The role of financial planning in achieving long-term financial goals

The role of financial planning in achieving long-term financial goals

Most people prefer to live by chance and allow things to simply take care of themselves rather than get all tangled in planning and executing those plans. To an extent, it does happen to have an expected end by things falling into place of thoughts, but other times, it can be quite disastrous. Planning, even though it does not necessarily translate to success, however has deliberate effects on how life and all things within it take shape. With that in mind, let's look at the roles of financial planning in achieving long-term financial goals.

What Is Financial Planning?

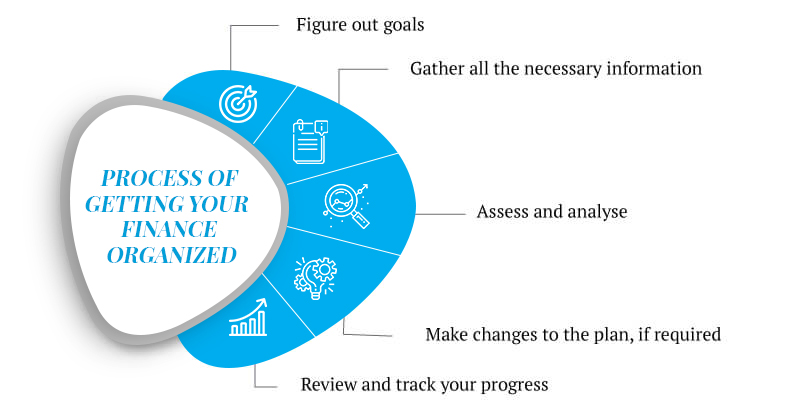

Financial planning involves creating a roadmap for diligent follow ups in finance management. The act of setting objectives on how to manage one's financial resources and achieve financial goals without a strain on its health. Individuals and organizations result in financial planning as a clear finance guide for making informed decisions.

These decisions generally involve the proper allocation of resources and management of money with aligned financial values and priorities, but most importantly as a hedge for unexpected financial challenges. Quite frankly, financial planning spans through other major aspects of money including investment, spending and savings. A properly planned finances enables one to stay on track and also at an advantage, ready to take leverage of every opportunity that comes forth.

To many, it is an easy phase to wish to spread one's legs over, but as aforementioned, the outcomes of financial carelessness or lack of financial planning as the topic begs, can, be disastrous, so, to ensure that one is not a part of this ruin, here are ways to plan out your finances effectively.

Don't click on the image - I warned you : ) src

Financial Planning - How To Stay and Scale On Budget

Everything is possible with all positivity and is obviously the first stage at properly managing one's finances, if one cannot put into perspective and be optimistic about achieving the set out goals, it is then unlikely that such plans pull through. That said, here are key ways to plan your finances and stay on budget:

- Writing Out Your Financial Goals

- Modifying Your Goals

- Examining Your Financial State

- Building A Roadmap

- Planning Ahead Of Unexpectations

- Implementation and Focus

These six outlines are properly curated ways of planning one's finances and staying and scaling on budget, below we'll discuss them in detail of their roles in achieving long-term financial goals.

Writing Out Your Financial Goals

Although planning begins in the heart, then the mind, it really becomes actual planning when written down or documented in some form, thus, writing down your goals will do a great deal but most importantly set your journey off for a great start.

The reason for writing goals can be factored into being a source for references, and a means of seeing a clear overview of what is stacked up for the roadmap.

Modifying Your Goals

A lot of people just write down things and call them goals, well, the first phase is merely a draft of what one should really consider a goal. The reason is because there are often quite a handful of things that should not be put there or are simply not "priorities". Modifying your goals allows you to put aside what isn't a necessity in the time-frame of which these plans are set to be executed.

When it comes to one's finances, there are quite a handful of surprises, with emerging financial networks like blockchains and it's tokenized assets and currencies, we see how it is much more packaged with expected surprises, thus, a well modified goal where priorities are separated from others is the way to goal, especially if achieving this goals are to be considered.

Examining Your Financial State

Some people are lucky with having the financial resources to set their goals off, while others unfortunately don't have or have as much to complete the task, thus, personal assessment of one's financial state enables them to understand how much work needs to be done for the set out goals to be achieved. Generally, this is where preparing a draft for asset allocation which includes spending, saving and investing. A clear view of one's financial state is a great determinate of how difficult or easy it will be to scale up.

Building A Roadmap and Planning Ahead Of Unexpectations

Building a roadmap is generally where the fun starts because this is the stage at which one draws baby steps that gradually expands into bigger steps through executing set out goals. Although roadmaps are merely a reference of process for others, to the builders it is a mindmap, a progress log and a push in the right direction of great steps.

Roadmaps are where each goal is well defined having carefully curated priorities and considered one's financial state. Roadmaps usually contain set out steps defined to build more value to meet set goals. Speaking of goals, roadmaps often come with plans for the unexpected, this is where one defines approaches needed for increased value flow to mitigate the risk of unexpected events, this is where most financial advisors will chip in the idea of building an emergency fund. Although not as easy as written, it is achievable with all positivity.

Implementation and Focus

With all previous steps considered, executing one's goals comes in as the last stage. The roles each and every stage plays all have similarity and that is achieving the goals at all cost, which means fighting all odds. At the stage of implementation, one can easily leverage his roadmap to track his progress and make necessary adjustments where necessary.

All of these create long-term effects on achieving financial goals, the discipline, proper asset allocation, progress tracking, adjustments and readjustment, financial planning puts it all in focus.

Thank you and please leave a, your thoughts matter to me

Posted Using LeoFinance Beta

It's funny but I never intentionally make financial plans. I only have a principle that I adhere to and it has kept me afloat in bad times and also given me surplus in good times.

My principle is to simply live within my means, and as one that depends on crypto for my livelihood, that's a big statement because of the volatility. My "means" varies with the market, and I constantly have to tweak my lifestyle to suit the state of the market.

Over the years, I've found that implementing this simple principle has enabled me grow as a person and gives me surplus to invest whenever the opportunity presents itself.

Posted Using LeoFinance Beta

I'm sure you're not alone on this as I can say the same for myself, but where's the fun in winning if there's no risk to take and manage the storm?

I almost laughed but it's not funny, however, the nature of life is to survive and we are often if not always able to endure.

Lol, for a second I feel like I'm no longer talking finance. 😂

Posted Using LeoFinance Beta

Setting measurable and meaningful goals is such and key to financial success. This is a good 1st quarter 2023 post.

Posted Using LeoFinance Beta

Thank you, I guess I might talk some more on general finance and business this years, unless of course a lot of fun stuff happens around crypto.

Posted Using LeoFinance Beta

Uhm. See that part of baby steps and not having enough financial resources? that refers to me. See, I have this plan of where I take out investment, savings and budget from my income but sometimes the income is not enough. But this article is helpful nonetheless. I have written and re-written so many times (planning) that I may as well be writing a financial memoir . LOL. Thank you so much for this

I totally understand, what I can add to what I've already stated above is to find what you can sacrifice to stay afloat, it's similar to modifying your goals to prioritize some over others, sometimes that's not enough and here's where you may outrightly need to sacrifice something to get another going.

Posted Using LeoFinance Beta

Yes. Thank you so much

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

https://twitter.com/1258373061239353345/status/1610933052682928128

The rewards earned on this comment will go directly to the people( @deraaa ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.