Regulatory Pressure is Keeping the Bulls On Their Toes.. But Not for Long

The Bitcoin chart is not looking good as of late.. but does it really matter in the long-run? For Hivers, we just keep our heads down and earn. But what does the rest of the crypto market think of this?

A weekly perspective shows us that BTC's performance over these past six months mirrors what many other assets have experienced during their own slides: namely weak recoveries after major corrections where investors who bought low eventually sell higher than they originally purchase tokens/ coins etc., but there are still plenty out here waiting patiently until things turn around before selling everything off completely - which could happen much sooner.

The market was in an optimistic mood just a few days ago, but it appears that China's real estate developer Evergrande has some bad news. This could be affecting markets around the world and leading to lower prices for stocks as well.

The Nov 10 price peak happened right when our very own US announced they hit one of their highest levels on inflation - until fears from this threat were realized by defaulting loans which impacted broader structures throughout various countries including America.

The pressure from regulators and policy makers on stablecoin issuers is relentless, but it seems like they can't stop this new currency. First came VanEck's spot Bitcoin ETF rejection by the U.S., which was directly related to concerns over Tether’s solvency - or lack thereof in their case (with an abundance of other reasons why).

The latest developments show that there are no signs for slowing down anytime soon!

The United States has started to pay more attention towards stablecoins and other digital assets. On December 14, the U.S Banking Committee held a hearing focused on consumer protection issues with these currencies as well their risks from both sides: users who may lose money when prices change frequently or casinos using them for gamblers' dollars instead of genuine funds.; meanwhile FSOC voices concern over adoption by stating that "The Council recommends state & federal regulators review available regulations."

In the wake of a largely negative aftermath from investors, CME Bitcoin futures contracts experienced an increase in premiums. This is evidence that people are becoming increasingly concerned about bitcoin's future prospects and whether or not it will continue to decrease as before year-end rolls around.

When the price of a share goes down, it can also go back up again. But when that happens there will be backwardation- which means people think negatively about future prospects for stocks in general and eventually sellers come out on top!

In the world of finance, there is a concept known as contango. Contango occurs when futures contracts trade at a slight premium to spot rates and this usually happens in healthy markets because sellers want more money upfront before they settle their trades over time frame rather than simply making one big payment immediately after sale like traditional stocks or bonds would dictate.

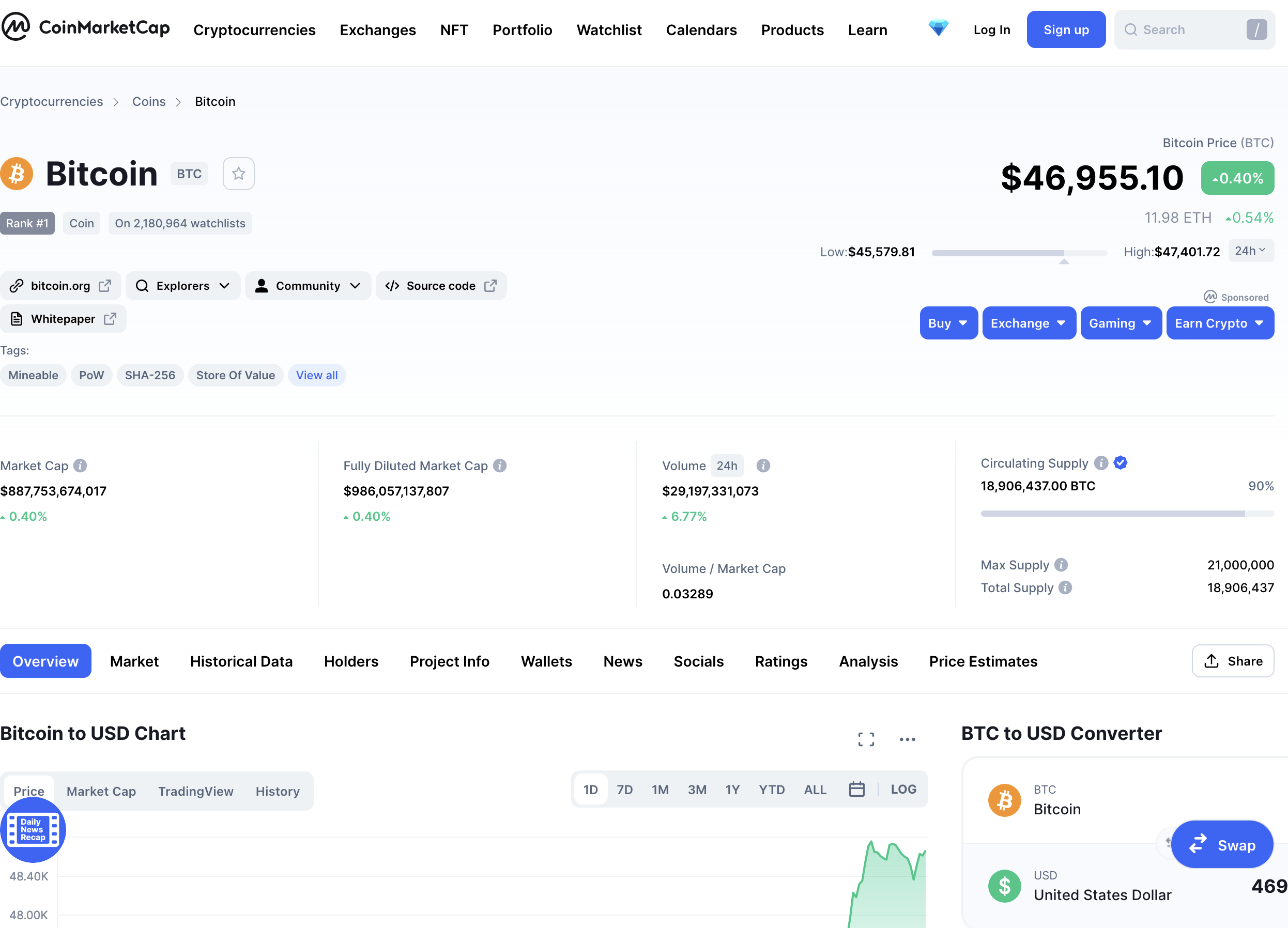

The indicator moved below the “neutral” range after Dec. 9 as Bitcoin traded below $49,000 which shows that institutional traders are displaying a lack of confidence in this market but it's not yet being seen as bearish due to how close we are to hitting 50k yet!

The data provided by the Exchange shows that professional traders have been heavily outweighing short sellers. This is an indication of a world where buyers are more powerful than seller, which could mean good news for those who want to trade stocks long-term!

Bitcoin saw a 19% correction since December 3, with top traders at Binance increasing their leverage longs by only 1%. However this is more than compensated when OKEx sees an increase from 1.51 to 2.91 in two weeks time!

The lack of a premium in CME 2-month future contracts is not considered an 'emergency alert' because Bitcoin has been testing the $46K resistance, its lowest daily close since Oct 1. Furthermore top traders at Derivatives exchanges have increased their longs even though prices dropped; this may mean that they expect more gains soon enough!

The market is not panicking, but there’s also little that the U.S government can do to stop stablecoin operations from moving overseas and operating with dollar-denominated bonds or assets rather than cash which means they are unlikely any time soon either way--even if it means an inevitable rise in prices for those who trade against them!

Posted Using LeoFinance Beta