Bitcoin Surpasses $30,000: Institutional Interest and ETFs Shape the Crypto Market

Bitcoin's recent surge above $30,000 highlights the growing institutional interest and the impact of ETFs on the wider crypto market. Explore the convergence of traditional finance and cryptocurrencies, regulatory challenges, and the future prospects for Bitcoin. Stay informed with the latest developments in the crypto sphere.

Bitcoin's Recent Surge and Institutional Interest

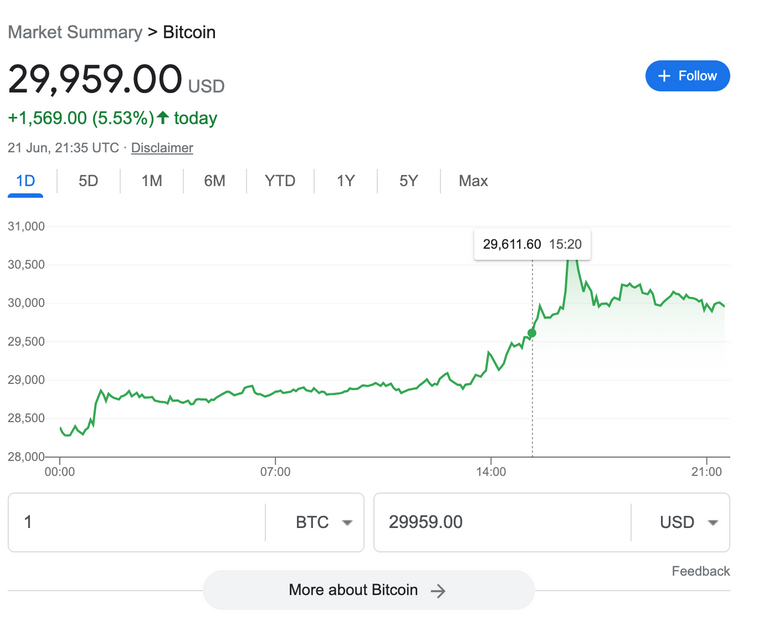

Bitcoin's surge above the $30,000 mark signifies a significant milestone for the world's largest cryptocurrency. This impressive growth can be attributed to the renewed interest of institutional investors who now view Bitcoin as a valuable asset. Prominent financial players like BlackRock, Invesco, and WisdomTree have recently filed applications for spot Bitcoin ETFs, indicating their confidence in the cryptocurrency market.

ETF Filings and Their Impact

Exchange-traded funds (ETFs) have long been recognized as a potential game-changer for the crypto market. These investment vehicles offer investors exposure to Bitcoin without the need to directly hold the digital asset. The recent filings by BlackRock and other major players have fueled speculation regarding the broader adoption of cryptocurrencies.

Approval of Bitcoin ETFs would enhance market accessibility, attracting a wider range of investors who may be hesitant to directly invest in cryptocurrencies. This increased participation could lead to heightened demand, potentially driving Bitcoin's price even higher. Moreover, the regulatory oversight and investor protection provided by ETFs may appeal to traditional investors, further expanding the crypto market's reach.

The Rise of Traditional Finance in the Crypto Market

The entry of traditional finance players into the crypto market underscores the growing acceptance and legitimacy of cryptocurrencies. EDX Markets, a digital asset exchange supported by Fidelity, Charles Schwab, and Citadel Securities, has recently launched with the aim of bridging the gap between traditional finance and crypto markets. This move seeks to attract institutional investors by merging the best practices of traditional finance with the world of cryptocurrencies.

The launch of EDX Markets and the filing of ETF applications reflect the shifting landscape of the financial industry. Traditional finance institutions are increasingly acknowledging the potential of cryptocurrencies and actively seeking integration with their existing offerings. This convergence of traditional finance (TradFi) and decentralized finance (DeFi) has the potential to reshape the entire crypto market.

Impact on Altcoins and the Crypto Market

Bitcoin's surge above $30,000 has not only influenced its own price but has also had a ripple effect on the broader crypto market. Altcoins, including cryptocurrencies other than Bitcoin, have experienced price surges following Bitcoin's upward momentum.

A notable example is Bitcoin Cash (BCH), which has seen a significant price increase due to institutional interest in Bitcoin. This interconnectedness within the crypto market highlights how the actions of major players can impact other cryptocurrencies, creating a domino effect.

Regulatory Challenges and Market Sentiment

While the surge in Bitcoin's price and institutional interest are positive signs for the crypto market, regulatory challenges persist. The U.S. Securities and Exchange Commission (SEC) remains cautious in approving Bitcoin ETFs, citing concerns such as market manipulation and investor protection. However, the filings by BlackRock and other financial giants indicate a growing acceptance of cryptocurrencies among traditional financial institutions.

Despite the challenges, market sentiment remains optimistic, with investors and analysts predicting further growth for Bitcoin and the wider crypto market. The increased interest from institutional investors and the potential approval of Bitcoin ETFs could serve as catalysts for sustained upward momentum.

Bitcoin's Future Prospects

As Bitcoin surpasses $30,000 once again, its future prospects appear promising. The convergence of traditional finance and cryptocurrencies, the potential approval of Bitcoin ETFs, and increased accessibility for investors all point towards a continued upward trend.

However, it's crucial to remember that the crypto market is inherently volatile, and caution is advised. While Bitcoin has experienced significant growth, it has also witnessed price fluctuations. Like any investment, thorough research and a long-term perspective are essential for successfully navigating the crypto market.

In conclusion, Bitcoin's recent surge above $30,000 reflects growing institutional interest and the convergence of traditional finance and cryptocurrencies. The potential approval of Bitcoin ETFs, coupled with the emergence of new digital asset exchanges, holds the power to reshape the crypto market. Stay informed as the captivating journey of Bitcoin unfolds, and witness the next chapter in its remarkable story.

My name is Asteroids - well, that's my Hive name, anyways. I believe firmly in the future of Web3 technology and its potential to reshape our lives. I'm a serial entrepreneur and my aim in life is to always evolve and find new ways to leverage technology in my life.

As I continue to build things, I find new and important wisdom in all sorts of places. My goal here on Hive is simply to share that wisdom so that you can improve as well.

Working is as much about building good habits as it is about doing the actual work. Remembering this on a daily basis has changed my life for the better.

Until next time

-A