Traditional and Behavioral Finance

What is traditional finance and behavioral finance theory? Traditional finance theory is an offshoot of traditional economics, which contends that most individuals aren't nearly as rational as traditional economic theory predicts when making financial decisions. Whereas traditional economic theory assumes that individuals are able to allocate capital in a manner that best matches their expectations, traditional finance assumes individuals will make random choices that do not comport to traditional economic theory. Traditional finance therefore suggests that you as a consumer make your decisions based on rational expectations.

This rational expectations approach to traditional finance is somewhat problematic, because it makes the assumption that individuals are rational, but traditional economics still predicts otherwise. It is difficult to explain how people can consistently make irrational choices when their only criteria for making these decisions are what traditional economics tells them is "rational." Further, traditional economics tends to ignore the fact that consumers have irrational perceptions about markets; they often believe prices to be "sticky" or that demand will be elastic if interest rates are high. These rigid expectations make traditional economics unable to provide a logical explanation for why the supply of money is inelastic or why interest rates are generally either high or low.

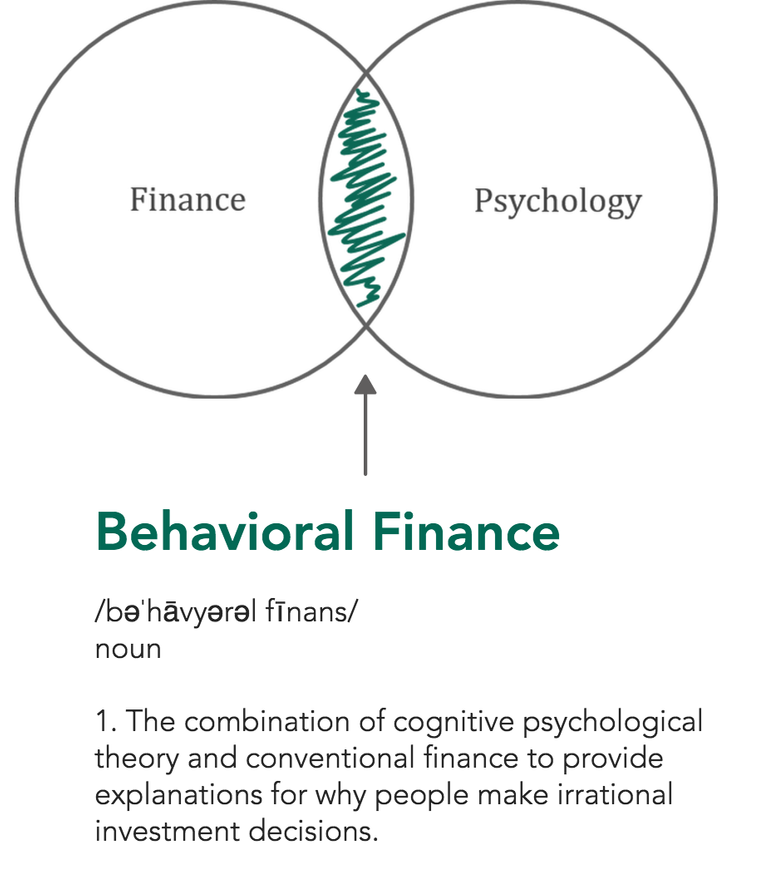

However, a more plausible explanation for why traditional economics is unable to offer explanations for traditional financial phenomena is the behavioral characteristics of individuals. In behavioral economic theory, individuals do not act rationally in the same way that traditional economists assume they would. In fact, human beings are remarkably consistent in making irrational decisions under certain conditions. For example, many people will engage in financial activity that contradicts their deepest beliefs. People are capable of trading stocks according to a craven calculus that regards rising stock prices as a sign of future wealth regardless of the reality of current stock price trends. Behavior is not consistent with traditional economic theory.

Behavioral finance also flies in the face of traditional methods of accounting because it emphasizes the importance of human behavior in making economic decisions. Traditional managers rely on historical data to guide their allocation decisions. But behavioral economists would argue that because investors do not behave rationally, traditional models are actually invalid. The result is a failure of the traditional methods of measurement and allocation because investors have irrational perceptions about future capital gains and the stock market itself.

Behavioral finance provides a unique opportunity to evaluate and test traditional assumptions. By observing and tracking market behavior, behavioralists can observe and test the predictive validity of traditional theories. If investors truly behave according to the predictions of their models, then any deviations from the expected path should yield consistent, predictable results. If they don't, however, then traditional theory will have been proven faulty.

Behavioral finance therefore implies that traditional models are actually defective. However, behavioral models are not able to provide any test of this proposition. Instead, they rely on an intuition about how markets work. This may sound good in theory, but when applied to real-world situations, it often leads to false approximations. In reality, most of the failures of these traditional approaches to the market are the result of unrealistic assumptions about the character of individual behavior.

Traditional approaches to the market also fail to consider some important institutional constraints. These include the fact that traditional models assume that all borrowers will behave in the same way regardless of their individual circumstances. They also assume that present day individual borrowers will maintain their propensity to lend money for several years even when they face significant challenges in doing so. These constraints, together with the historical data that they use to construct their models, make traditional monetary policy substantially less effective in the actual course of events.

Finally, traditional models don't attempt to address some crucial aspects of the market. They simply assume that all of the institutional constraints discussed above will still hold true no matter what, and that the level of the interest rate will not affect lending in any significant way. This may be true in some economic environments, but it is clearly false in others. As a consequence, they completely miss the fact that changes in the level of the money supply or interest rates can affect the structure of the market even to the point that these changes can significantly impact individual decisions about spending.

Posted Using LeoFinance Beta