Are Decentralized Exchanges Bigger than Centralized Exchanges? - Data says…

As we've had quite a number of conversations centering on centralization, blockchain, decentralized exchanges, Defi, and cryptocurrencies as a whole, it's time to look at some April data on how DEXs faired to see if there's a chance the cryptocurrency space will be decentralized on it's greater half.

Sidenote: this comparison is focused on "value transfer" much more than it should celebrate "users" but all things the same, we'd see at the end if the user base should be a factor of determination.

As of April, a report by chainalysis showed some interesting numbers on the value inflow on the decentralized protocols called Defi. DeFi is coined from merging the word decentralization and finance, the idea is having a system that runs parallel to the traditional system of finance and investment, operating on an opposite structure to it.

DeFi has made quite the name over the years, as we know that it was a key factor in the 2021 bull run. The aftermath of such exposure has put the digital assets markets in some shady position that got people asking: is DeFi worth it? Can DeFi survive?

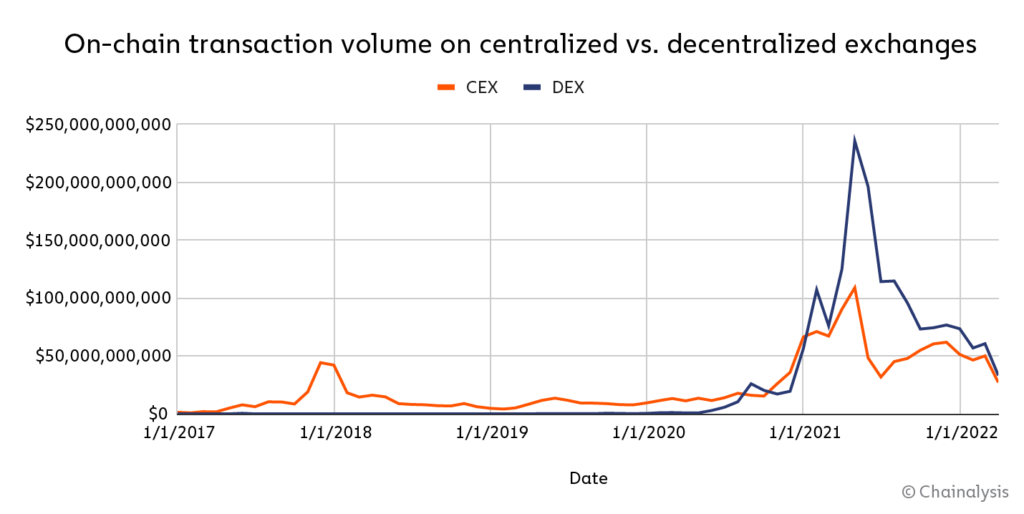

What we're looking at here is a volume chart comparing on-chain transactions via decentralized exchanges and centralized exchanges. The obvious metrics point to DEXs having more chain value inflow. According to chainalysis, as of April 2021 to April 2022, $175 billion was sent on-chain to CEXs, while about $224 billion was sent to DEXs.

I must say I'm surprised at these figures. Do take note that this is not a reflection of "trading volume" this data captures only "inflow", not the internal market activities, what people don't know is that "trading volume can be pretty deceptive at times, the only data that can be estimated from exchange volume is fees earned, and while these volumes are in billions, fees earn across exchanges are in millions.

Speaking of fees,

How much do liquidity providers earn from transaction fees?

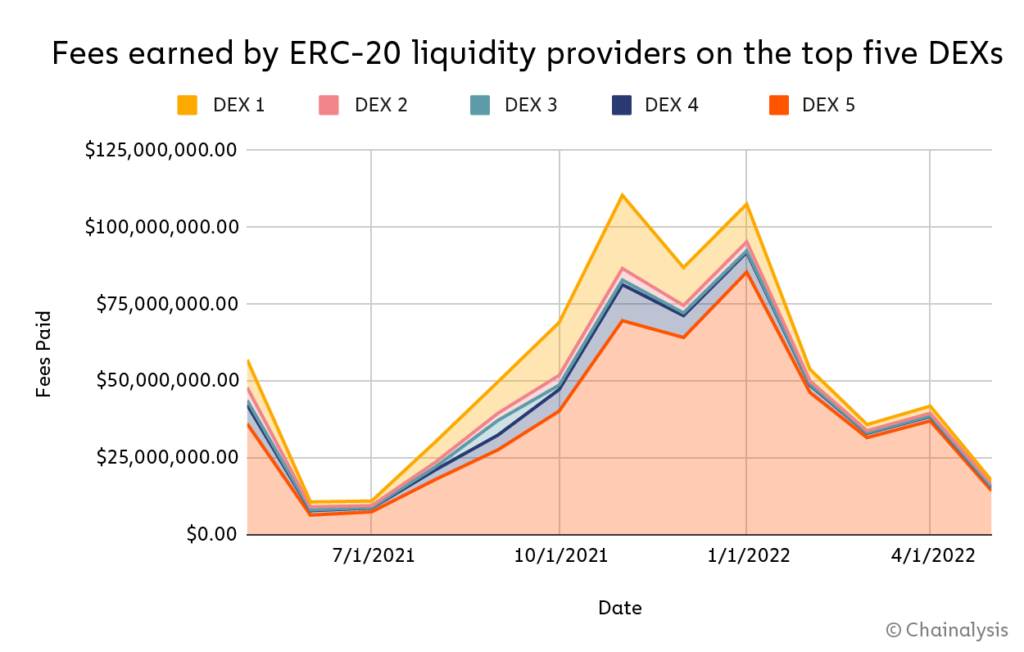

For the Ethereum blockchain, an average of $50 to $150 million a month as of April. This would mean the user base is still a bit small thus the market activities are relatively low compared to centralized exchanges.

Centralized exchanges earn billions in fees on a monthly basis.

Hacks - How has it affected DeFi?

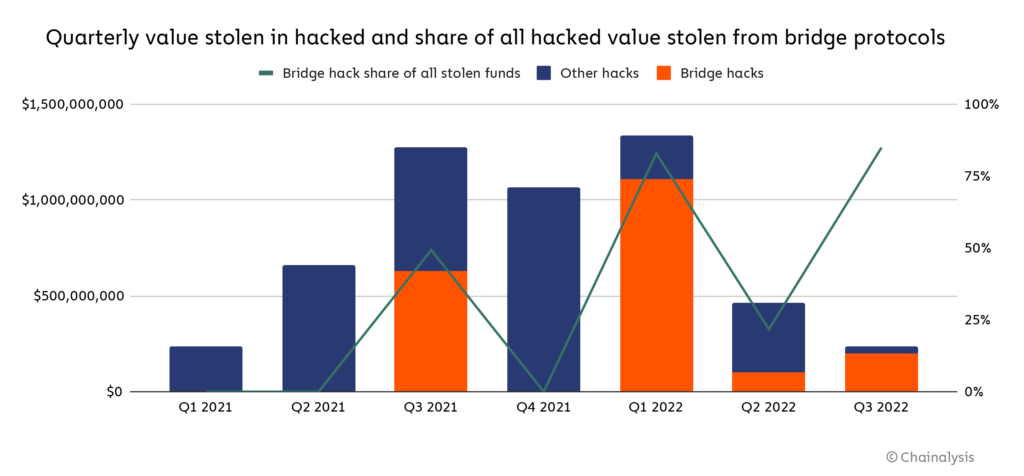

Cross-chain bridges have suffered the most attacks in the current year, the decentralized finance ecosystem has lost more than $2 billion to it with binance being on the latest profile to be attacked.

This sum accounts for roughly more than 70% of funds stolen in cryptocurrencies this year. While this looks really bad for DeFi, these protocols can enhance their security and fix smart contract vulnerabilities easing attacks to rob the network.

Userbase - The Future of DeFi

Thousands of users interact with DeFi contracts on a daily, and most of these activities are on pancakeswap, however, these figures are yet to replace the user base of centralized exchanges.

Considering the nature of DeFi protocols in current times, users are mostly not comfortable with the hacks ongoing posing a threat to their assets. This is expected to influence the rate users will utilize these protocols going forward, but considering the technology is ever-evolving, the cryptocurrency space will sooner build better security structures to reduce the rate of attacks.

Posted Using LeoFinance Beta

Question

I remember reading about how the FTX founder made millions arbitrage trading Bitcoin through Japan even though the opportunities were better in Korea, the Korean money laundering laws made the arbitrage trade to difficult.

Have you ever looked at the trading volumes on Korean Exchanges with an arbitrage traders eyes?

Posted Using LeoFinance Beta

Yes, I have, I have also tried setting up an account on these exchanges but haven't had any success stories due to the "language gap", there is a huge opportunity there.

The part about the government, I can understand because there's a similar case with citizens in Nigeria.

Truth is, the government hate any means of flexible global movement of money, I believe this is actually the reason we have different currencies across nations and even countries using the dollar still lack flexibility and also, it has zero effects on the Nation's economy, weird but, it's almost as though it's a different dollar entirely.

That said, if money were to be more easily moved across borders, opportunities would be on a grand size.

Currently the Naira in Nigeria is valued at about 780/$( that is a dollar gets you 780 naira in the free market (the black market) but in the internal market, the central bank suppresses this down to 415/$ last time I checked, this is a whooping 53.3% price manipulation from what should be the original value.

This of course opens up a route for arbitrage on the Naira against the dollar, but the government knowing fully well that this will great wealth for a lot of people have made it really difficult to transact with dollars globally.

So yes, these volumes create "real" arbitraging opportunities, but government restrictions may not allow people enjoy the price premiums.

Very interesting. Thank you.

Question:

So if for example, if you buy Bitcoin here for 20k and send it to your exchange account on Huobi, then sell your Bitcoin at a premium netting Korean Won, can you use the Won to buy a stable coin like USDT, then send the USDT back to your account in the US, then rinse and repeat?

Posted Using LeoFinance Beta

Something like that, that's why the restrictions are there. Frankly, if you were able to freely move dollars out of Nigeria you would become a million in a matter of hours of trading that price difference and possibly a billionaire in a month!