currently seeing myself that we are rolling into a alt coin season and with that defi should take center stage again as liquidity increase and trading and demand for other projects and tokens heats up as Bitcoin and Ethereum prices stagnate.

Posted Using InLeo Alpha

It does seem to be hanging around more than I would have thought. The returns aren't quite as crazy, but it is still nice to see that it hasn't totally flopped or wholesale rugged